TO RECAP . . .

You will recall that in the previous post dealing with the highly questionable disposal of publicly-owned land by the Regeneration Investment Fund for Wales we encountered two Guernsey-based companies, Imperial House Investments Ltd (Incorporated 30.11.2013) and South Wales Land Developments Ltd (Incorporated 01.02.2014) both of which had just two directors, Langley Davies and Jane Pocock.

It became clear that South Wales Land Developments was set up to serve as a vehicle for the real purchaser in the land deal with RIFW, Sir Gilbert Stanley Thomas, originally of Merthyr, but now resident in Guernsey. So what might be the purpose of Imperial House Investments Ltd?

The obvious question, to me, was, ‘Is there a specific Imperial House that might answer the question?’ Yes, and unsurprisingly it’s to be found on Imperial Park in Newport, listed among the publicly-owned assets disposed of by the Regeneration Investment Fund for Wales.

As I shall explain below, Imperial House was bought by Langley Davies and South Wales Land Developments on behalf of Stan Thomas in the controversial ‘portfolio disposal’ of RIFW assets. But is there anything in the pipeline – as with the housing planned for the Lisvane land – that might affect its value in an upward direction? And come to that, does SWLD still own Imperial House?

The answer to the first question is that Imperial Park will be very close to the projected M4 relief road / ‘black route’ announced by Edwina Hart in July 2014, which is bound to increase its value. ‘But wait!’ I hear you cry, ‘Imperial House Investments Ltd of Guernsey was created in November 2013, a full eight months before Redwina spoke’.

Which could suggest that Stan Thomas and Langley Davies are gifted with second sight . . . or there may be a more mundane explanation

The answer to the second question is where it gets interesting. For Imperial House – or at least, part of it – is now owned by yet another Guernsey-based company involved in these shenanigans.

Here are the details and the documentation.

Imperial House was bought on July 13th, 2012, from South Wales Land Developments Ltd by Imperial House Investments Ltd – a company that didn’t officially exist until November 2013 – for the sum stated on title number WA701104 as being £1,750,000. Here is a link to that document, and here’s a link to the plan of the site, showing the land bought bordered in red.

Then, on October 26th, 2015, it appears that part of the Imperial House site – known as “Phase II” – was sold for £3,853,823 (title number CYM664986) to Oxenwood YPL (Investments) Ltd of PO Box 25, Regency Court, Glategny Esplanade, St Peter Port, Guernsey GY1 3AP. Here’s a link to the title document, and here’s a link to the plan of the site, with the Oxenwood purchase bordered in red. It’s worth comparing the two plans.

So what do we know about Oxenwood? Not a lot. I couldn’t turn up anything for Oxenwood YPL (Investments) Ltd. (And what does YPL stand for anyway?) There is however an Oxenwood Real Estate LLP based in London which might or might not be connected. Though Imperial House doesn’t show in its portfolio.

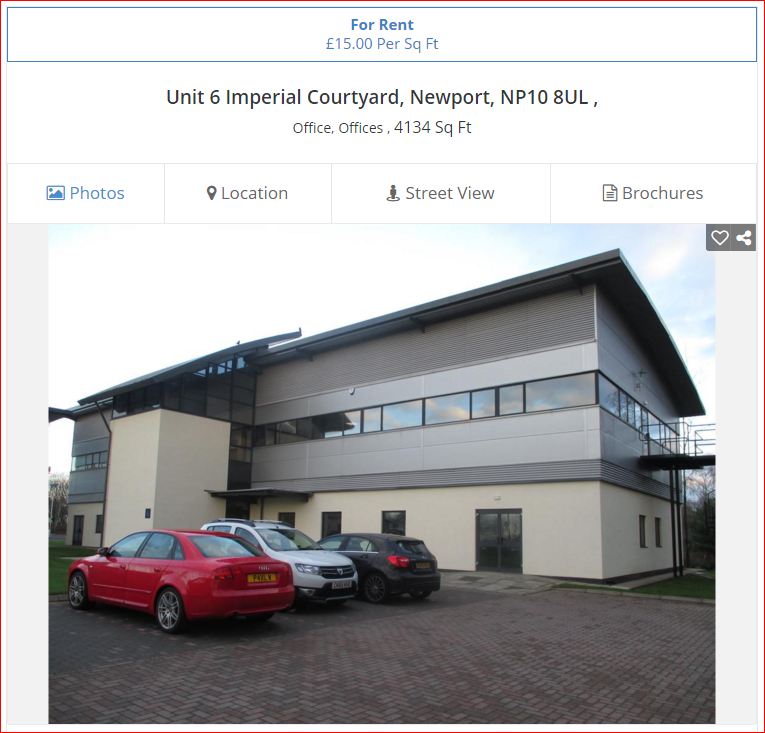

While searching for Imperial House I did turn up an advert for offices for hire in Imperial Courtyard, which forms part of the Imperial House purchase. The agent is Lambert Smith Hampton, the company that advised RIFW on the sale of its assets.

