![]() I’m returning to a couple of devious characters involved in running retirement and care homes in Wales. Both appeared in the previous ‘Miscellany‘ posting; in the section, ‘The Old Folks At Home’.

I’m returning to a couple of devious characters involved in running retirement and care homes in Wales. Both appeared in the previous ‘Miscellany‘ posting; in the section, ‘The Old Folks At Home’.

Reminding us that the care home sector is a bit of a mess, and will inevitably attract grifters like Mohanananthan Kuhananthan and Raqia Bibi.

And I warn you now, it’s worse than I originally thought. Then again, it’s a modus operandi we’ve encountered in the recent past with another crook.

So stay tuned!

♦

Since that post appeared on September 28 there have been developments. A piece appeared in WalesOnline last Friday telling of more problems in homes run by Bibi and Kuhananthan.

Followed by the article below in last Saturday’s Western Mail.

Two care homes were mentioned that I hadn’t found in my research for the earlier piece: Manor Park Care Centre, in Wrecsam, run by Manor Park Residential Home Ltd; and Plas-y-Bryn, near Cross Hands, run by Comfort Care Homes (Plas y Bryn) Ltd.

Though Manor Park is owned by Manor Park Property Company Ltd. Here’s the title document. The only director is Mohanananthan Kuhananthan. But the accounts – for a dormant company – show assets of only £100. So where’s the property being hidden?

I had considered making up a table of the companies with which the Gruesome Twosome are or have been involved, but there are just too many. Another problem is that they’ve also been involved in companies where they were not shown as directors on the Companies House website.

UPDATE 14.07.2022: What the hell! I trawled the Companies House website and found 57 companies one or both of them has been involved with. Here’s the list, most recent at the top, each name is a hyperlink that will take you to the relevant CH entry.

∼

To explain what I mean by that suggestion of the ‘hidden hand’, let’s look at a care home in Newport, which got a mention in the earlier post and then an update.

I’m referring to the Danygraig Nursing Home on Quantock Drive, run by Comfort Care Homes (Danygraig) Ltd. This company received loans in June from the Development Bank of Wales.

It seems the first thing done with this new money was to pay off an earlier loan from posh banker Coutts & Co.

As I made clear in the update, Bibi has never been a director of this company, and Kuhananthan left in January 2020. However . . .

When we click on the ‘Persons with significant control’ tab we bring up Dreams Care Homes (RB) Ltd, launched December 3, 2021. And notified to Companies House as taking control of Danygraig on 24 August, 2022.

Not long after the DBW loans were secured.

The two registered directors of Dreams Care Homes are Bishwa Tara Ghimire and Basanta Nepal. Both were aboard 3 December, 2021 when the company was launched.

Nepal joined the Danygraig Company 17 May, 2022, and Ghimire followed on June 6, the very day of the DBW loans. Nepal is said to control the company. The DBW loan relates to this company also.

Even though there’s no mention of Raqia Bibi and Mohanananthan Kuhananthan I suggest that the ‘(RB)’ in Dreams Care Homes (RB) Ltd is a bit of a giveaway.

