![]() This piece took root in my head when I read in late September that Aberllefenni had been sold. This small village not far from me had been on the market since 2016.

This piece took root in my head when I read in late September that Aberllefenni had been sold. This small village not far from me had been on the market since 2016.

If you want to get there, just pass the Slaters Arms in Corris and keep going ’til you can’t go much further. That said, if you bear right after Aberllefenni there’s a nice drive that brings you out in Aberangell.

The extensive media coverage, from Cambrian News to the Times reported that the buyer was a London company, Walsh Investment Properties Ltd.

That was my first disappointment. For I assumed that a big-spending London property investor would have a top-notch website. But there’s nothing.

I’ve drawn up a list of the properties bought by Walsh Investment Properties Ltd. It’s in pdf format with working links. You’ll need it to help you understand what follows. Not least, the captions accompanying the images.

♦

RHYL! MAIS OUI

Then I learnt that the address in London is just a post box, for the eponymous Mr Walsh actually lives in Rhyl, or thereabouts. So I got to wondering what other companies he might have been involved with.

Here’s a list I drew up of the companies I found. (Available here in pdf format with working links.)

You’ll see that Christopher Paul Walsh has tried his hand at a number of ventures over the years. Both the oldest and the most recent companies see him in partnership with Sion Joseph Suckley.

The table also tells you the first of them was North Wales Hydroponics Ltd. Now hydroponics is an interesting line of business. You can grow all sorts of exotic plants by that method.

Though I suppose buying up property across northern Wales might be viewed as quite a departure from hydroponics. Then again, maybe not. Whatever . . .

As I’ve hinted, Suckley and Walsh were partners in North Wales Hydroponics Ltd, which ran dry in November 2013 with debts to the tune of £76k.

Suckley’s interest in hydroponics continued with Gaerwen Hydroponics Ltd, which also suffered desertification in November 2013, without ever filing anything.

Suckley next seemed to try his hand at the courier business, with two companies in Rhyl. The first was S & C Couriers NW Ltd, formed in May 2015 and voluntarily struck off in March 2016.

The next company was HCS Couriers Ltd. Again, Sion Suckley is the only person named and this company lasted just over a year, collapsing in August 2019.

The final Suckley company was Crypto/And Investments Ltd Ltd. (Yes, ‘Ltd’ repeated.) This company didn’t last much longer than the courier outfits, with the big difference being the claimed share issue of £100,000.

Why so much for a one-man band destined to fold the day it was formed? Again, Sion Suckley is the only person named in connection with this company.

Walsh also went solo in hydroponics with The Hydroponic Warehouse Ltd.

He also entered the building business in May 2014 with EMW Developments Ltd. Again, there’s no website, just the Companies House entry.

The most recent creation brings Walsh and Suckley back together in Clewistion Cars Ltd Incorporated last December. And there is a website.

Clewistion Cars seems to have taken over part of the site occupied by Mountainview Cars. Both specialise in upmarket used motors.

Hydroponics, courier services, a building company, a burgeoning property empire, and now, second-hand Beemers, Mercs and Range Rovers!

Whatever next?

UPDATE 12.11.2024: The proprietor of Mountview Cars makes clear that he has nothing to do with the Walsh company: “Clewistion cars moved onto a site next to us in 2022 also we are not on company house due to us being a sole trader“.

◊

A LITTLE GENTLE WEEDING?

Having mentioned hydroponics, it may be worth remembering that this area of human endeavour attracts some interesting characters.

For example, a few years ago an ex-Marine was growing marijuana on a farm near Gwyddelwern in eastern Meirionnydd, not far from Cwm Main, where my late father-in-law was born and raised.

According to the Shropshire Star David Duffell was growing for his own use – though 500 plants suggests he was a very heavy smoker. He was also charged with a firearms offence.

I’m not sure who owned the property at the time of these offences, but in 2010 the farm was bought by two other men with the Duffell surname. These were Matthew Samuel Michael Duffell of Cornwall, and Andrew Michael Duffell of Huddersfield.

Here’s a copy of the Land Registry title document.

I’m sure the three Duffells are brothers because they all carry their father’s name, Michael. And it is an unusual surname.

And then they all appear as directors in Lendlock Group Ltd. Which seems to be the Duffell family’s holding company, with group figures for 2021 showing a profit of £4.8m on a turnover of £32.4m.

The Companies House entry for Lendlock International Ltd provides more information with: ‘Nature of business (SIC) 22290 – Manufacture of other plastic products’.