The building is shown above, with Unit 6 being the ground floor. Is this still owned by Stan Thomas or was it part of the sale to Oxenwood Real Estate LLP, which might have been no more than Stan Thomas selling from one of his Guernsey companies to another?

(To save you taking your socks off, 4,134 sq ft x £15.00 = £62,010.)

Or is this a new build on the “c1a (circa one acre) development site” that was part of the Imperial House transaction? And if “Unit 6” is offered in this ad can we assume that there are at least five other units?

Another big question is – how much did SWLD pay the RIFW for Imperial House? Whatever the answer we can be sure that it will be a very good deal for Sir Gilbert Stanley Thomas.

Reminding us that while the Lisvane site may be the ‘jewel in the crown’ there are a number of other lucrative elements to this portfolio sale by the RIFW that the media may have overlooked.

THE DELOITTE REPORT, INTRODUCTION

One thing that’s become clear as I’ve looked at the RIFW story is how the ‘Welsh’ Labour Party and its laughable ‘Welsh’ Government has procrastinated and dithered, how hard it has tried to stop the truth emerging while simultaneously trying to distance itself from the fall-out. Among the tactics employed has been to regularly trot out the line that the RIFW is an “arms-length” organisation.

The Deloitte report that we shall now consider might also be seen as another bit of procrastination, another effort to buy time in the hope that the critics would get tired and give up. The report was presented to the ‘Welsh’ Government on August 8th, 2013. Its findings are so conclusively damning that it should have resulted in immediate action, but those clowns down Cardiff docks continued to dither.

Before progressing with a detailed look into the Deloitte report I also recommend that you read Owen Donovan’s Oggy Bloggy Ogwr blog, where you will find an excellent analysis of this scandal stage by stage and learn how the Assembly and the ‘Welsh’ Government have handled it. Here’s a link to his most recent contribution, Dirty Deeds Done Dirt Cheap VI: The Debate and you can work back from there to read the earlier pieces.

Click on the title to open the full report, Welsh Government Peer Review – RIFW Asset Portfolio Disposal and keep it open in another window. I know I always say this, but this time I really mean it – please set aside an hour or so to read the report through. I should warn you that it is redacted, but not so heavily as to detract from the seriousness of its findings. (Though of course it did make me wonder, given what is left, how damning were the redacted parts.)

I shall now list what I consider to be the most important of Deloitte’s findings, page by page, but before that maybe I should explain who’s who, and what their roles were.

- Chris Munday is the civil servant behind the creation of the Regeneration Investment Fund for Wales. There is surely a knighthood awaiting Mr Munday . . . or possibly a posting to the Gurnos community centre (personal injury insurance provided).

- Lambert Smith Hampton is the commercial property consultancy that advised the RIFW on the sales, through its Cardiff office headed by Lee Mogridge, with input from Jeremy Green who is based in London.

- Amber Infrastructure was the other RIFW adviser and is now considering taking action against LSH. (The second link contains the sentence, ” . . . they [the Public Accounts Committee] were concerned that one of the company’s [LSH’s] employees was working for both RIFW, which was selling the sites, and South Wales Land Developments, which was buying the site.” This is also referenced in this report from 2013 into the internal governance of the RIFW – page 29 iii – but the individual is not named.)

- The public interest was supposed to be have been safeguarded by the five people appointed to the RIFW Board by the ‘Welsh’ Government. These were Richard Anning, of the Institute of Chartered Accountants in Englandandwales; Ceri Breeze, a ‘Welsh’ Government civil servant; Richard Harris, another apparatchik; Chris Holley, the former Lib Dem leader of Swansea council; and Jonathan Geen, of Acuity Legal, the Endgame Group, and, more recently, Bellerophon Scotland, plus of course, South Wales Land Developments Ltd and, ultimately, Stan Thomas.

