![]() Well, here we are again, with the latest instalment in this saga, and the first since Weep for Wales 19 in November 2021. As that title tells you, there were 18 previous instalments (and a few updates scattered about), so set a day aside if you want to catch up with it all.

Well, here we are again, with the latest instalment in this saga, and the first since Weep for Wales 19 in November 2021. As that title tells you, there were 18 previous instalments (and a few updates scattered about), so set a day aside if you want to catch up with it all.

For this latest chapter I’ve had to buy quite a few documents from the Land Registry, so why not help out by making a contribution? Just click on the ‘Donate’ button in the sidebar. (Believe me, you’ll feel better for it!)

I should add that WfW 20 contains, inevitably, a considerable amount of update; because without understanding the past it’s difficult to make sense of the present, and impossible to make informed assessments of what lies ahead.

Though I’m hoping this contribution ends the saga; and that the current owners, and future owners, give me no reason to return to Plas Glynllifon.

♦

BACKGROUND

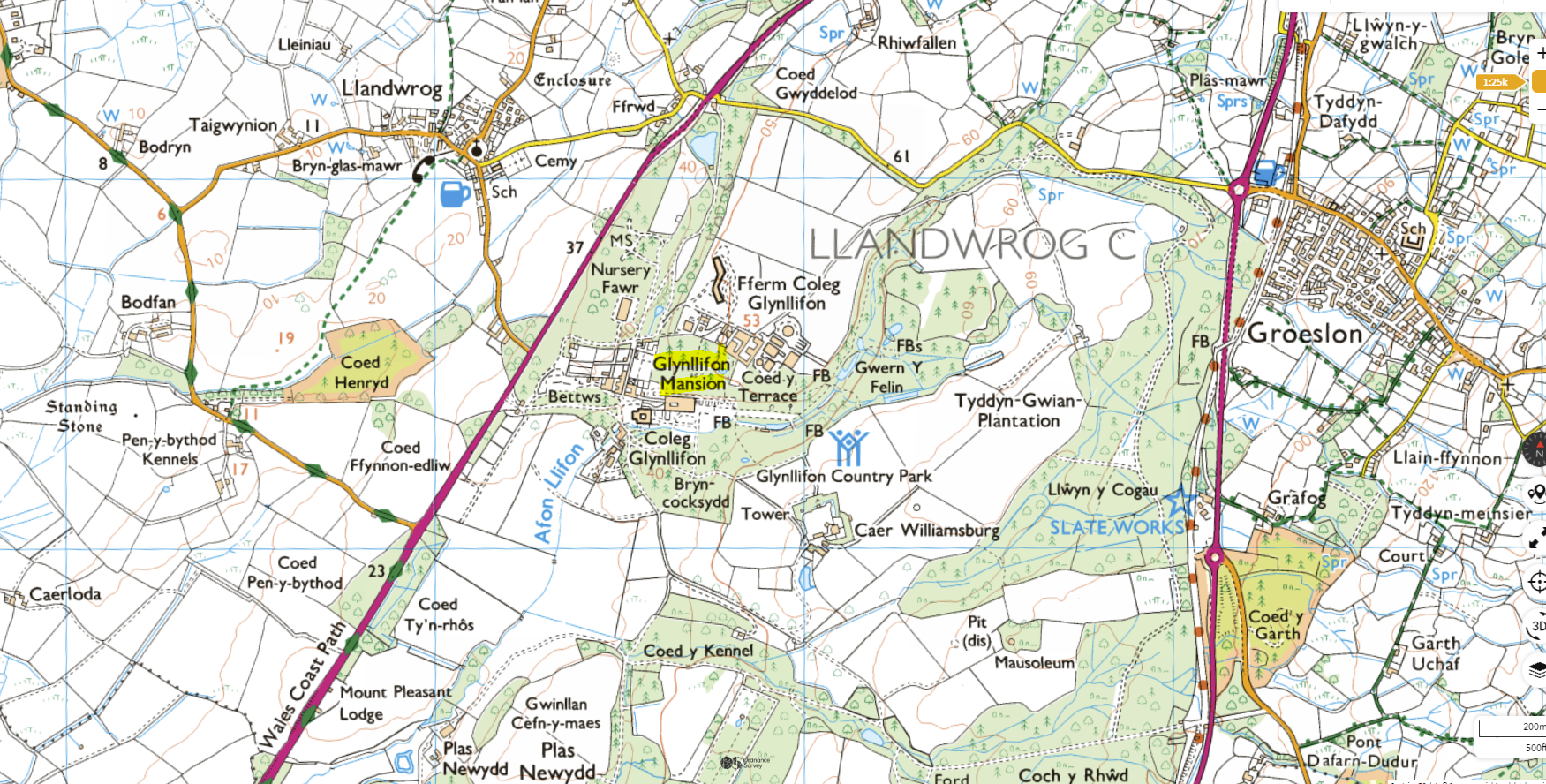

Let’s start with the location. Plas Glynllifon is an impressive old pile found just outside the village of Llandwrog, on the A499, a few miles south west of Caernarfon.

That said, it’s not that old, having been built in the decade after 1836 for Spencer Bulkeley Wynn, third Baron Newborough. But on the site of at least three earlier houses. (The eighth baron can now be found at the Rhug Estate.)

By one route or another the Glynllifon estate passed to Caernarvon County Council, then its successor authority, Cyngor Gwynedd, before it became the responsibility of Coleg Meirion-Dwyfor, which merged in 2012 with with Coleg Llandrillo and Coleg Menai to form Grŵp Llandrillo Menai.

But soon after the handover in 2001 – maybe even before – it became clear that while a further education college could certainly use the other buildings it had no need of the mansion, and so it was put up for sale.

Which saw the mansion being sold in 2003 to Glynllifon Ltd.

Though I find it odd that this company was set up as early as 7 November, 2000, by pharmacist Dr Devendra Shah. For this was even before the site was officially handed over to Coleg Meirion-Dwyfor.

