![]() Our story begins in Pembrokeshire, to the north of Haverfordwest. To be exact, at Withyhedge landfill site. Which lies to the east of the A40 and just south of the railway line to Fishguard.

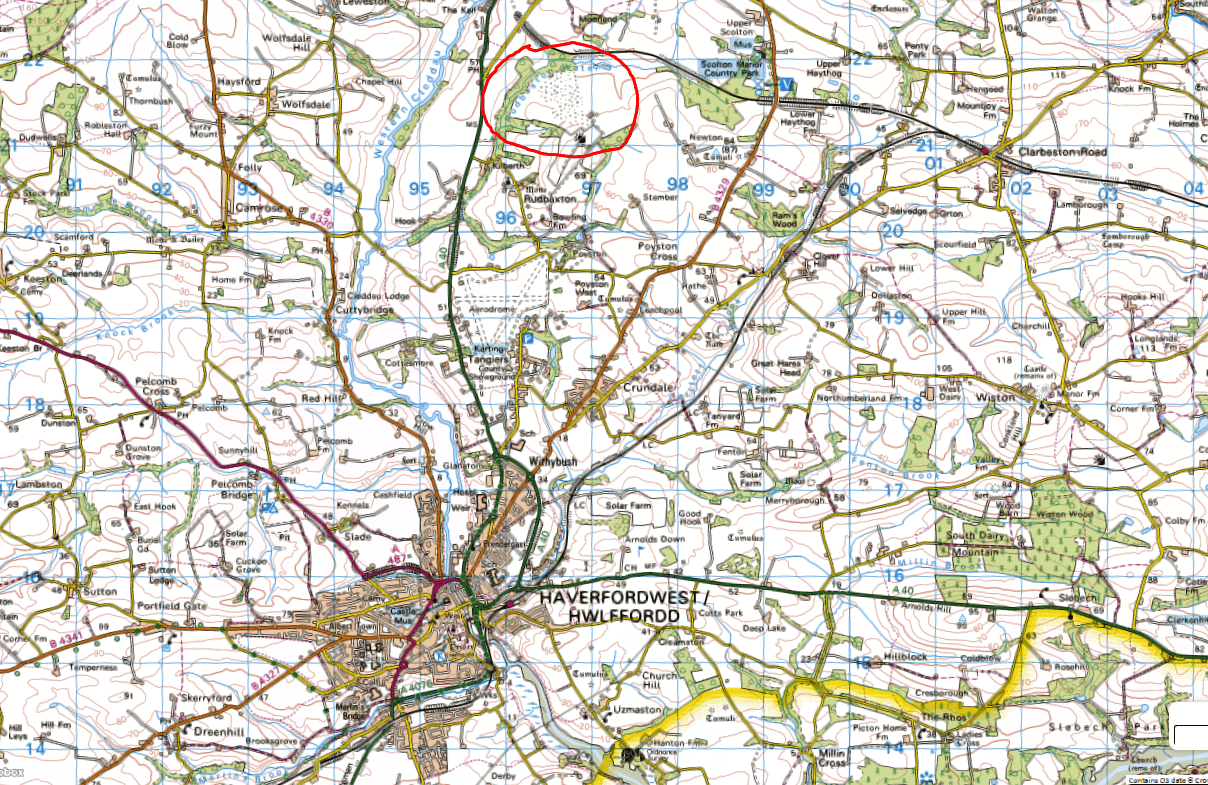

Our story begins in Pembrokeshire, to the north of Haverfordwest. To be exact, at Withyhedge landfill site. Which lies to the east of the A40 and just south of the railway line to Fishguard.

◊

WHERE?

You can see the site for yourselves in the OS map below. Circled towards the top.

I believe the site was originally managed by the county council. Then, 1995 saw a new arrangement involving Resources Management UK Ltd. This company was taken over by SITA UK – now Suez Recycling and Recovery UK – from whence it transferred to the Potter Group of Welshpool, Wales’ biggest recycling company.

In March 2022 Potter sold Resource Management UK to the Dauson Environmental Group Ltd of Cardiff, helped by a loan of £1,143,000 from Walters Land Ltd of Hirwaun. (Though this may have taken the form of writing off a debt incurred in January 2020 by Potter.)