Though the Lendlock website seems to be down. And there was a Health and Safety Executive notice served not so long ago.

The other companies listed in the Lendlock Group accounts as group members are: Lendlock International Ltd, Specialist Anodising Company Ltd, Scott Closures International Ltd, Nekem Ltd, and F-L Plastics Ltd.

These companies all have the Duffell parents and sons listed as directors and, in some cases, other people as well.

But then there are companies at the Guilden Sutton Lane location, not part of the group, which have also seen the parents and sons as directors (sometimes with others): Toiletries UK Ltd (a dormant company dissolved 17.01.2017), GTL Plastics Ltd, North Wales Construction Ltd, Cynwyd Enterprises Ltd, ABC MK Ltd, and Livestock (UK) Ltd,

In a third category is MK Products (North West) Ltd, a company with two Duffell brothers as directors. Although David Duffell is no longer a director the three brothers exercise control.

This company has equity of £1.2m.

Finally, we have NI Products Ltd, a company where no Duffell has been a director, yet the three brothers are shown as exercising control.

This company has liabilities of over £2m.

David Michael Duffell has been a director of many companies since his release from prison. Mainly with his brothers, but other names also appear.

For example, another director who left North Wales Construction Ltd on May 1 2019, the same day as David Michael Duffell, was Christian Martin Suckley.

Another company where both were directors (but not at the same time) is Cynwyd Enterprises Ltd. Cynwyd is a village a few miles from Gwyddelwern, the other side of the A5. It’s the village where the Ifor Williams trailers business is based.

A current director of both Cynwyd Enterprises and North Wales Construction is William Ward. Who last year set up a ‘consultancy’ in Flint. (Go on! haven’t we all dreamt of a nice little consultancy in Flint?)

I can’t tell you much about Ward but Cynwyd Enterprises owns The Dudley Arms, in Llandrillo, on the B4401 between Corwen and Bala. A hostelry for which the company paid £302,500.

Though the way this pub is being run is upsetting many locals. It seems opening hours are being reduced. A prelude to closure / change of use?

I suggest that because there are a number of interesting comments from ‘Scutler1’ to the news report I’ve just linked to; talking of, um . . . . ‘change of use’, and turning the pub into flats.

Another comment in support of the owners comes from ‘roosimpson’. Might that be Katy Simpson, the only director on NI Products Ltd, a company we just looked at, and owned by the three Duffell brothers?

The only other comment is from ‘JacksonSbollock’, the famous American painter. (Who I thought had died in 1956!)

For me, it boils down to this question: Why would the Duffells buy a pub and then argue it’s not viable as a pub? Only one answer – change of use was the plan all along.

On the ‘unaudited financial statements’ for y/e 28.02.2021, ‘Tangible assets’ for Cynwyd Enterprises reads, £849,752. Seeing as the Dudley Arms wasn’t bought until February this year ‘assets’ must refer to other properties. Where, I wonder?

And seeing as Cynwyd Enterprises loaned Walsh Investment Properties £300,000 in November 2020, to buy the Grosvenor Social Club in Shotton (No 9), I would have expected to see this loan showing in the 2021 filing as a debt.

But I don’t see it.

◊

THE EMPIRE OUT BACK?