Such foresight!

But it was two and a half years after its formation when Glynllifon Ltd bought the mansion for a stated £500,000. Though by then Shah was long gone, and the only director at the time of the purchase was Pravin Gabhubha Jadeja.

Their company is still alive, with four outstanding charges. The long-departed Welsh Development Agency is owed an unspecified amount from March 2004, and Cyngor Gwynedd £130,000 from a month later. (The two may be linked.)

All the various purchases and Land Registry titles involved can be found in this table I’ve drawn up for you. (Available here in pdf format with working hyperlinks.)

The way this 2003 transfer was done, or perhaps the way it wasn’t done, has caused confusion for many people over the years, myself included.

I say that because if we consult the original Land Registry title number CYM 8531 we see that ‘The Mansion House and Glynllifon Estate, Glynllifon, Caernarfon’, is still shown as belonging to Grŵp Llandrillo Menai. Which is obviously not the case.

Confusion added to by the real title document for the mansion, CYM127981, referring to ‘land adjoining Glynllifon College, Clynnog Road, Caernarfon (LL54 5DU)’.

The separation is explained in this document. (Scroll down.)

I’m sure this mess could be tidied up without too much trouble or expense.

Despite liabilities pushing two million pounds Glynllifon Ltd hoped to give out an impression of liquidity by valuing the mansion at £2,245,053 and claiming a share issue of £400,000.

No one was fooled. And so the company was voluntarily liquidated in April 2016 with the mansion, Plas Glynllifon, now ‘Estimated to realise’ £720,000. A third of the valuation.

What I found strange was that, despite the charges still being outstanding, neither the Welsh Development Agency nor its successor body – the self-styled ‘Welsh Government’ – was listed among Glynllifon Ltd’s creditors.

Had the debt been written off?

◊

THE ERA OF THE CRIME FAMILIES

Now we enter the glorious chapter when Paul and Rowena Williams appear on the scene. And what a splash they made. Without going into too much detail, the Gruesome Twosome were (among other things) mortgage fraudsters.