Throughout changes of ownership Resources Management UK Ltd has remained the registered operator of the Withyhedge site. Here’s the Land Registry title document complete with plan. (Which needs to be updated.)

It may be worth mentioning that some three years ago Walters extended the Withyhedge site for the Potter Group. And as the Walters Linkedin page tells us, “As a result of delivering this project, Walters have been awarded a new landfill cell construction project (by Potter) in Telford.”

Walters Land is part of the Walters Group of Hirwaun, which has a history in opencast mining but is now rehabilitating itself with the planet-botherers with wind turbines. Even wind turbines on former opencast sites.

Anyway, that’s the background, so let’s push on.

◊

WHAT’S NEW?

I’m writing this because people living in the vicinity of the Withyhedge landfill site have had enough of the increasing smells from the site, suspected water pollution, and the traffic problems caused by a constant stream of trucks bringing waste from Cardiff and even from England (via Cardiff).

As if that wasn’t enough, a local farmer has even told me, “This site is why so many of us have gone down with (Bovine) TB in the last ten months! Cleared the woods and disturbed all the (badger) setts.”

Here are some very recent reports of locals complaining and politicians getting involved.

The Pembrokeshire Herald on December 21. Western Telegraph from the day after Boxing Day. And then a statement last week from Natural Resources Wales, which may have resulted from a complaint made by local Senedd Member Paul Davies.

In addition to the noise, the traffic, and the smells, there was also a fire on the site in July, 2018.

The image below shows trucks queuing up to dump their rubbish at Withyhedge. The blue trucks belong to Atlantic Recycling Ltd, part of the Dauson Group which, as we’ve seen, owns the site.

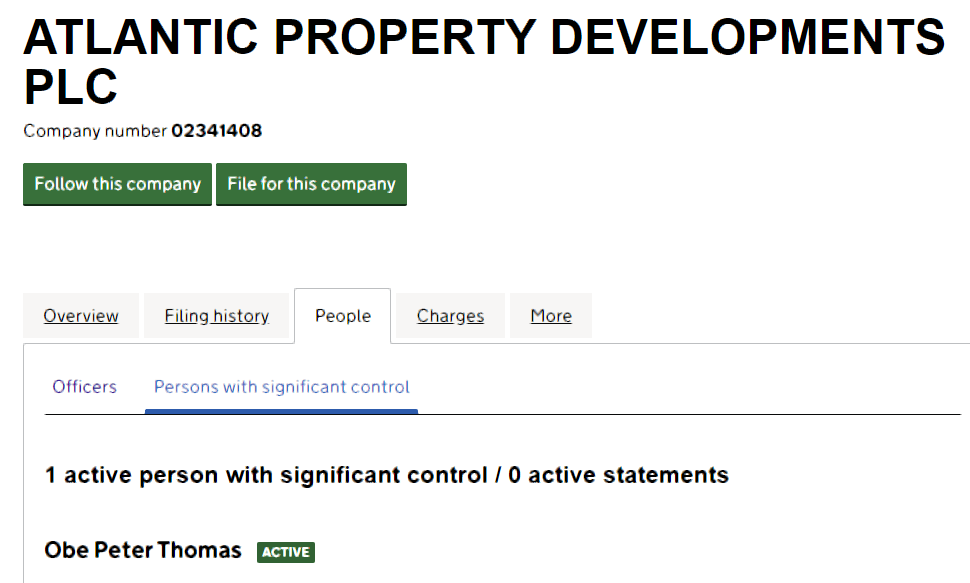

The Dauson Group itself is owned by David John Neal of Rumney, Cardiff. Who runs many companies.

Neal seems to have been in this business for a long time and, perhaps inevitably, has had his brushes with regulatory authorities. Here’s a case from May 2013 involving the sensitive Gwent Levels.

Neal was in court again in November 2017 for having done nothing to clear up the mess he’d made. “Neal was fined £30,000, ordered to pay £20,000 costs, and given an 18 week prison sentence, suspended for 12 months.”

I must confess I hadn’t given landfill much thought lately, I assumed it was being phased out in favour of recycling. Because you don’t have to be an enviro-loony to think that putting thousands of tons of waste into the ground may be a bad idea.