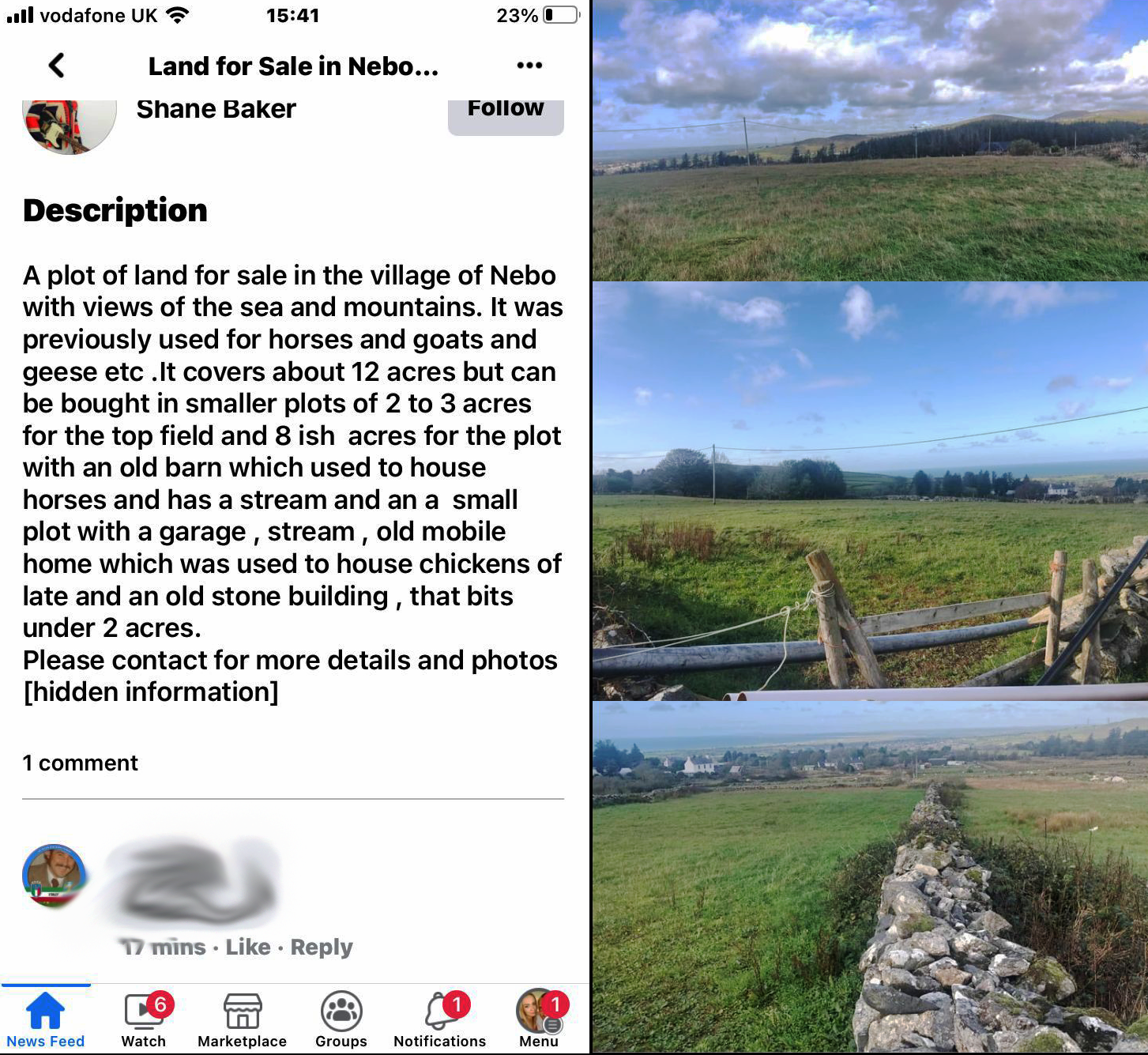

It’s time to look a little more closely at what’s been bought by Walsh Investment Properties Ltd. The list is too big to reproduce as an image, so here’s another link to the table I drew up. Let me explain how it’s laid out.

The column furthest left is simply a number for each loan, not for each property. That’s because some properties have more than one loan, which is why they’re shaded yellow. These loans are listed as ‘Charges’ here on the Companies House entry.

The next column gives the address of the property bought. Wherever possible the name provides a link to a Google Maps image of that property.

The third column is ‘Lender’. This provides the source of the loan. Where this is shaded orange it means the loan came from a member of the Duffell family or a company run by members of the family.

The fourth column is the Land Registry title number, while the fifth and sixth columns are self-explanatory.

Clearly, there is a connection between the Duffell family and Christopher Paul Walsh. To date, they’ve put up £5.6m for Walsh to buy property.

Though there’s no discernible pattern to the purchases. Walsh has bought commercial properties in town centres; pubs, clubs and shops; also houses, new and old; a care home; and then, most recently, with Aberllefenni, a whole village.