∼

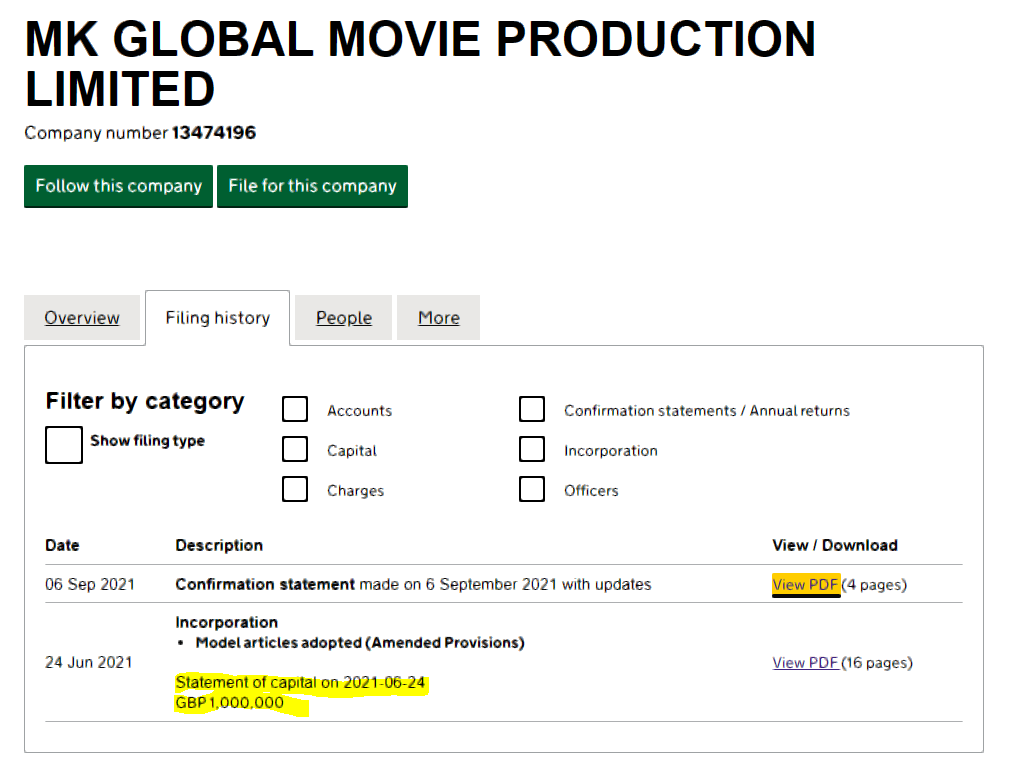

So where might Kuhananthan have gone after ostensibly severing ties with the Newport home? Well, I was as surprised as you’re going be, to learn that in June 24, 2021, the imaginative Mr Kuhananthan launched MK Global Movie Production Ltd.

Like most of his companies, this venture is already heading for the rocks. And yet, what I found fascinating was that there was an initial issue of 1000 x £1,000 shares. Which works out at exactly £1,000,000!

I’m not for one minute suggesting it’s the same money, but just weeks after the Development Bank of Wales slipped the readies to the care home in Newport – where he’d been a director – our boy set up a new company with capital of one million pounds.

A company that I guarantee is planned to fold as soon as is decently possible. Which will effectively write off £1,000,000.

And look at the address for this imaginative departure from granny farming – ‘RB Management Consultancy, 1 Bromley Lane, Chislehurst Business Centre, Chislehurst, England, BR7 6LH’.

Again, I suggest we can all guess what the ‘RB’ stands for.

∼

The company providing that accommodation address is otherwise known as RBMC Global Ltd, set up by Raqia Bibi in February 2017. She was joined by Kuhananthan in April 2021. Though you have to wonder why he bothered, seeing as RBMC Global files as a dormant company.

Which means that Kuhananthan joined a dormant company just two months before he decided to become a movie mogul. (Was he inspired by The Producers?)

On the very same day as RMBC Global was launched, another Bibi-Kuhananthan epic was unleashed on an unsuspecting world. This being RB Care Homes Ltd. Which is also filing as dormant.

Contradicting its prone position I found a glossy sales brochure for RB Care Homes Ltd, which seems to trade as Luxury Property Global. Or should that read traded, for the website is defunct.

Whatever the answer, that brochure alone must have cost a few bob to knock up and to print. All 18 pages of it.

Getting the picture now? If not . . .

Bibi and Kuhananthan seem to be acquiring care homes and then leasing or selling the rooms in those homes. Described in the brochure as ‘Buy to let’.

They could be running any number of homes in Wales on this model, in many or most cases working through proxies and using companies unknown to local authorities, Care Inspectorate Wales, and others.

UPDATE: When I published what you see above, earlier today, I was unsure if Kuhananthan and Bibi had actually sold or leased any rooms. A bit more digging has turned up the evidence.

The Administrator’s report for Nant-y-Gaer Ltd, dated 30 June, 2022, from which the panel below is extracted, makes it clear that 26 rooms were leased, for 250 years, at the Wrexham Care Centre.

Those who bought the leases have formed a group, The RB Action Group(?), claiming £2,074,984.

If it was done at one care home, then it’s reasonable to assume that Kuhananthan and Bibi were pulling the same stunt at their other homes. In fact, the report I’ve linked to talks of ‘associated companies’.

Questions need be asked as to how ‘Welsh Government, Care Inspectorate Wales, and local authorities, allowed these shysters to operate for so long.

∼

Which fits with the curious arrangements I mentioned in the previous post, in which the company supposedly owning a business or property is, effectively, dormant, while an unknown entity actually owns the building and runs the business.

In the recent case in Pontypridd, the company mentioned as running things is RB Care Homes Ltd, which produced the brochure yet, as you’ve just read, files as a dormant company, and has nothing in the way of assets other than £1,000 in the bank.

The Land Registry title document tells us the property is actually owned by Pontypridd Care Home Ltd.

Both companies run by Raqia Bibi and Mohanananthan Kuhananthan.

It was a very similar picture in Wrecsam over 3 years ago. The report I’ve just linked to mentions ‘Wrexham Care Centre’. There was certainly a company of that name, but it also filed as a dormant company, with no assets beyond another £1,000 in the bank. It was Dissolved 24 May, 2022. Bibi was a director, but not Kuhananthan.