So I was surprised to find so many landfill sites in Wales, and so many operators. Here’s the list provided by the self-styled ‘Welsh Government’. (Updated 16.08.2023.)

One that caught my eye was the site at the old Tir John power station in Swansea, where I had family and friends working. The site is operated by Enovert South Ltd of Stafford. There’s also an Enovert North Ltd, which runs the Hafod landfill in Wrecsam.

Both companies are owned by Enovert Management Ltd, which is in turn owned by Brad Scott Huntington, a Canadian living in the Cayman Islands.

In fact, most companies operating Welsh landfill sites are based over the border. Making me wonder if these sites are used for local waste, or if they’re taking – as at Withyhedge – garbage from England.

It seems obvious that David John Neal would not have been interested in the site unless there was money to be made. Either in the form of an extended lifespan for the site, or an increase in capacity. Maybe both.

And indeed, I’m told that a new 250,000 tonne extension has been issued. It is even suggested that old waste is being dug up to make way for new deliveries, and that this accounts for the recent deterioration in air and water quality in the vicinity.

What’s more, local sources say that last year the site accepted 44,000 tonnes more than its permit allowed.

◊

CONNECTIONS

Despite the bad odour around landfills, and his record, Corruption Bay – in the form of the Development Bank of Wales (DBW) – has been generous to David John Neal and his many companies.

Despite the damage caused to the Gwent Levels DBW has made three loans since 2020 to Neal Soil Suppliers Ltd, one of the companies named in the court proceedings.

There are other outstanding DBW loans going back to 2013.

As we’ve seen, a name that crops up regularly in connection with David Neal and this saga is Dauson. The Dauson Group owns both the Withyhedge site and the ‘Atlantic’ trucks that deliver there.

I knew I’d seen the Dauson name before, and so I did a bit of digging. Sure enough, I turned it up – on this very blog!

Back in October 2019 I wrote about ambitious plans for the old Ferodo site in Caernarfon. Scroll down to the section ‘Brakes off at the Ferodo site’.

As originally written, this was a complicated story, a number of players. I’ll try to keep this recap simple, but you can read the original piece if you want the fuller picture.

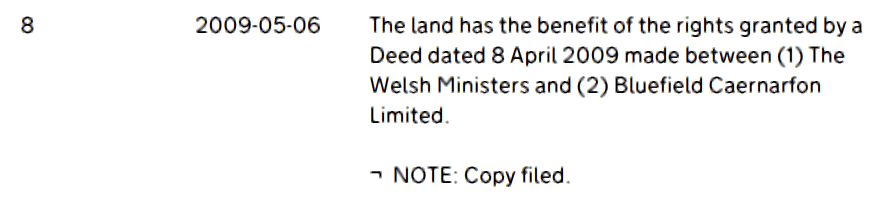

So to cut a long story short . . . after the successor company to Ferodo pulled out, and the plant finally closed, the site passed into the possession of the ‘Welsh Government’. (Here’s the title document.)

In April 2009 there was an agreement between our respected tribunes and Bluefield Caernarfon Ltd, a company formed July 2007. There was also a Bluefield Caernarfon Management Ltd.

Both companies dissolved in January 2016. With Bluefield Caernarfon leaving four outstanding charges.

A familiar name because Bluefield Land Ltd, formed in 2004, is another David John Neal company. With five outstanding charges with the Julian Hodge Bank.

Neal did not figure among the directors of the Bluefield manifestations in Gwynedd. He may have been represented by associates. But he definitely held shares.

The 100 shares for Bluefield Caernarfon were split 35 for Bluefield Land and 65 for Twenty20 Homes Ltd of Bridgend, which also dissolved in January 2016, the same month as the Bluefield Caernarfon companies.

A majority of the shares in Twenty20 Homes was held by Macob Property Holdings Ltd, also of Bridgend. Macob finally went belly-up in January 2020, though an administrator had been appointed as early as March 2014, just 26 months after formation.

We seem to be looking at considerable shuffling around and interplay between companies destined to fail.

One of the Neal ‘associates’ I find particularly interesting is Gary Goodman of Liverpool. Interesting because all the others involved are from south east Wales.

Goodman was a director of both Caernarfon Bluefield companies and the Cardiff company of the same name. But more than that, Goodman was also a director of Bluefield Sandbach Ltd.