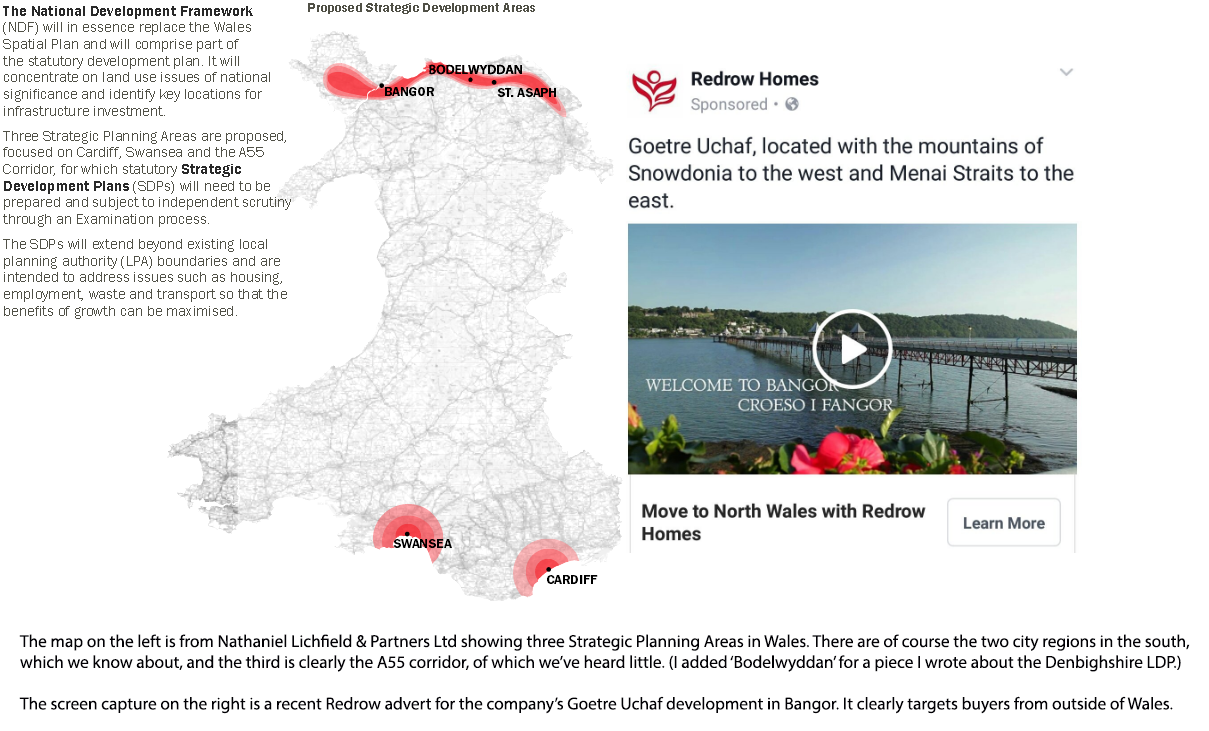

That said, most tend to be near the main highways: the A548 up the Dee estuary past Broughton, Flint, Ffynnongroyw, Prestatyn, Rhyl, and then Abergele; where it meets the A55, which has come past Broughton and Buckley before running on to Llandudno, Conwy and Bangor.

And yet, one thing did stand out as I checked over Walsh’s purchases.

They are either detached properties or, if they’re not detached, then they tend to have side entrances, or rear entrances, or garages. In many cases two of those features, and in a few, all three.

◊

LENDERS

Now I want to look at some of the lenders, and a link that emerged.

Out of all the lenders, only one is a name that most of you will recognise, and that’s Barclays Security Trustee Ltd. (You’ll at least recognise the ‘Barclays’ element.)

Otherwise the lenders tend to be specialist, obscure, even exotic.

Apart from these specialist lenders, the loans have come from individual members of the Duffell family, or companies controlled by members of that family. Fourteen loans in total.

Six came from Andrew Michael Duffell. Two from his father, Michael John Duffell. Four from Livestock (UK) Ltd, and one from each of Cynwyd Enterprises Ltd and North Wales Construction Ltd.

Livestock (UK) Ltd is an odd name, and a departure, for a family involved in plastic packaging for perfumes and unguents; but for a short time, just after the company was formed, there really was a farmer (and Denbighshire county councillor) involved.

Cynwyd Enterprises I’ve already looked at, which leaves North Wales Construction Ltd. Which must be a building company, surely; employing bricklayers, carpenters, and others with building trade skills.

Well, no.

The unaudited financial statement for North Wales Construction tells us (page 3, 3) that there are no employees. Never have been. So either those working on the company’s sites are self-employed or there’s something else going on.

It’s something else.

For North Wales Construction Ltd seems to be nothing more than a conduit or a repository for money. So why that company name?

Finally, if you refer to the table I supplied, you’ll see that seven of the properties bought in the past three and half years have already been remortgaged or had second loans taken out against them.

Of this seven, six were originally financed by the Duffells.

◊

SUMMARY AND QUESTIONS

Just over three years ago Christopher Paul Walsh set out to become a property tycoon. Since May 2019 he has bought 26 properties. Or, to rephrase that, there are charges against 26 properties.

