![]() This ‘quickie’ is in response to a news item about 200m tall wind turbines planned for Mynydd Fforch-dwm, near the village of Tonmawr, east of Neath. Permission has been granted by the so-called ‘Welsh Government’ on the grounds that it’s a Development of National Significance.

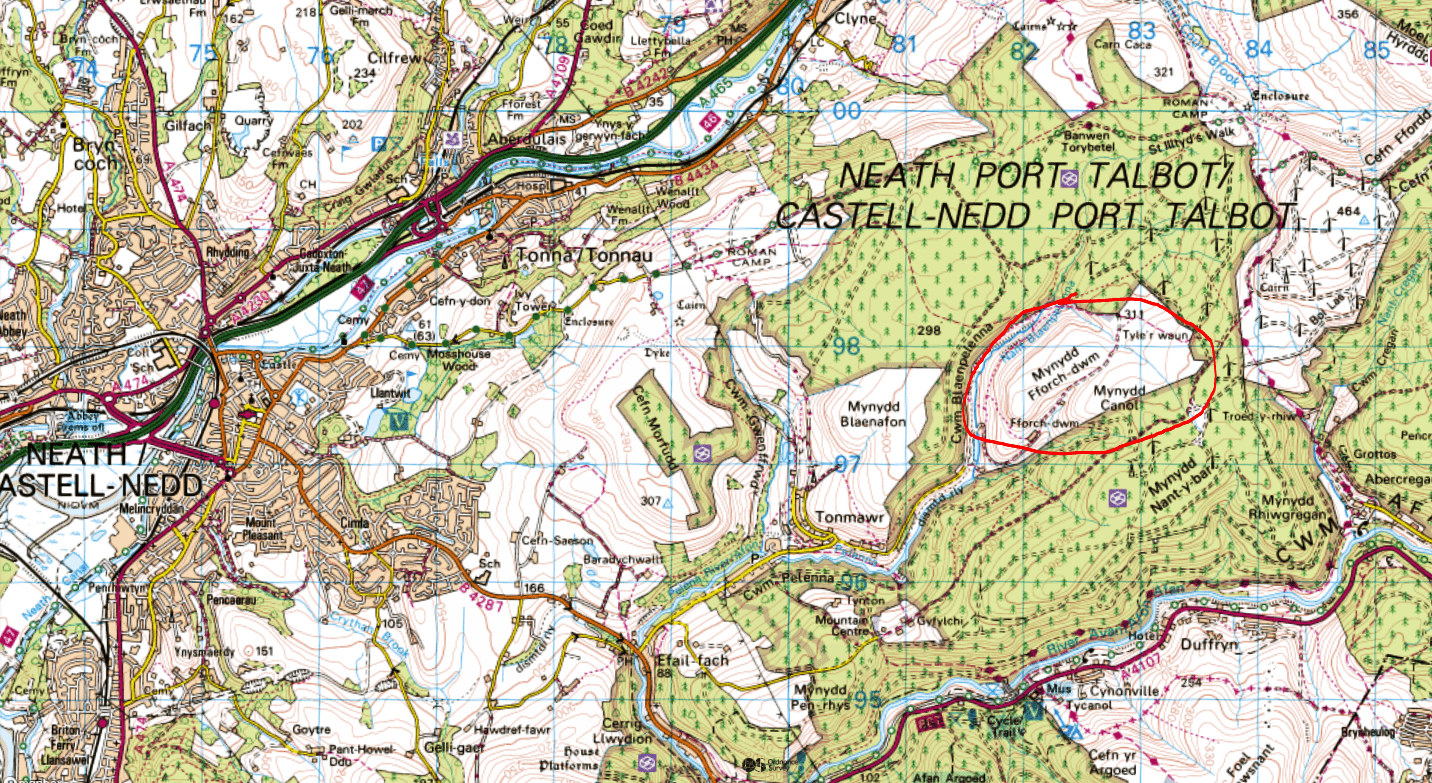

This ‘quickie’ is in response to a news item about 200m tall wind turbines planned for Mynydd Fforch-dwm, near the village of Tonmawr, east of Neath. Permission has been granted by the so-called ‘Welsh Government’ on the grounds that it’s a Development of National Significance.

The bulk of this post will be taken up with a look into the labyrinthine ownership of the company said to be behind this project, and others, before concluding with more general thoughts on ‘renewables’ in Wales.