And among the other directors of Bluefield Sandbach I saw a name I’d noticed earlier in the research for this piece, Daymion Jenkins. In fact, he seems to have had a Nap hand of Bluefield companies.

His Linkedin page mentions Bluefield but would have us believe he quit in 2009. But as we’ve just seen, according to Companies House he hung on until April 2014. Why the discrepancy?

Bluefield Sandbach also threw up a new name, Howard Wyn Evans of Haynes Watts, accountants of Cardiff. And yet another Bluefield company in Bluefield Energy Ltd. Though I can’t see any connection to David Neal.

Evans has been director of quite a few companies, many in the ‘renewables’ sector. One that caught my eye was Sundorne Products (Llanidloes) Ltd, owned by Potters Waste Management Ltd of Welshpool.

Remember Potters, former owners of the Withyhedge landfill site in Pembrokeshire? Small world, innit!

◊

CONCLUSION

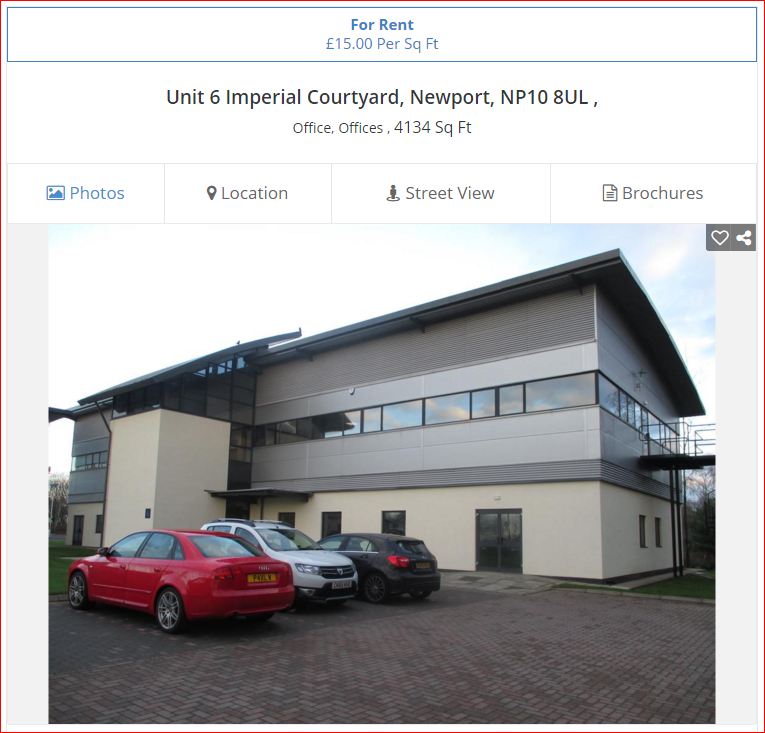

As I was writing this I kept thinking of the remarkable case of Stan ‘The Pies’ Thomas and the publicly-owned land he was able to buy at knockdown prices.

I wrote about the case early in 2016: Pies, Planes & Property Development, and Pies, Planes & Property Development 2. (I try to be imaginative in naming follow-ups.)