They operated like this . . .

Step 1: Buy a property – maybe from a liquidator – for, say, £200,000.

Step 2: Set up a company to ‘buy’ that property, from yourself.

Step 3: Get a qualified (but bent) valuer to say the property is worth £1,000,000.

Step 4: Ask a bank to loan the new company £500,000 to help buy the property.

The bank is happy to lend the money in the belief that even if the company goes bust it can recoup its ½ million loan because it has first call on a property worth £1m.

The most outrageous example would be the Radnorshire Arms in Presteigne. It was claimed that Leisure & Development Ltd, in August 2015, paid £3,487,049 for this modest pub with a restaurant and a few rooms.

(After the collapse it sold, in April 2020, for £240,000.)

By the time Paul and Rowena Williams bought Plas Glynllifon for £630,000 in April 2016, their property empire was in big trouble; the Radnorshire Arms and the Knighton Hotel had both closed suddenly.

With the closures explained by those and other properties having been sold for £11m to their associate, convicted fraudster Keith Harvey Part(d)ridge.

Leisure & Development Ltd went under with 12 outstanding charges against it for various properties, owing millions to the National Westminster Bank. And more again to Together Commercial Finance Ltd.

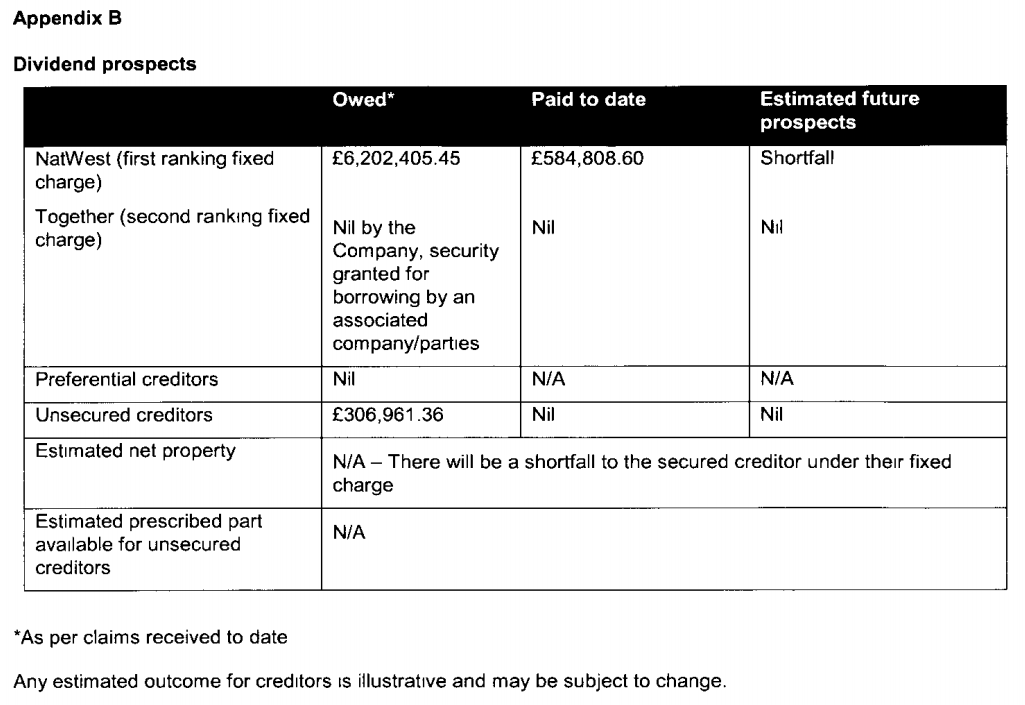

The panel below, from the Administrator’s report of July 2020, tells us that of £6.2m loaned to Leisure & Development Ltd by the NatWest, only £1.7m was repaid (realised from the sale of the properties against which the loans had been secured), leaving a shortfall of £4.5m.

