My intention was to start winding down this blog, spend more time with my wife, grand-children, books, Malbec . . . but things keep cropping up. That said, it’s very unlikely I shall undertake major new investigations. Diolch yn fawr.

♦

![]() This week’s offering is a bit different, but it’s a format with which regulars will be familiar. I’m going to cover a few topics and I’m sure everyone will find something to pique their interest.

This week’s offering is a bit different, but it’s a format with which regulars will be familiar. I’m going to cover a few topics and I’m sure everyone will find something to pique their interest.

It’s a biggie, but broken up into easily digestible – and nutritious! – chunks.

♦

AFAN VALLEY ADVENTURE RESORT

Following last week’s blog piece devoted to the relaunched AVAR project the ‘Welsh’ media played its usual role by allowing those I’d written about to respond. And just like a Taliban press conference, no questions were asked.

The piece below appeared in Llais y Sais on Wednesday. It’s worth a few comments.

According to the article, the project’s funding is coming from ‘Octopus Real Estate’. Oh no it’s not. For this is a one-woman company formed in April to buy a property in Wiltshire.

And so I presume it refers to one of these pension fund Limited Partnerships, Octopus Commercial Real Estate Debt Fund II and Octopus Commercial Real Estate Debt Fund III.

But which one? And, again, what is the ultimate source of the money?

The Beans on Toast followed up on the same day with this. Also authored by Richard Youle.

In it we read head honcho Martin Bellamy quoted as saying: “I would be very interested in ensuring that local people get the opportunity for employment.”

Which is a very convoluted statement. What the hell is, ‘I would be very interested‘ supposed to mean? Because I would be ‘very interested’ in winning the Lottery. But it ain’t gonna happen.

Then there’s, ‘ensuring that local people get the opportunity for employment’. So does that mean they’ll be allowed to complete an application form – which will then be binned?

Why couldn’t he just say, in a clear and unambiguous way, ‘We shall give locals priority when it comes to recruitment’?

It would be nice to think that local Labour councillors will press Bellamy on this, demand a firm commitment to employing as many locals as possible, and not just in the low-pay jobs. But there’s more chance of me winning the Lottery.

But these plugs for AVAR throw up other questions.

In the Neath Port Talbot Borough Council press release of October 12 we read that the project is now called Wildfox Resort Afan Valley. And there are two Wildfox companies.

The first is Wildfox Resorts Afan Valley Ltd. The other is Wildfox Resorts Group Ltd. Both companies formed March 16, 2021 by Benjamin Daniel Lloyd who was later joined by Bellamy.

Then there are the Rocksteady companies, Rocksteady Resorts Group Ltd and Rocksteady Group Ltd, where we find Lloyd and Bellamy joined by the interesting Paul Christopher Baker. These two companies were also launched in March.

And they weren’t the only companies launched that month

Are Lloyd and Baker still involved? Why were so many companies formed in March?

This story ain’t going away, and neither am I.

♦

TREASURE ISLAND

This saga began with the plan for a £1.3bn tidal lagoon in Swansea Bay, promoted by a geezer who never quite managed to come across as kosher. Whatever, the plan was thrown out by the UK government in June 2018.

Then Swansea City Council stepped in with a Tidal Lagoon Task Force. This heralded the ‘Dragon Island’ chapter, promising 10,000 floating homes.

Behind the plan, according to WalesOnline, was:

'Malcolm Copson who lists previous projects including Dubai's Atlantis the Palm resort and the delivery of Disneyland Paris, is behind the plans in SA1. Mr Copson, who founded and co-runs Hong Kong based company MOI Imagineering, has been advising the tidal lagoon taskforce set up by the Swansea Bay City Region'.

As late as last month it was being reported that this project was still going ahead.

But now, in the past few days, everything seems to have changed as we turn to chapter 3, and new characters, with the £1.7bn Blue Eden project. Said to have one great advantage over its predecessors in that it will not require public funding.

And while what passes for the Welsh media has stressed the involvement of DST Innovations Ltd of Bridgend, RE News makes clear that DST leads ‘an international consortium’. Though quite what ‘leads’ means is unclear.

The new project is explained in this ITV report with a video interview with Tony Miles, the man said to be behind the project. If I sound unconvinced it’s because of the US connection and events last year in West Virginia.

It’s worth mentioning that this project includes a battery factory promising jobs for over 1,000 people. Which lives up to the company’s name in that it uses locally available anthracite coal rather than imported, and expensive, rare earth metals. Explained here.

So what can Companies House tell us about DST Innovations. Well, for a start, it’s based in Bridgend and it was Incorporated in November, 2011.