◊

THE PROJECT

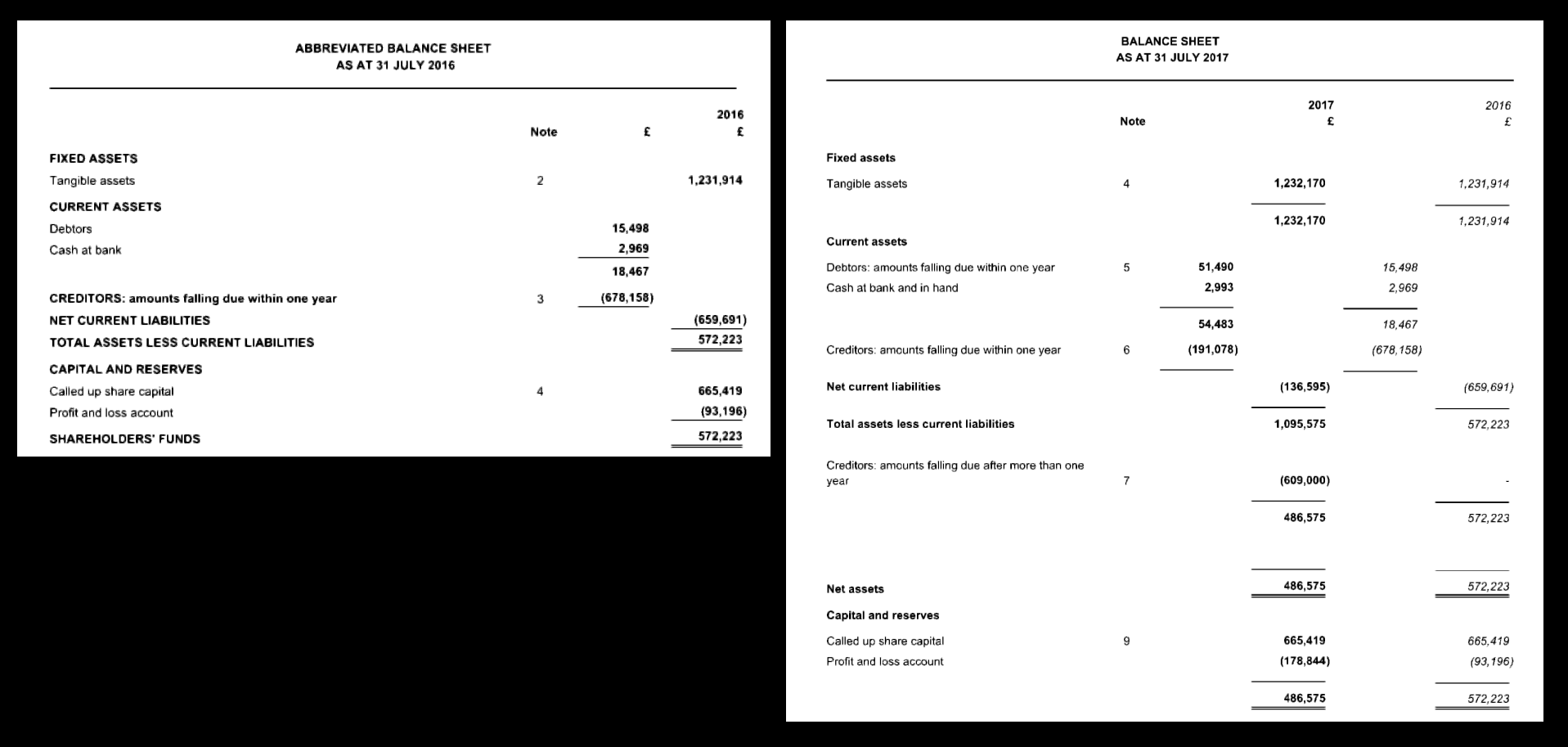

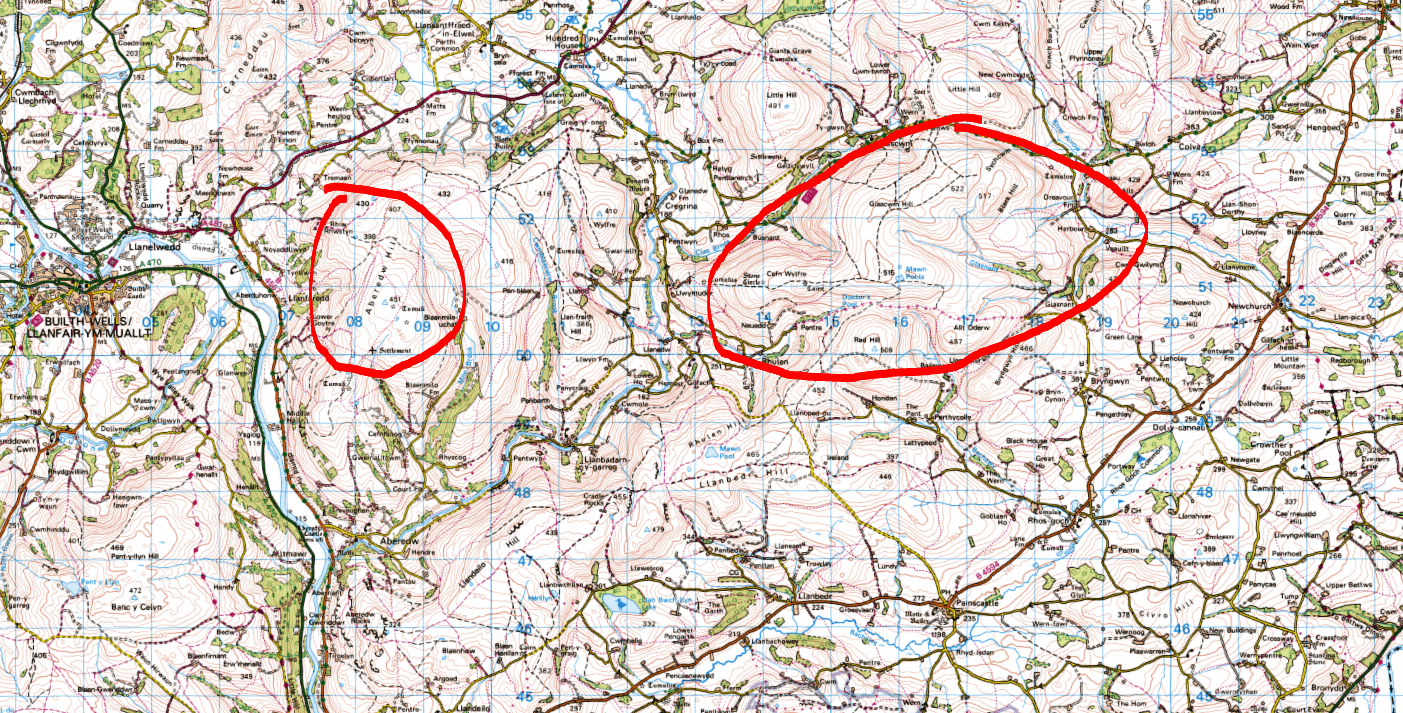

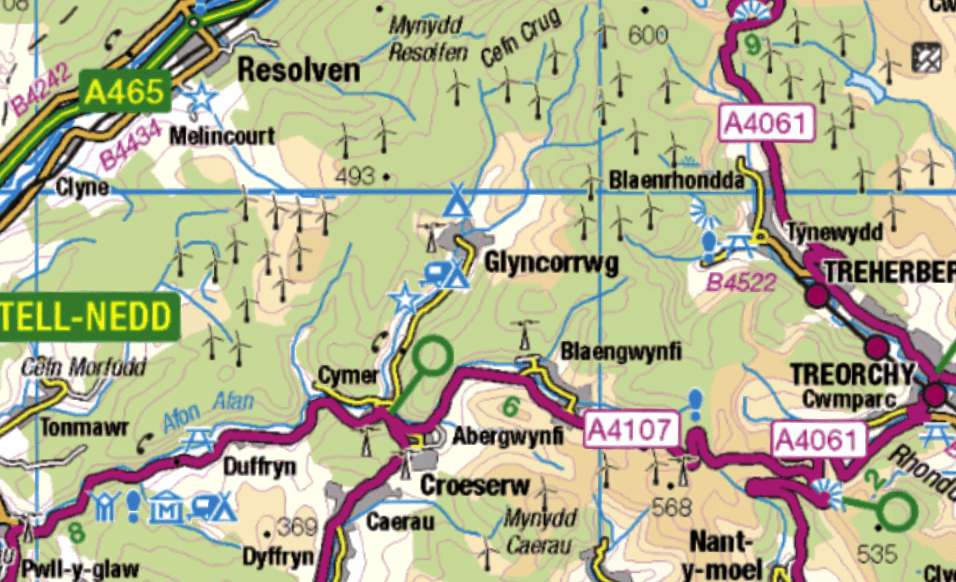

First, let’s give you an idea of the where we’re at. As I’ve said, it’s to the east of Neath, and in the map below I’ve circled Mynydd Fforch-dwm in red.

The additional run-off of rainwater generated by the huge concrete turbine foundations, the cable trenches, the access roads and all the other work, will run into Nant Pelenna, which joins the Afan near Pontrhydyfen, and then flows on down to Port Talbot.

It’s an area already cursed by many turbines, with even more planned. Such as the proposal to erect even taller turbines just a few miles away at Y Bryn.

Though it’s not just the six huge wind turbines that are being promised, for this ‘energy park’ will bring even more goodies:

As well as the six large turbines . . . the site could also contain up to 10 hectares of solar photovoltaic panels mounted on frames fixed to the ground along with associated infrastructure such as battery storage facilities, electricity transformers, and access works.