But spare a thought for the unsecured creditors, owed £306,961.36, who got sod all; these were the employees, the tradesmen, the suppliers, and all the small people who lost out to Paul and Rowena Williams, and their equally crooked associates.

Plas Glynllifon was bought through a new company, Plas Glynllifon Ltd. Which soon racked up debts with the ever-obliging Together Commercial Finance. Eight charges in all, unpaid when that company went into liquidation in January 2022.

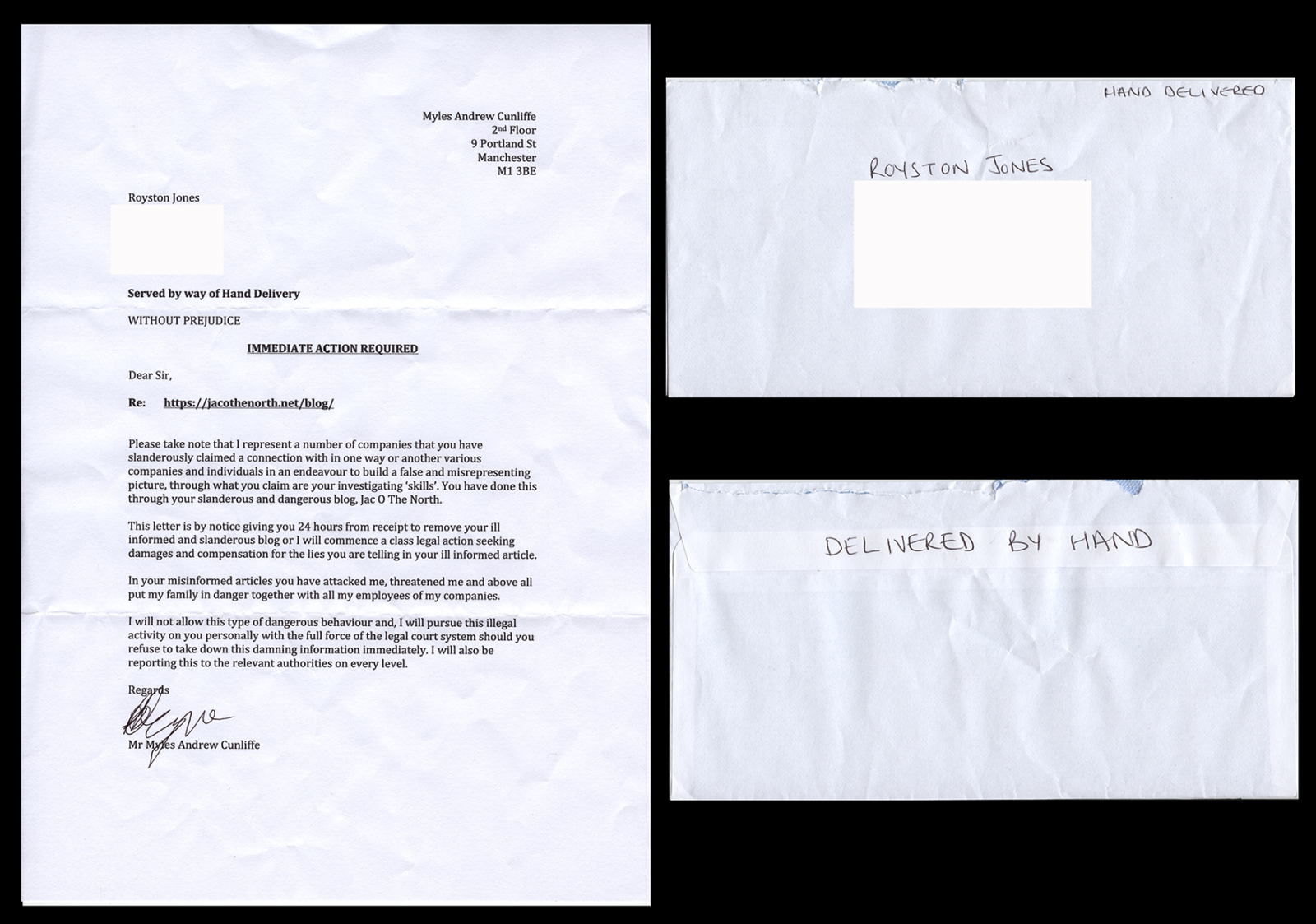

Before liquidation, with the whole scam now being exposed, help arrived in the form of Myles Cunliffe, described at the time, by Paul Williams, as a “finance guy”.