THE DELOITTE REPORT (by page and column heading)

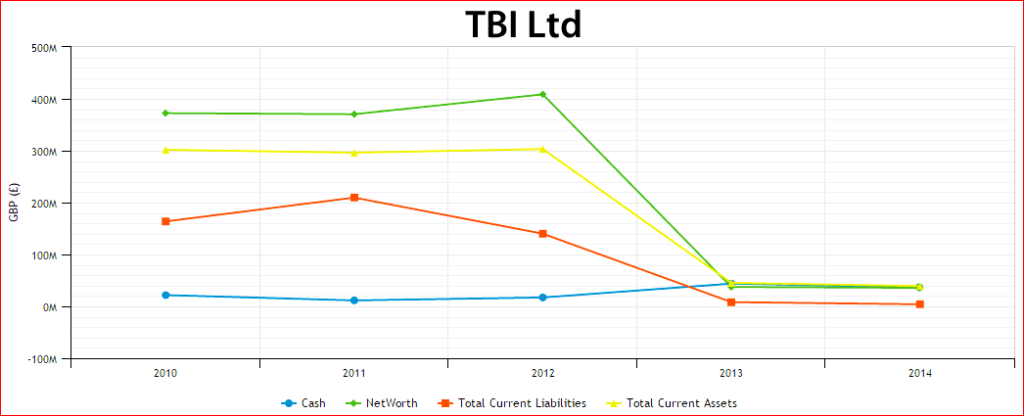

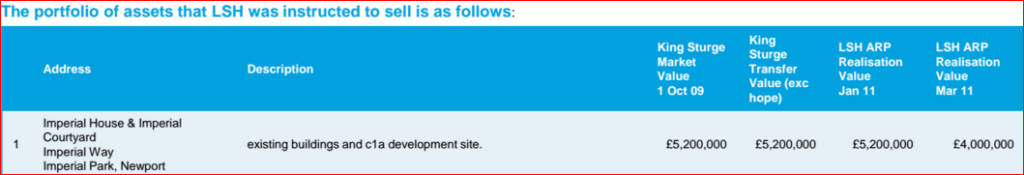

Page 12: Note that the original value put on Imperial House was £5.2m, yet SWLD was able to sell the property to Imperial House Investments Ltd for £1.75m, so I ask again, how much did SWLD pay for Imperial House? And remember, the £5.2m value was given before anyone knew of the M4 ‘black route’ coming right by Imperial House.

Page 14 Observations: January 31st, 2011: “The Investment Manager’s Report and the Minutes of the Board Meeting at which this document was discussed make no mention of consideration of a portfolio disposal”. Suggesting that the original intention was to sell the lots individually, or perhaps in batches.

The reference in the lower box to Imperial House could be interpreted as someone trying to drive down the asking price.

Page 15: This theme of driving down the supposed value of Imperial House continues.

Page 17 Description: The reference in the lower box makes it clear that by March 28th, 2011, an offer has been received to buy all the properties in a “portfolio disposal”.

Page 21 Observations: It seems clear that Deloitte cannot understand why the Realisation Value of Imperial House has fallen since 2011, and no explanation is offered.

Page 24 Description: This tells us that in the early part of 2011 there were a number of companies interested in the RIFW land, it lists them. Legat Owen, for example, had a client interested in all the sites in the north. But the job lot had already been promised to Stan Thomas.

Page 25 Observations: Lambert Smith Hampton – the Investment Managers to the RIFW, entrusted with securing the best possible deal for these public assets – has not advertised the properties but has “informally canvassed” likely purchasers.

Also note something I commented on in my previous post. Jonathan Geen is dealing with Langley Davies of South Wales Land Developments, Stan Thomas’ front man, but SWLD didn’t officially exist!

Page 26 Observations: Read it all. “No advertising took place” says Deloitte. Though there are more vague references to “informal canvassing”, making it clear that the deal was already done and dusted.

Page 27 Description: Some time before April 21st, 2011 it was known that an offer had been made by Stan Thomas. May 10th, 2011, Langley Davies says that Stan Thomas (through GST of Guernsey) will be lending him the money to make the purchase “at 3% over interbank rate”. So Langley is the real purchaser, with Stan just lending him the money?

Observations: On April 21st, 2011, Board member Jonathan Geen declares a “potential conflict” (of interests). AT WHICH POINT HE SHOULD HAVE BEEN GIVEN THE OLD HEAVE-HO FROM THE RIFW.