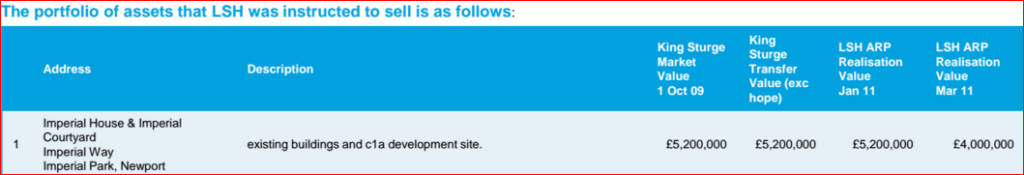

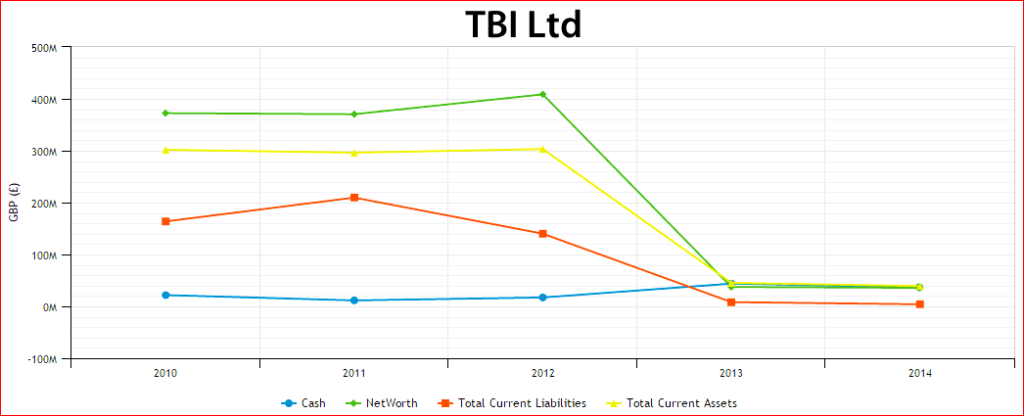

Back then, I and others tended to point the finger at the Regeneration Investment Fund for Wales LLP (RIFW), which had responsibility for disposing of public land for the best possible price. Or so we were led to believe.

Fingers were also pointed at one of the LLP partners, Amber Fund Management, and valuers Lambert Smith Hampton.

Following the Stan Thomas fiasco, RIFW was reorganised, with now just two partners (Amber was given the heave-ho), and has some £50m in the bank. What it actually does nowadays is open to question.

But thinking back, I can’t help wondering if instead of – even in addition to – dodgy dealings there might have been political intervention in favour of Stan Thomas. And perhaps others.

For over the years I’ve come to suspect that certain businessmen, in and around Cardiff, in positions to smooch Labour politicians, get favoured treatment. Maybe ‘pointed’ in certain directions.

This obviously works against those further from Cardiff, and those who would prefer not to get too close to those reptiles.

Looking back, with all we now know, there’s also something of a whiff about the Ferodo deal; the site being gifted by the ‘Welsh government’ to people who couldn’t find Caernarfon on a map – but were already known to Corruption Bay.

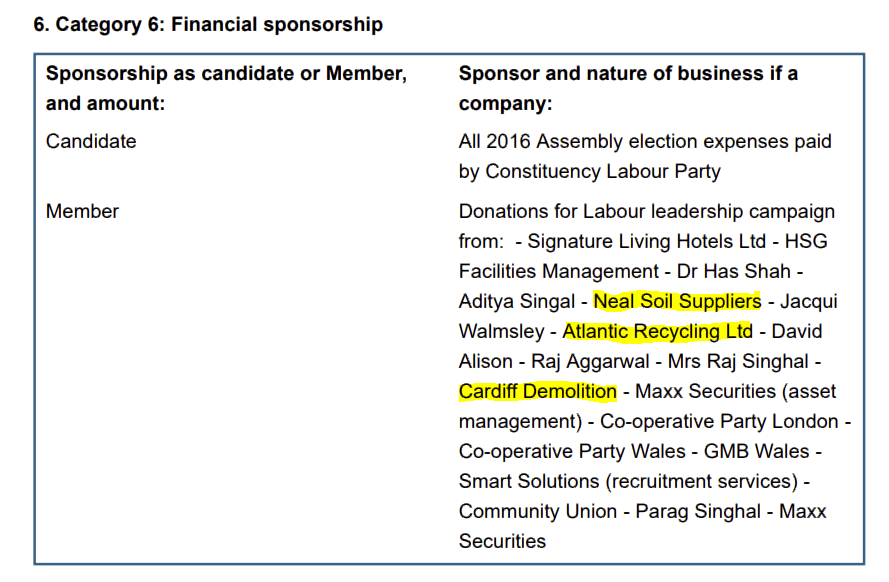

And when we learn that the principal in this case, David John Neal, was so generous towards his local Assembly Member you have to fight your rapidly elevating eyebrows.

For God’s sake, three donations, from three different Neal companies, to Vaughan Gething’s 2018 leadership campaign! Was making it look like three separate funders supposed to help Gething?

Will Dai Neal be contributing to Gething’s current leadership campaign? Why not!

As a much-loved sitcom character might have put it – ‘Lubbly jubbly!’

♦ end ♦

© Royston Jones 2024