Which would be one way of putting it. For Cunliffe and his mentor, Jon Disley, were certainly involved in money, and on an international scale.

One of their specialities was targeting companies in trouble. How this might have operated, with more on Cunliffe and Disley, in Weep for Wales 11 – 19. They even advertised for struggling businesses through their stable of ‘Goldmann’ companies.

One of the ‘Goldmann’ companies was Goldmann and Sons (Thailand), which became The European Clothing Company Ltd, run by Danish con man Benny Falk. Being a con man it was inevitable that Benny would get involved in ‘Green’ energy.

Eventually it all turned to dark comedy, especially after Paul and Rowena Williams fell out with Cunliffe and Disley, with each pair suggesting the other was dishonest. Well, laff!

But the poor buggers working for the new management saw no real change. For just like those the Williamses had abandoned in Powys and elsewhere, the staff at Seiont Manor were left high and dry, unpaid, just before Christmas 2019.

This hotel was owned by Rural Retreats & Development Ltd, another Williams family venture, with Cunliffe also on board for a while. Although over three years behind with its accounts it’s still active on the Companies House register. Perhaps kept from liquidating itself by creditors.

◊

RECENT DEVELOPMENTS

We left off with the media telling us the new owner of Plas Glynllifon was David Savage of Dragon Investments Ltd. But as I explained, that was not true.

David Savage and Dragon Investments were simply a front for David Russell and his Property Alliance Group Ltd.

The first development to report is that Seiont Manor and its ‘gatehouse’ property, Llwyn y Brain Lodge, which were owned by Paul and Rowena Williams and then the Disley-Cunliffe gang, have now been separated from Plas Glynllifon. These properties are situated just outside the village of Llanrug, north east of Caernarfon.

They remain in the possession of David Russell, through Caernarfon Properties Ltd. Which is owned by Dragon Investments Ltd. With Dragon in turn owned by Russell’s Property Alliance Group Ltd.

Though the ever-loyal front man David Savage is the only director of both Caernarfon Properties and Dragon Investments.

As I explained in the table I drew up, the mansion itself was owned by Cowm Top Properties, a company launched by David Russell in September 2014.

He was relieved of his post by Savage in July 2020, and Savage left two years later to be replaced by Christopher Stephen Nedic. Which means that Nedic is now the owner of Plas Glynllifon.

So who is he? Well, the Nedic family, headed by Christopher Stephen Nedic, seems to have a few different lines of business.

On the one hand, they have a heavy haulage operation in Wolverhampton, with Nedic Transport & Plant Hire. Here’s the Companies House entry. But then there’s Shadwell Park Estates, which is a quarrying company.

And there are a few of what appear to be caravan / chalet sites, such as Cotswold Grange. Perhaps also Nedic Park Estates Ltd. Though the two Nedic sons seem to have behaved irresponsibility on at least one occasion.

Finally, there are the film companies. Arcade Films 4 LLP, Chelmer Films LLP, and Swale Films LLP, all of which Christopher Stephen Nedic has been involved with for over a decade.

The address given for these companies is, ‘The Khyber, Holyhead Road, Kingswood, Albrighton, Wolverhampton’. I couldn’t find that establishment, but I did find an Indian eatery on Waterhouse Lane, off Holyhead Road, named The New Khyber. A successor?

I have no idea what the Nedic family’s plans are for Plas Glynllifon, but last June they set up a new company, Glynllifon Estates Ltd. So, given their established interest in caravans and chalets, maybe this is the future planned for Plas Glynllifon.