Page 28 Description: Here we learn that the “portfolio offer letter from GST Investments Ltd” was received on March 4th, 2011.

Also that, “LSH met Sir Stanley Thomas and Langley Davies to discuss the sale” on March 30th, 2011. Was no one else present?

Page 29 Description: Value of Imperial House downplayed, again.

Page 30 Description: At 20th April, 2011, we learn of the first written evidence of LSH recommending acceptance of the Stan Thomas offer. We also learn that Carwyn Jones and the “IM” were informed of this development.

We also see yet another mention of no due diligence carried out with regard to GST or SWLD.

Pages 32 & 33: With a few minor caveats the Board decides by the end of April 2011 to (officially) accept Stan Thomas’ offer.

Page 38 Description: Lambert Smith Hampton “writes to Martin Pollock of Barclays Wealth (acting for Stan Thomas) accepting an offer of £22.5m based on three staged payments” on June 15th 2011. Anyone who’s been paying attention will have noted that this purchase figure has changed a few times.

Observations: Note Deloitte’s curious and rather worrying mention of the Board’s recorded vote.

Here’s some more information on the Board, “From January 2011, the Board comprised five voting members: two Welsh Government officials (one of whom served as Chair), a Welsh Local Government Association representative and two external members appointed following an advertised public appointments process. Although Welsh Ministers appointed the Board members, under the LLP model all of the Board members had a legal responsibility to act in the interests of RIFW, even if those interests were not entirely aligned with those of Welsh Ministers(?). LSH told the Committee that they felt the composition of the Board contained the right expertise for this venture.”

I’m quoting there from the January 2016 report by the Assembly’s Public Accounts Committee (page 18). Which goes on to say, “The small size of the RIFW Board meant that its capacity to discharge its responsibilities was weakened when a conflict of interest regarding the portfolio sale to SWLD arose when one of the external members, Jonathan Geen, started to act as the legal advisor to SWLD on the sale transaction.”

Further documentation on the Public Accounts Committee investigation is available here.

Page 39 Description: It is noted on July 22nd 2011, Redrow offers “£2m unconditionally for the Bangor site”. This offer was made to Lambert Smith Hampton’s Manchester office. Why didn’t Redrow go to the Cardiff office handling the sale? Did they know something?

Whatever the answer, this offer seems to have slipped through the floorboards, though of course we should remember that the deal with Stan and Olly had already been stitched up by then.

Page 40 Description: Heads of Terms between RIFW and Newco Ltd (acting for Stan Thomas), July 15th, 2011,“describes the sale of 18 properties, but it also states that RIFW may not be in a position to dispose of Imperial House and Garth Park”.

Observations: “Jonathan Geen is noted as the purchaser’s solicitor”.

Page 44 Description: Against the date November 15th, 2011, we read, “Purchaser is now TBC – a Guernsey Registered Holding Company wholly owned by St Lawrence Property Investments Ltd, registered in UK and funded by GST”.

St Lawrence Property Investments can be found at Unit 6, Imperial Courtyard, the property for rent we looked at earlier. Its directors are Langley Davies and Jane Pocock, but as a new face we have a Karen Davies, who could be Langley’s wife or, given that she was born in the same month as him, his twin sister.

This company, Number 07545621, was Incorporated February 28th, 2011, and before moving to Newport its address, until August 17th, 2011, was 3 Assembly Square, Britannia Quay, Cardiff Bay. The same address as Acuity Legal, where Jonathan Geen is listed as “Partner – Real Estate”.

If St Lawrence Property Investments was registered at 3 Assembly Square, the address of Jonathan Geen’s company, Acuity Legal, and Incorporated on February 28th, then it’s reasonable to assume that Geen was representing Stan Thomas and Langley Davies some two months before he confessed to his “potential conflict” on April 21st. It may have been longer.

THOUGHTS

The ‘Welsh’ Government seems to think that the RIFW fiasco was all over with the Public Accounts Committee report in January. That was certainly the opinion of Lesley Griffiths AM, Minister for Communities . . . the very communities that have lost out by RIFW not realising anything like the potential of the assets it was entrusted with.

We have since learnt that the ‘Welsh’ Government is getting tough, and earlier this month it was announced that there are plans to take legal action against Lambert Smith Hampton, which has also been referred to the Royal Institution of Chartered Surveyors.

