RCT HOMES

Earlier this month Martin Shipton of the Wasting Mule and WalesOnline had a brief bout of outrage on learning that RCT Homes was advertising for a chief executive at a salary greater than that paid to the UK Prime Minister or Wales’ First Minister. Here’s the advertisement – with a London recruitment agency – that occasioned his momentary unhappiness with the colonial system.

This recruitment follows on from a number of personnel changes at RCT Homes (mentioned in the same article) that are worthy of reporting, not least the departure of Andrew Lycett, the previous chief executive. So let me hand you over to a correspondent who explains the complexities of it all. I have added links and a few comments to help you understand better who’s who and what’s what.

Now read what follows carefully and join up the dots.

“The Wasting Mule tells us that Andrew Lycett left RCT Homes for reasons that were unexplained on the grounds of “confidentiality”. A more typical corporate response to that question is that he “has found career opportunities elsewhere” which led me to investigate.

Lycett submitted his resignation from RCT Homes at the same time as Cllr Kieron Montague (Labour) announced he would step down and not seek re-election. He is Cabinet Member for Tackling Poverty, Engagement & Housing. He also sat on the RCT Homes board, on behalf of RCT council.

Lycett has actually taken up the role of Finance Director with the Jehu Group, a real estate development company, who beside being a major player at the SA1 development in Swansea, but also has expanded to the west, opening a new office in Haverfordwest, under their subsidiary Waterstone Estates.

Montague, meanwhile, has now taken up a role with Cynon Taf Housing Association, who unlike RCT Homes, has a substantial holding of vacant development land.

In a previous post (here, scroll down) you correctly pointed out the outsourcing of estates administration by a number of local authorities to PwC. A partner of PwC, Lynn Pamment, also sat on the board of RCT Homes, alongside Lycett and Montague. She will, of course, be very conversant with the issues which PwC has been required to ‘assist with’, that of, balancing the budget for Pembrokeshire and Ceredigion councils. This includes selling off land for development.

This, of course, is the very footprint that Waterstone Estates has opened an office for in Haverfordwest for. Waterstone Estates is a wholly owned subsidiary of the Jehu Group, which Lycett is now director.”

We are all familiar with the links between the Third Sector and the Labour Party, but now we see a third element become more evident, that of private businesses, which recruit people with local government and Third Sector experience to help ‘smooth the way’ with the acquisition of land, the gaining of planning approval, and of course the clamping of the sweaty paws upon the funding public.

The supplier of the information mentions the RCT Board, and so I took a peek for myself. It hasn’t been updated, so here it is before it’s changed.

It’s the usual mixture of Labour time-servers, Third Sector spongers and token residents. But as we were warned just now, there’s also the PwC representative, looking after her company’s best interests. Lynn Pamment is of course one of those selfless English missionaries without whom we Welsh would be running around naked doing unspeakable things to each other and gabbling away incoherently.

Also on the Board is someone I’ve mentioned before, a regular contributor to the Letters page of the Wasting Mule, where he can be relied upon to fly the flag for Queen and Country (his country that is, not ours), Kel Palmer. And talking of flying, his bio describes him as “A former fast jet pilot in the RAF” . . . not to be confused with those slow jet pilots . . . always getting in the bloody way . . . slowing down the bombing runs. It’s a wonder regime change is ever achieved.

This I think is one to watch. Particularly the future careers of Andrew Lycett and Kieron Montague.

[With so many different people sending me stuff I seem to have lost the original e-mail containing the information used above. So will whoever sent it please get in touch to remind me who you are.]

APPRENTICE APPARATCHIKS

There’s been a lot of talk lately about the need to provide apprenticeships, with political parties trying to outdo each other in the number they’d provide if elected, but did you know that the ‘Welsh’ Government has its very own apprenticeship scheme?

I am indebted to another correspondent for drawing this to my attention. Though he’s very concerned by the fact that most of those chosen for these apprenticeships seem to be related to someone already working for Carwyn and his gang.

Which, I suppose is only to be expected. For it seems that these apprenticeships are advertised only on the ‘Welsh’ Government website. Now with the best will in the world, I doubt if many young people visit the site . . . unless advised to do so by family or friends.

Is this how it should be done? Doesn’t it risk getting nepotism a bad name?

And by the way, Carwyn, I wouldn’t give a job to that shifty-looking little bugger in the middle, the one fiddling with his tie. If he’s going to do Oliver Hardy impersonations he needs to put on about 150lb . . . and also develop a personality.

CHRISTOPHER MUNDAY, GOAT-TETHERER

A third supplier of information has very interesting things to tell us about Christopher Munday who, you may remember, is the genius who set up the Regeneration Investment Fund for Wales which I – in my previous post – likened unto tethering a goat and waiting for the predators to appear.