The company named in the article as being behind the project is Naturalis Energy. Here’s their elementary website. Naturalis describes itself as a joint venture between Renantis and REG Windpower Ltd.

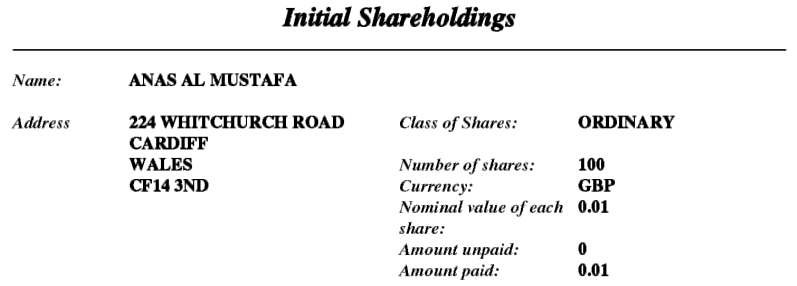

Companies House shows a Naturalis Energy Ltd based in Telford, Shropshire. But I’m taking a punt on the company we’re looking for being Naturalis Energy Developments Ltd, formed 23 September, 2019, as the timing fits with the website dated 2020.

Also, because control is exercised by Renantis UK Ltd. Running Renantis are two Americans and a Brit. This is one of the Americans, and this is the other. And here’s the Brit, Michael Nagle.

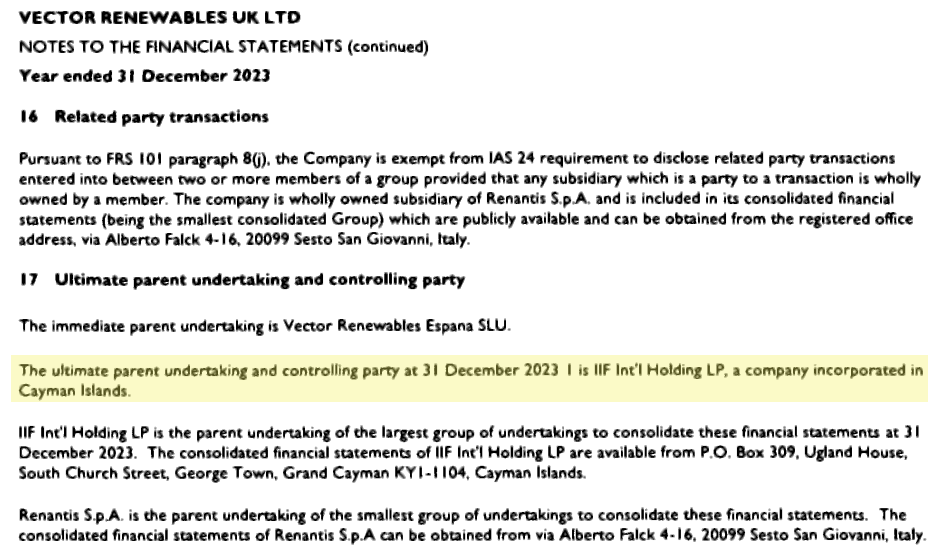

The same trio controls Vector Renewables UK Ltd at the same London address as Naturalis Energy Developments. Vector is owned by an outfit in the Caymans.

These three may control other companies, but they can’t be traced in a Companies House search because they aren’t listed as directors, only as ‘Persons with significant control’.

From what I can see, the expertise in ‘renewables’ for Mynydd Fforch-dwm will be supplied by REG, with the money coming from Naturalis-Renantis. So I’m going to concentrate on the second element, the funding.

But before leaving REG . . . It was a tortuous trail but I eventually established that it’s all owned by Andrew Nicholas Whalley. Who’s been involved with many companies. Quite a few with Welsh names.