Watch this space?

God knows, the old pile has suffered enough indignities in recent years, often at the hands of television. Also social media. The latter culprit includes this 37 minutes of faux terror and bullshit by some silly buggers with American accents making money out of videos for even sillier buggers.

We can but hope that the future for Plas Glynllifon is an improvement on the recent past. But this cynical old bastard is not optimistic.

And the problem is not limited to Glynllifon, for there are big, unloved old houses all over Wales.

One in the news of late stands where once stood a house that Glyndŵr knew. For Nannau is the estate where legend says the great man killed his traitorous cousin Hywel Sele, and stuffed the body into a hollow oak.

But Nannau is owned by somebody in England who doesn’t care, or doesn’t have the money to save it, and so it’s falling down.

It Nannau had belonged to Horace FitzLandgrabber, and if he had killed and cleared the Welsh off the land, no doubt our ‘Welsh Government’ and Cadw would be throwing money at it.

Maybe if the name was changed to ‘Gilestone‘ . . .

◊

DIGRESSION-CONCLUSION

We have a problem in Wales that too many people would rather ignore. That many have never even thought about. I’m referring to the ownership of domestic property and smaller commercial buildings, also farms and land.

So many issues could be resolved by addressing that problem with a simple piece of legislation. Legislation that has been introduced in other countries.

A recent example is the Balearic Islands, part of Spain with a devolved administration. This interesting article cites both independent states and sub-national territories where such legislation exists.

There is a system in the Channel Islands that divides the housing market into ‘Open’ and ‘Closed’ sectors. A majority of domestic properties is in the ‘Closed’ sector, which is restricted to local buyers.

To qualify for ‘Entitled status’, ‘You must live on Jersey for a combined period of 10 years before you’re 40’. Which seems designed to rule out retirees.

By restricting ownership of domestic property and smaller commercial property to permanent residents of Wales, with a qualification period of 10 years, we could, in one fell swoop, solve a number of current problems. Such as . . .

- The ‘Welsh Government’ has empowered councils to increase council tax on holiday homes to 300%. But even if raised to 300% these new provisions will only reduce the numbers of holiday homes not eradicate them altogether.

- A bigger obstacle to Welsh people being unable to buy a home is those moving to Wales as permanent residents. With too many of these falling into the older age brackets, with the inevitable strain on our NHS and other services.

- Thanks to climate hysteria and the scams it encourages we see Welsh farms bought by hedge funds for ‘greenwashing’. Welsh farms now owned by money-shufflers who can’t even pronounce the names of those farms!

I can already hear the Conservative and Unionist Party, and other defenders of England’s hegemony, tut-tutting and dismissing the very idea. One argument I guarantee we’d hear would be that the property market would collapse.

But it wouldn’t. Because its effects would be gradual. And in some areas of the country the impact would be minimal.

What’s more, in the early stages few would notice because no one would be thrown out of their home, or off their land. And we could allow properties to be passed on to (inherited by), but not sold to, non-residents.

Flexibility would be one of the keys to making the policy work. Flexibility without losing track of the objective.

Obviously, domestic property prices would fall, allowing many Welsh families to buy a home. Perhaps their first home. Who could object to that?

Just think, Gwent could be saved from degenerating into the outer suburbs of Bristol. And the north would be spared any more commuter communities linking to the A55.

But legislation such as I’m advocating would obviously have its greatest impact in our rural areas, where the indigenous Welsh population is on the point of becoming a minority. In some areas it’s passed that point.

Whereas in our cities, major towns, and post-industrial areas, where property is more affordable, and incomes generally higher, there would be less impact because there’s less cross-border ownership.

I’m open to suggestions, even criticism; but let’s at least debate the idea.

If nothing else, it would mean that I wouldn’t have to write about any more of the con artists, money launderers and other crooks I’ve written about over the years. I could instead turn my hand to embroidery.

Which is what I’ve always wanted to do . . .

♦ end ♦