He writes . . .

“CM is typical of many public sector employees who see their advancement “up the greasy pole” by avoiding decision making and adopting the mantra of “plausible deniabilty” if anything goes wrong.

He joined Welsh Development Agency in the 1980’s having formerly been a “site finder” for a medium sized house building company. He progressed through a number of low and medium grade clerical jobs, as the WDA expanded through the 1990’s, and then became employed in a department seeking to access private sector money to add to the Agency’s budget for property development purposes.

As he had little knowledge of funding (and no knowledge of property development), his approach was to appoint major firms of accountants to “write reports” as to how private funding might be accessed. It was quickly realised in Cardiff, that operating a large budget for the purposes of employing private sector accountants, made CM a prime target for the KPMGs, PWC, Deloittes of this world in “keeping him sweet”. He attended, for many years, the annual MIPIM property junkets in Cannes, where his time was spent networking (i.e. being entertained) by his accountancy pals.

Once these reports had been completed, at costs between tens of and hundreds of thousands of pounds, these would be “topped and tailed” by CM and subsequently presented to his line managers and, ultimately, ministers as “all his own work”. On two or three occasions the reports suggested “arms-length” initiatives, with a view to private sector organisations participating in the development of offices and factories in Wales.

In at least one of these initiatives (called WISP) the “partner participant” was a company called Babcock and Brown. By this time WDA had been “absorbed” into the Assembly. The basis of WISP was that the Assembly would take a long lease on an office block before it was built, and the investment would be pre-sold to provide the funds to build it in the first place.

Unfortunately, after a couple of office developments, Babcock and Brown went bust, and the WISP idea terminated. Babcock and Brown’s contact with CM was Leo Bedford(LB), and LB started up another company out of the ashes of Babcock and Brown, called Amber.

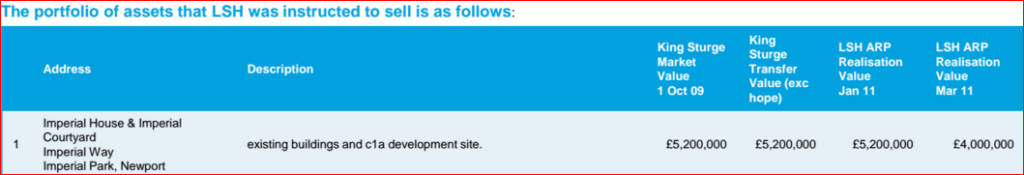

It was, therefore, of little surprise that when the RIFW (a.k.a. JESSICA) initiative was suggested to Welsh Government, CM was put in charge of running it, and (surprise, surprise again) Amber was appointed as Fund Manager. It is not clear who decided Lambert Smith Hampton (LSH) should be appointed as Property Advisers, but it is clear that Welsh Government appointed both firms (see attached press release). It is also interesting to note that when the RIFW s**t hit the fan, CM denied flatly that Welsh Government had appointed LSH, and insisted that LSH had been appointed by Amber without his knowledge (!).

I know several people who have worked, and still work with Mr Munday, and it is the case that work colleagues, AMs and Ministers largely regard him as a . . . at which point I have to intervene because it gets rather personal, and I’m down to my last couple of mill. Munday commutes to Cardiff from Wiltshire.

What are we to make of this, boys and girls? Now as you know, Jac is a simple soul, and talk of conferences in the South of France, and big numbers that I can’t get my head around, send me into a tizzy. But if half of what my informant tells us is true, then this man sounds like a complete asshole! But of course he’s an English asshole, so he’s guaranteed an important job in Wales, losing millions and millions from the Welsh public purse.

JAMES BOND COMES TO CARDIFF

The ‘Welsh’ media has gone overboard reporting the fact that Aston Martin is to build a new plant in Sant Tathan, just outside Cardiff. Now me explain this to you.

This has nothing to do with jobs; the number of jobs created is almost irrelevant for those who persuaded the ‘Welsh’ Government to bribe Aston Martin to set up on the outskirts of Cardiff. The motivation, pure and simple, is the promotion of Cardiff.

The Aston Martin plant is just another prestige project to add to the Millennium Stadium, the Millennium Centre, the Swalec Stadium, the National Ice Rink and all the other developments we’ve seen in recent years, including – don’t laugh! – the Assembly building itself. Within a very short time I guarantee we shall be hearing, ‘Cardiff – Home to Aston Martin’.

Many are already asking how much the ‘Welsh’ Government paid Aston Martin to move to the Vale, but nobody’s answering. I am indebted to @tomgallard for letting me publish this letter in which the ‘Welsh’ Government refuses to disclose how much it invested in this wonderful project that will be of benefit to the whole of Wales.