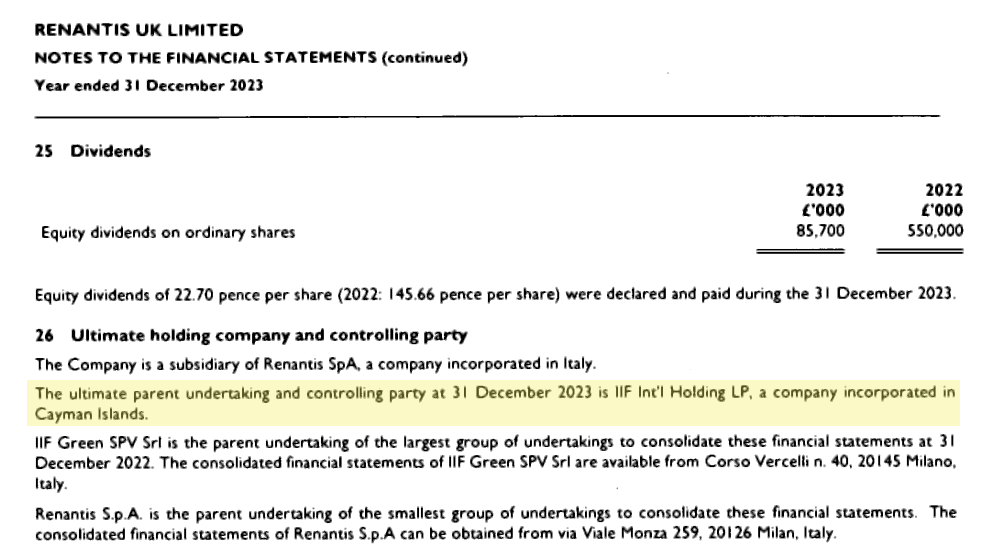

Back to Renantis UK Ltd, and the latest accounts filed with Companies House (to Dec 31, 2023) which tell us who owns this company. And whaddya know! – we’re back to the Cayman Islands, and the wording is the same as we just read for Vector.

Now it gets a little complicated, so let’s hope I can explain it.

The panels above tell us Renantis UK is a subsidiary of ‘Renantis S.p.A’, registered in Milan, and elsewhere we learn that until November 2022 Renantis was known as Falck Renewables, following an acquisition in February that year by ‘institutional investors, of which J.P. Morgan Investment Management Inc. is adviser‘.

Which started to make sense, and ring bells. For Falck’s been mentioned on this blog before. Back in February 2022 in ‘Bute Energy Selling Wales For Danegeld?

To explain . . . Learning of the link-up between Scottish company Parabola Bute Energy (planning some 20 ‘renewables’ projects in Wales) and Copenhagen Infrastructure Partners, I went to the CIP website looking for a reference to Parabola Bute.

I couldn’t find one, but I told readers back then what I did find.

‘Copenhagen Infrastructure 1 has invested GBP ~155m of equity for a 49% stake in Falck Renewables S.p.A.’s (Falck) operational onshore wind portfolio in Scotland and Wales.’

That was written in February 2022, the month Falck was taken over by the ‘investors’ advised by JP Morgan Chase. Whose CEO, Jamie Dimon, wants to compulsorily purchase land and property – to accommodate the wind turbines and the solar panels needed to save the planet!

Wind farms and solar arrays that – by pure chance! – will be owned by companies, hedge funds, corporations, and other entities run by men like Jamie Dimon.

If this dangerous nonsense had come from the studded tongue of a green-haired newt-botherer, or even a TV envirogrifter, I might laugh it off. But as the headline reminds us, Dimon is a ‘Wall Street titan’.

When I first read that I thought it was the most frightening – yet revealing – example of the Globalist corporate mentality I had ever read. And I still think that.

Maybe I should explain at this point that Copenhagen Infrastructure Partners acts as an intermediary, finding environmentally acceptable investments for investors.

CIP manages 12 funds and has to date raised approximately EUR 30 billion for investments in energy and associated infrastructure from more than 180 international institutional investors.