This is the very least the ‘Welsh’ Government could do, because the performance of LSH leaves only two possibilities:

1/ Those allocated by LSH to the RIFW contract were so utterly inept and unprofessional that they should never be given another job more complicated than a house sale.

2/ The company, or one or more of its employees, was in the pay of Langley and Stan, which is what is suggested by more than one source. If an employee of LSH was simultaneously working for the RIFW and the Langley and Stan show, then surely that person can be prosecuted?

It is therefore wholly correct that Carwyn and his posse should ride off into the sunset in pursuit of the LSH gang. But I don’t understand why Jonathan Geen has been allowed to leave town unmolested. I’m assuming he’s left Cardiff, for as I suggested just now, he seems to have moved to Scotland, where he is currently starring on the Bellerophon Scotland website, now calling himself ‘Jon’ Geen but using the same, Acuity, photograph. (Open out for full profile.)

Jonathan Geen was appointed to the RIFW Board in December 2010. The Terms and Conditions of his appointment can be found here (page 31). I’m linking again to the somewhat neglected report, published in April 2013, into the governance arrangements of the RIFW, written by Gilbert C. Lloyd FCA CPFA. You can read it for yourself, but I can save you the trouble by telling you that Mr Lloyd concludes that the RIFW is a bit of a shambles.

The penultimate Duty reads, “Acting in the best interests of the Fund”. Was it possible for Jonathan Geen to act in the best interests of the Fund while also serving Langley and Stan? His responsibility to the Fund should have meant maximising its profits, yet the gruesome twosome wanted to pay as little as possible for the land.

The final Duty says that the Committee on Standards in Public Life’s Seven Principles of Public Life are adhered to. Read them and you may think that Jonathan Geen broke most of them while acting as a Board member of the RIFW, supposedly safeguarding the public interest.

So why was Jonathan Geen allowed to take the high road?

CONCLUSIONS

The Regeneration Investment Fund for Wales was a cock-up from the outset. A perfect example of what goes wrong when civil servants and politicians with no knowledge of the real world try to deal with ‘businessmen’. Setting up the RIFW in the manner it was done was like tethering a goat and waiting for the predators to appear.

Another contributing factor was that, despite its grandiose ambitions, Cardiff remains a relatively small city, and those in particular sectors – such as property sales and development – will almost certainly know each other. Not only professionally, but also socially. Perhaps they’ll belong to the same Lodge or golf club.

While I consistently argue for contracts and jobs to be given to local companies, in the case of the RIFW land disposal, the contracts should have been dispersed to people unknown to each other. This must be borne in mind for all similar business in future and, indeed, more generally when awarding contracts.

For as I travel around Wales I notice signs on development sites telling me that the architect, or the surveyor, or the agent involved, is based in Cardiff, and almost certainly got the contract because he is close to the ‘Welsh’ Government, perhaps in more senses than one.

So let’s learn from the RIFW scandal and in future spread the contracts and the wealth they generate around the country.

All that said, the ultimate blame for the Welsh people being deprived of £200m or more does not lie with Langley Davies or Stan Thomas, Jonathan Geen or anyone at Lambert Smith Hampton, for these were simply being true to their natures. No, the blame lies squarely with the ‘Welsh’ Labour Government down Cardiff docks.

The Regeneration Investment Fund for Wales was a disaster waiting to happen, and it was obvious as early as March 2011 that the disaster was playing out, that there were conflicts of interest, that companies showing interest in doing deals were being cold-shouldered in favour of a single buyer, who seemed to be known to all involved, and was at the very same time making a tidy profit out of selling Cardiff airport to the ‘Welsh’ Government!

And while this tragedy was unfolding those buffoons were hiding behind the ‘arms-length’ defence. Yet the RIFW was their creation and they could have stepped in at any time to protect public assets. And that’s exactly what they should have done. It was their duty.

The response of the wretched Lesley Griffiths sums up not only the ‘Let’s move on’ attitude of her administration, but also ‘Welsh’ Labour’s complete lack of ambition for Wales, which could be summed up with, ‘Ooo, we’ve got about 5% of what these assets should have realised – isn’t that wonderful’!

As I’ve said, these clowns will be asking for your vote again in May. Anyone who votes Labour does not – cannot – have the best interests of Wales at heart. Vote for anyone but Labour!

Let’s get the Labour monkey off Wales’ back!