Have others been bought without loans?

To help me understand the locations of the purchases I drew up the map you see below. It shows the number of properties in each location. (The figure for Prestatyn is inflated by four properties in one purchase, 21 & 25 in the table I linked to.)

If Walsh is not fronting for the Duffells then why have they loaned him £5.6m, and at such generous rates of interest, sometimes no interest at all? And these are short-term loans, over 12 or 24 months.

Which means that some are now overdue, so are the debts being chased up? I don’t know, but according to Companies House not one loan has been repaid. Which means, I suppose, that the lender effectively owns the property concerned.

And is perhaps being repaid by remortgaging the properties for which they provided the original funding?

But what are we to make of the properties Walsh has bought with which the Duffells have no obvious involvement?

Another mystery is that I can’t find a connection between Christopher Paul Walsh and the Duffells prior to the loans . . . other than perhaps the Suckleys, who may be related.

We know Sion Suckley has been Walsh’s partner in a number of companies, from hydroponics to second-hand motors.

Then there’s Christian Suckley, who was a director in Cynwyd Enterprises and North Wales Construction, so was pot-growing David Michael Duffell. Both companies have loaned money to Walsh.

Christian Suckley is a known associate of Rhyl’s John Gizzi. And was sent down for 6 years 8 months for his involvement in drugs. Before that he was imprisoned for trying to run down a policeman with his Mercedes.

◊

CONCLUSION

This production began starring Christopher Paul Walsh and Walsh Investment Properties Ltd, but as it’s unfolded the Duffells have emerged from the wings to move into the limelight.

Due to their funding of Walsh, and also the properties they’ve bought themselves in the Bala-Corwen area (and perhaps elsewhere). To the point where I’m no longer sure if the story is really about Christopher Walsh or the Duffells. Maybe it’s both.

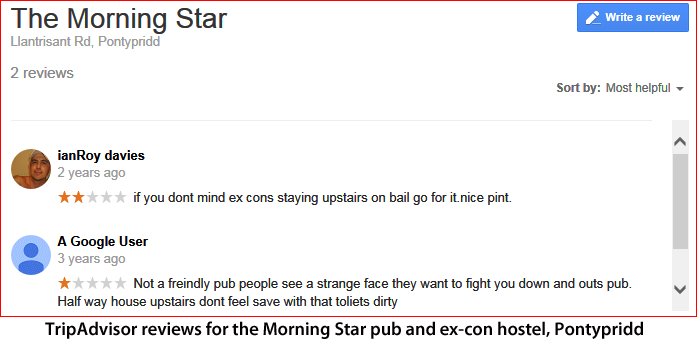

Whatever the answer, one possibility must be that the properties have been bought to be Houses of Multiple Occupation (HMOs). If so, then this might link with another Walsh company, Blue Chip Accommodation Ltd.

And if that is the plan, then Wales does not need any more HMOs taking in the social rejects and misfits of north west England’s cities and towns, bringing with them the misery and the violence associated with the drugs trade.

This extravaganza began in Aberllefenni, too close to home for me to let it be bought by property speculators without comment. Over the years I’ve known people who lived there, good people, and the area deserves better.

Writing this has made me wonder what sort of society we live in when a village can be bought in this way. You’ve almost got to remind yourself that it’s 2022 not 1822, and Wales has something called devolution.

For what it’s worth.

One thing I am sure of is that many of you who’ve read this offering will have your own views as to what lies behind these property purchases. So why not get in touch?

I remain uncertain. But curious.

♦ end ♦

UPDATE: Someone has contacted me with a possible source for the money now being splashed around buying properties willy-nilly.

Richard George De Winton Wigley was a director of Lendlock International Ltd and Specialist Anodising Company Ltd, both Duffell companies.

It is alleged, in the Channel Islands, that he defrauded Can$50m. He has since removed himself to Panama. For the sunshine.

Although he lives in Panama Wigley has a company in London, Questbourne Ltd, in the business of ‘letting and operating of own or leased real estate’. The other directors are Wigley’s son and a couple named Belcher.

Michael Perry Belcher is in the plastics business, just like the Duffells.

In fact, we find Belcher and Duffells together in Plusimage Ltd, Hyde Plastics Ltd, Mackenzie King Ltd (Dissolved), Quadrant Tube Company Ltd (The) (Dissolved), M & M Plastic Industries Ltd, Atlagraph Engineering Co Ltd.

Belcher has also been a director of Duffell companies we looked at earlier.