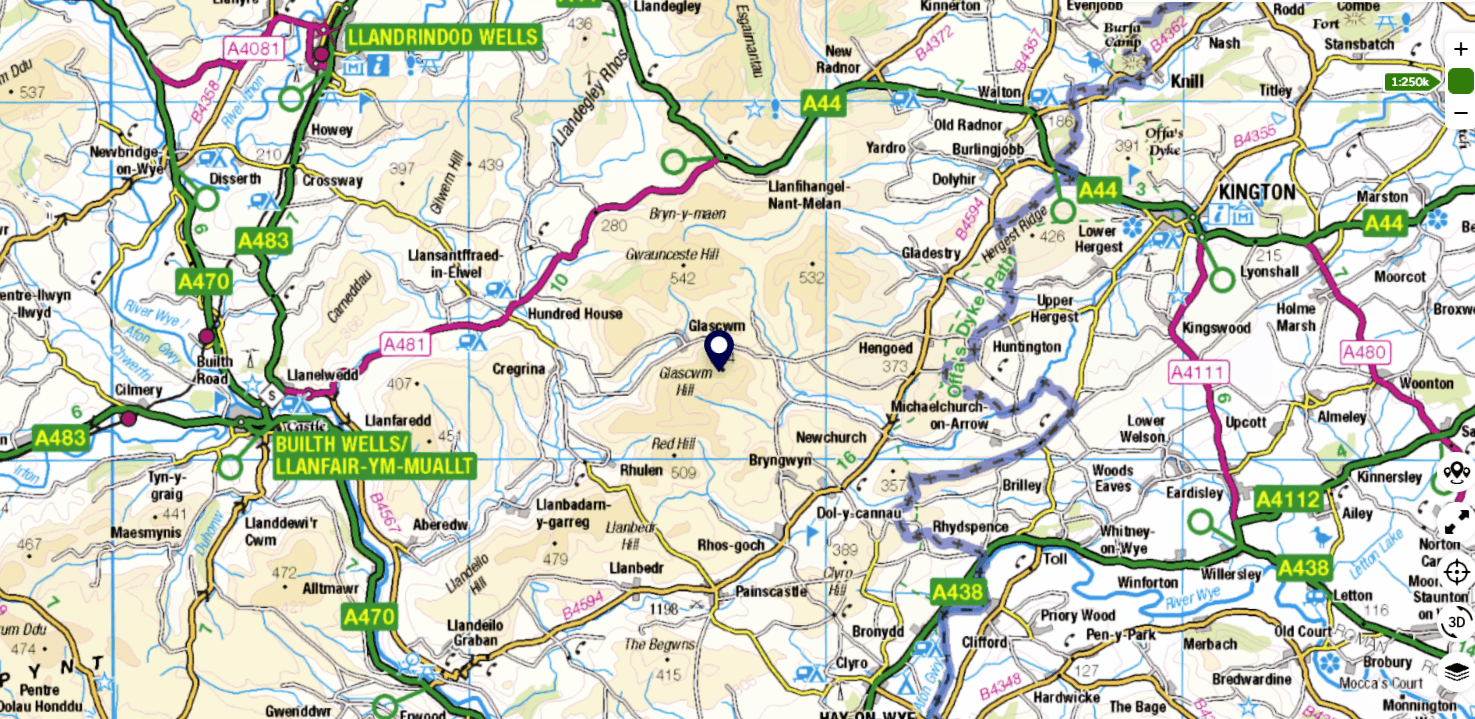

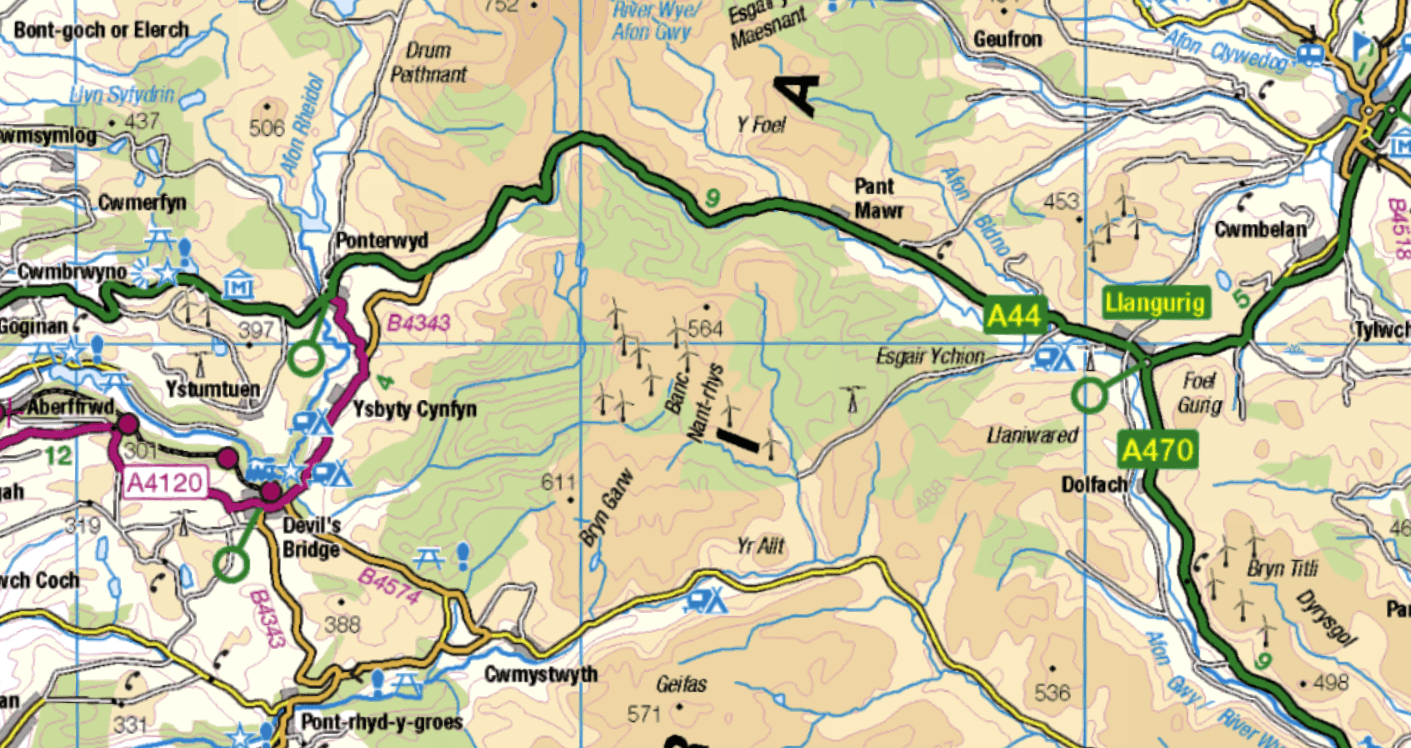

Getting back to Falck . . . I’d come across the company even before the CIP connection. For Falck owns (owned?) 20-year-old, 39-turbine Cefn Croes Wind Farm, above the A44. In its day, said to be the biggest (by output) in the UK.