If you think I’m just an embittered old Jack, and that the ‘Welsh’ Governments’s prime consideration was jobs, just ask yourself this – would they have rolled out the red carpet with gold thread for Kia, or Dacia, even if these companies were creating 3,000 jobs? And answer that honestly.

And if you believe that employment / investment was the prime consideration, and that’s why the ‘Welsh’ Government was prepared to break the bank to get Aston Martin to Wales, then why weren’t the jobs directed to an area where they are much more needed than the Vale of Glamorgan, where I guarantee residents will soon be opposing all the disruption the Aston Martin development threatens?

Oh, and one final thing. Scroll down on the letter to Tom Gallard and see who signed it. Yes, that’s the same Christopher Munday we discussed just now. Whenever there’s Welsh public funding to be wasted, Munday’s yer man!

P.S. Another factor worth considering is that this rush of automotive good news – Aston Martin to the Vale of Glamorgan, TVR to Ebbw Vale – comes just ahead of the Assembly elections on May 9. The Labour Party must be calculating that news like this is worth a few thousand votes, maybe saving the party a couple of seats. Very important when we remember that Labour currently holds 30 out of the 60 seats and is predicted to lose anything up to 5 of them.

*

What we see in these examples, and in other cases I’ve highlighted over the years, is utter contempt for the democratic process and the public purse – which works to the detriment of us all. Basically, it’s, ‘Sod off! we don’t have to tell you anything’.

When RCT Homes was questioned by Martin Shipton about the £150,000 salary for its chief executive he could only tell us, “A spokeswoman for RCT Homes said the body would not be offering a comment.”

And when Andrew Lycett left RCT Homes to take up his post with real estate company the Jehu Group, the reasons for his leaving were unexplained on grounds of “confidentially”. This, remember, is a Registered Social Landlord getting large dollops of funding from the public purse.

The ‘Welsh’ Government apprenticeships are obviously aimed squarely at those in the know. Otherwise they’d be advertised properly so that everybody’d have a chance.

The RIFW scandal for which Christopher Munday is so culpable is still shrouded in mystery because so much information is being withheld and so many lies are being told.

Finally, we have the countless millions lobbed Aston Martin’s way to get another blue chip company to Cardiff. Yet we cannot be told how much because this information is – so someone at the ‘Welsh’ Government argues – “exempt from disclosure”. Is that really true?

And all this is happening in a system that prides itself on ‘openness’, focussed on a building made of glass, so that we, the people, can see what they’re up to. What a load of deceitful symbolism and absolute bollocks!

(Calm down, Jones.)

Now a compete change of subject, but another indictment of how Wales is run, and the priorities of those who run our county and our cities.

BEDD GWYROSYDD

When I was a boy, I used to catch the school bus at Brynhyfryd Square, which would then make the long haul up Llangyfelach Road, past the ‘Public Hall’ and its bust of Daniel James, before the turning left and along Heol Gwyrosydd to Penlan School.

Of course I knew the hymn Calon Lân, and I knew that the words had been written by local man Daniel James. (Bit of a hero of my mamgu!) Which was just as well, because I wasn’t going to learn things like that in Penlan School, or any school in Swansea. Trigonometry, Latin, and the history of British imperialism would stand me in much better stead for the world that awaited me.

These memories came back when I opened an e-mail and saw a photo that someone had sent with it. The photograph was taken the day after Palm Sunday, and it shows Daniel James’ sorry-looking grave in Mynyddbach cemetery. The person who sent me the photograph said he had to avoid huge Victorian headstones leaning at dangerous angles to reach the grave, and that a machete would have helped to get through the undergrowth.

Doesn’t the man who wrote perhaps our most famous hymn deserve better than this? If I was talking here about some monument to our subjugation, or a reminder of our colonialist exploitation, or some house where Nelson had enjoyed Lady Hamilton, then Cadw, or the National Trust, or some other bunch of colonialist grant-grabbers would demand a few million to ‘maintain it for the nation’. (And we know which nation.)

If you feel as I do, that Daniel James deserves to be remembered better than this, then write to somebody; Swansea council, the ‘Welsh’ Government, anybody. Send a letter or e-mail to your local paper, or the Daily Post, the Western Mail.

Because how much would it cost to maintain this grave with the dignity it merits? Less than a set of tyres on an Aston Martin. Probably less than Christopher Munday earns in a week. One per cent of what the chief executive of RCT Homes will be paid in a year. Wake up people! let’s start getting our priorities straight. Let’s start remembering who we are.

UPDATE 28.03.2016: Good News! A mystery benefactor has appeared to help with the restoration of the Gwyrosydd headstone.