The property was in fact owned by Nant-y-Gaer Ltd (the former name of the home). Bibi was a director there at the death, but Kuhananthan had departed in October 2015.

Finally, there was also Nant-y-Gaer Hall Ltd, wound-up in March 2020, Bibi ceased to be a director 15 July, 2019, Kuhananthan 21 April 2017.

Yet the June 2019 report in the Leader says the home was run by Raqia Bibi and Mohanananthan Kuhananthan. But in June 2019 Kuhananthan was not a director of any of the three connected companies.

His involvement was limited to Nant-y-Gaer Hall Ltd where, after ceasing to be a director in April 2017, he remained in control until the bad publicity of June 2019 may have forced him out 18 July, 2019.

Nant-y-Gaer Hall Ltd is still in existence, with two outstanding loans, but has been without a single director since Raqia Bibi resigned in July 2019, also following the unfavourable publicity.

Were the council and Care Inspectorate Wales even aware of Nant-y-Gaer Hall Ltd?

Which, by a roundabout route, brings us back to RBMC Global and RB Care Homes, and the same questions – if both have been filing as dormant, who’s running the show, and what happened to the money attracted by that ‘imaginative’ sales brochure?

Bibi and Kuhananthan dabbling in the lease / buy-a-room business was not of itself illegal, but it offers great scope for criminality, including money laundering.

∼

I referred earlier to this being an MO we had encountered before, and indeed we have. Just think back to Gavin Lee Woodhouse, of Northern Powerhouse Developments, the self-styled ‘Wolf of Wharf Street’.

Grand lad, our Gavin . . . apart from being a lyin’, thievin’ little bastard.

Despite it all, not so long ago representatives of the ‘Welsh Government’ were fighting to shake Gavin’s hand. I treasure the image below. But what happened to little Kenny Skates? Did he disappear one moonlit night while dancing in the Flint Ring?

I do so miss him!

Gavin took a great liking to Wales, buying up hotels from Llandudno to Tenby. Then leasing the rooms individually, a kind of timeshare arrangement. You lease a room from Gavin, then you get paid when someone stays in it.

‘Lubbly jubbly!’ Order your Ferrari now!

One of the properties Woodhouse bought was the Fishguard Bay Hotel. It was run by (and perhaps renamed) Wyncliffe House Hotel Ltd. Here’s the relevant Land Registry title document. Scroll down to see the 125-year leases of individual rooms.

At the time I was writing about Woodhouse I also bought a few of the lease documents from the Land Registry, and my suspicions were raised.

It seemed to me that not all the stated lessees were kosher. There were exotic addresses given that would have been difficult if not impossible for HMRC or anyone else to trace.

Then I remembered that the timeshare business, which is very similar to what we’re discussing here provided golden opportunities for money laundering.

You buy a run-down hotel or apartment block in some Mediterranean locale. Next, you form a timeshare company. Then, you tart up the building, get some glossy brochures printed. Finally, you start selling leases to genuine buyers. But you can also sell the same leases to entirely fictitious buyers and take in money you can’t otherwise account for.

Bingo! Money laundered.

And there are other ways of taking people’s money with timeshare. Some of those involved in such scams have appeared on this blog, mentioned in a long-running saga.

Buy a few hotels and you can defraud any number of people, and launder a hell of a lot of money. The same applies to care homes.

I’m not sure if Gavin Woodhouse went in for retirement homes in Wales, but as the video above makes clear, that was certainly his planned route to riches over the border. But he wasn’t interested in buying existing care homes like Bibi and Kuhananthan – Gavin was going to build new.

Well, no, he wasn’t. He had no intention of actually building the care homes, just in taking the money from investors he’d suckered.

Described by a high court judge as ‘thoroughly dishonest’. No shit, Sherlock!

The Wolf of Wharf Street had other plans to bring joy and prosperity to Wales, as we see in the image above of Woodhouse with Labour luminaries.

For he is said to have come up with the idea for the Afan Valley Adventure Resort. He even roped in no less a personality than Bore Grylls. (Who is probably in Ukraine right now stealthily and mercilessly dispatching Russian generals.)

∼

All joking aside, there are so many questions.

How many homes are Raqia Bibi and Mohanananthan Kuhananthan still involved with in Wales, directly or indirectly? How many of them are run on the ‘invest-in-a-room’ model?

Does anyone know? Is anyone asking?

What’s the legal situation if some old dear gets raped, robbed, or dies in an accident in a room where responsibility might be difficult to establish because ownership rests with a shady company in the British Virgin Islands?

Finally, let me suggest that it would be a good idea for ‘Welsh Government’, Care Inspectorate Wales, our councils, to establish exactly who ultimately owns each and every care home, if only to ensure they’re not dealing with shell companies.

As they have been too often in the very recent past.

♦ end ♦