Let’s go back to the complicated ownership details on the Renantis UK accounts. Where we read: ‘The ultimate parent company and controlling party at 31 December 2023 is IIF Int’l Holding LP, a company Incorporated in Cayman Islands‘.

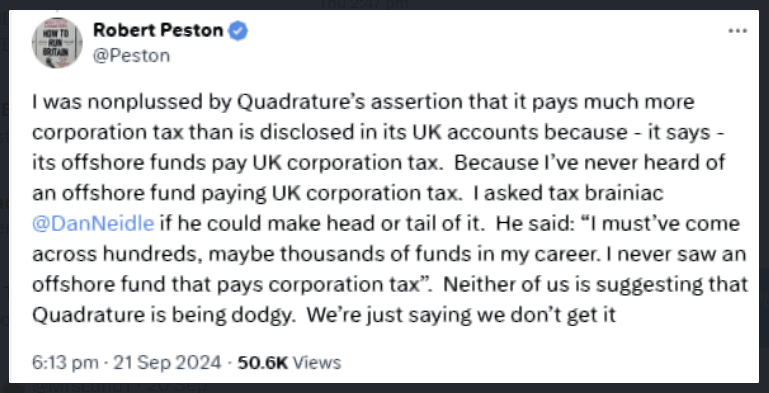

A bit more searching told me that ‘IIF’ stands for International Investment Fund, which makes sense. An entity that was handling $24 billion two years ago. But it seems not everybody’s happy.

This article from US consumer advocacy organisation Public Citizen wants US regulators to look more closely at Jamie Dimon’s outfit’s dealings. While this piece from the European Commission outlines the takeover of a big German energy supplier by ‘a wholly owned subsidiary of IIF Int’l Holding L.P.’

The world of corporate finance, eh!

The key to knowing who’s behind the Mynydd Fforch-dwm project seems to lie in Milan. Where, in February 2022, local company Falck was taken over by ‘investors’ advised by JP Morgan Chase, using the Renantis-Naturalis label, and further obscuring their activities by operating from the Cayman Islands. It was reported at the same time that Copenhagen Infrastructure Partners had taken out a 49% shareholding in Falck’s Welsh and Scottish onshore operations.

But these entities only invest other people’s money, we still don’t know where the money for Mynydd Fforch-dwm originates. Do those clowns in Corruption Bay even care?

UPDATE: Soon after putting this piece out I was contacted by a good source with further information. In the summer of 2023 Renantis linked up with Ventient Energy, and then last year, this resulted in a new company, Nadara.

Under various guises the new entity already has 10 sites in Wales.

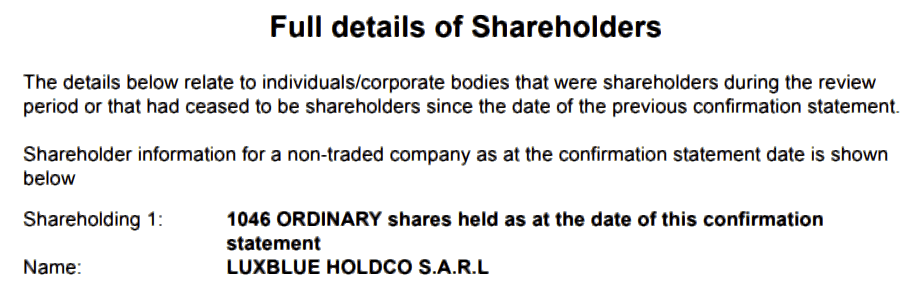

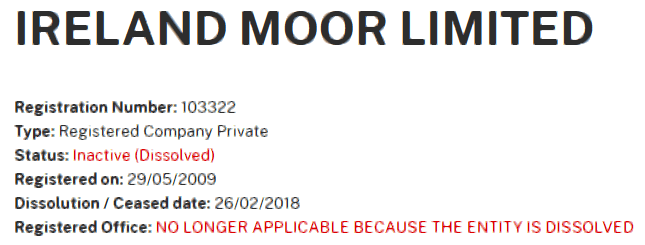

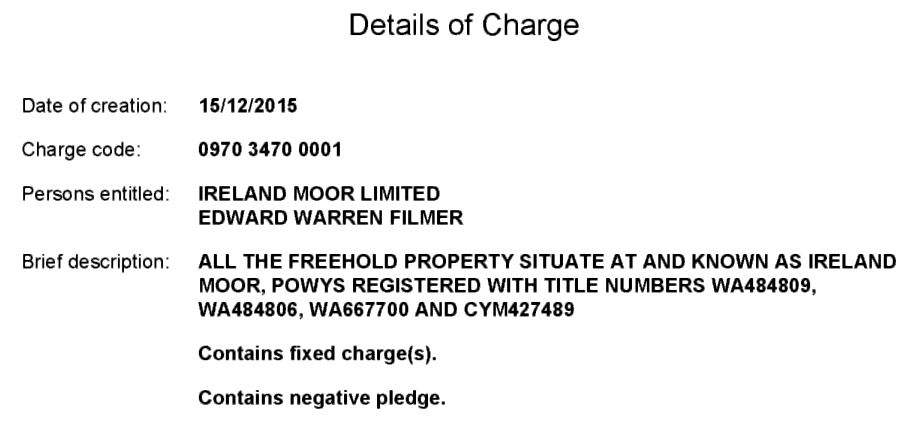

Nadara is registered in Scotland using an Edinburgh address. It brands itself as a Scottish company, even claiming its name is derived from Scottish Gaelic, though it’s owned by an outfit registered in the EU tax haven of Luxembourg in November 2023.

A name associated with LuxBlue Holdco SARL is that of Paul Farmer. He’s also involved with IIF Int’l Holding, of the Caymans, which we encountered earlier. His Linkedin profile says he’s some kind of freelance.

The Blue element in the name may come from another link-up involving Renantis. This one with Blue Float Energy. They are doing deals in Scotland with the Crown Estate, which is of course devolved up there.

This may account for the clamour from politicians in Wales for the Crown Estate to be devolved here too, if only to show we’re getting some benefit from ‘renewables’.

I have no doubt that, once again, the trail leads back to the Cayman Islands. And so the question remains – where’s the money coming from?

◊

FINAL THOUGHTS (SOME RATHER PERTURBING)

When I began looking into Mynydd Fforch-dwm Energy Park I thought, from the name ‘Naturalis’, that I’d be seeing previously unknown companies, and fresh faces.

Boy! was I wrong.

Not only have we re-acquainted ourselves with loveable Jamie Dimon of JP Morgan Chase, through part of his empire operating out of a British Overseas Territory, but via the Italian connection we also bump into Copenhagen Infrastructure Partners again.

A good time to remember that a 25% stake in CIP is held by Danish turbine producer Vestas. Among Vestas directors and shareholders is former Danish PM (sometime MEP) Helle Thorning-Schmidt. Who’s married to Aberafan MP Stephen Kinnock.

(Thorning-Schmidt is also a director of the Islamic Development Bank and the Schwab Foundation for Social Entrepreneurship.)

By a remarkable coincidence, the planet-saving extravaganza planned for Mynydd Fforch-dwm is either in, or on the border of, the Aberafan constituency.

But even without that propinquity we can guarantee moolah from Mynydd Fforch-dwm making its way to Helle. (But will she share it with hubby?)

And of course that also applies to CIP’s involvement with Parabola Bute Energy.

As stated at the top, this project is justified by the ‘Welsh Government’ on the grounds that it’s a Development of National Significance. For which nation? We already produce more than enough electricity to meet Wales’s needs, so this project must be of national significance for England.

So where are the benefits to Wales?

We scar our hills, increase the risk of flooding, with foreign-built turbines and pylons owned by companies and ‘investors’ from God knows where that regularly catch fire or get blown over. They’re erected by crews brought in for the job, after which the only work is changing the oil, firing up the diesel generator to pretend the bloody things work, and collecting the dead birds and bats.

In real world terms wind turbines just mean higher electricity bills for everybody and falling property values for homes within sight and sound of the damn things.

There are no benefits to Wales whatsoever, apart from the pitiful ‘community funds’ . . . the green energy equivalent of beads and infected blankets.

As I wrote this, and saw so many links emerge, I wondered if it’s an attempt to forge a ‘renewables’ monopoly in Wales. For Jamie Dimon would get red carpet treatment if he visited Cardiff, as most Senedd Members would gleefully implement his demand to compulsorily purchase farmland for yet more turbines.

Thankfully, ‘over there’, Donald Trump sees through the plot to deindustrialise and impoverish the West. Which will make it increasingly difficult for European leaders to continue down the self-destructive path of Net Zero.

One day we’ll look back on the climate scam and wonder why otherwise sensible people fell for it all. Until then, we just have to keep fighting.

With truth on our side.

♦ end ♦

© Royston Jones 2025