The latest accounts (to November 30, 2020) show Assets of over £5m, of which only £113,076 is Tangible assets. The remainder being accounted for with shares.

Looking at the distribution of those shares we see that lead director Tony Miles has 183,100, but his holding is dwarfed by the 750,000 of Etive Investments, and the 619,413 of RC3 Inc. So who are these major shareholders in the new Swansea Bay project?

Etive Investments is a name that has cropped up in New Zealand, South Africa, and Luxembourg. I think we should focus on the third one because DST Innovations is mentioned.

RC3 Inc could be a Green building company in Kentucky or an apparently inactive company in Baton Rouge, Louisiana. I’m not familiar with US terminology but I get the impression this second company may have been struck off.

Whatever the company’s status, RC3 of Baton Rouge is definitely more promising due to the presence of a William Wray as president. (Though the RC3 parent company, may be in Delaware.)

Since April last year four long-time directors have left DST Innovations and one new director has joined. The new boy is William Wray III, a US citizen. I think it’s reasonable to assume that William Wray of RC3 is William Wray III.

And is his possibly struck-off company a major shareholder?

Another major US shareholder is Blue Rock Manufacturing LLC, with which DST Innovation entered into a partnership last year in West Virginia. This also seems to be a battery plant using coal.

“The new development is at the forefront of green technology,” Gov. Jim Justice said during a virtual press conference, “using existing organic materials, such as coal, and creating new clean energy storage solutions.”

What struck me about this piece from the Governor’s office last November was mention of the Swansea Bay plant, before most of us here knew about it. Council leader Rob Stewart is even shown in a video call with the WV Governor.

It seems obvious that Swansea council has been involved with DST for at least a year before any public announcement of the new project.

How is this West Virginia battery project progressing? Does anyone know?

As a Jack, I would love to see this venture succeed and create a few thousand jobs in the old home town. But given the two false starts I’m not hanging out the bunting yet.

And I still want to know more about some of those involved. I would expect our politicians and media to be equally inquisitive.

♦

THE ‘SERIAL ENTREPRENEUR’

A regular reader was looking for an eatery in the Vale of Glamorgan and remembered Fredwell, a new place that opened in August, so he went online to check the menu. What he found surprised him.

For the website says the establishment has already received full marks on the food hygiene rating, which is impossible, as it takes a while for the process to be gone through. What was also odd was that the rating was shown in English only. (In Wales, of course, these notices are bilingual.)

The matter was reported to the Food Standards Agency Wales, who had no record of the place, and also to VoG council, who responded with: ‘Thank you for your email. We do not have a record of the business you mention so we will look to ensure that the relevant action is taken. Thank you for bringing this matter to our attention.’

Naturally, he got to wondering who runs the place.

The answer is that it’s Fredwell Cafe and Restaurant Ltd, Incorporated as recently as the first of this month. The directors are Christopher John Birch, Jak Rhys Bjornstrom, and Kieron Roy Phillips.

I’m going to dismiss Phillips and focus on the other two. For in recent years they’ve been involved with many, many companies. Often under the umbrella of the Birch Group.

(Takes deep breath . . . )

Haus-keeping Ltd. Incorporated April 13, 2019. Still bumbling along with accounts showing assets of a few hundred pounds.

Birkenhaus Events Ltd. Incorporated April 16, 2019, Dissolved September 7, 2021 without filing accounts.

Artemis Securities and Technologies Ltd. Incorporated June 11, 2019, and Dissolved without filing accounts March 23, 2021. The third director was Lee Williams.

Haus Realty Ltd. Incorporated June 11, 2019. Bjornstrom and Birch were joined October 14 by new director Carina Alexandra Henriques. For some reason Bjornstrom’s name is spelled ‘Bromstrom’.

Alder Birch Properties Ltd. Incorporated June 24, 2019. A few other Birches involved but the company doesn’t seem to be doing anything.

Birch-Bjornstrom Investments Ltd. Incorporated September 18, 2019, as Birkenhaus Investments Ltd. A dormant company with filed accounts showing only the share issue.

Apollo Franchising Ltd. Incorporated October 3, 2019, Dissolved without filing accounts April 6, 2021. The only share held by Birkenhaus Investments Ltd (later Birch-Bjornstrom Investments).

Haus CDF 20 UK Ltd. Incorporated January 29, 2020, Dissolved August 3, 2021, without filing accounts.

Entrepreneur Consulting Ltd. Incorporated April 22, 2021. For some reason Bjornstrom does not appear as a director, but he and Birch each hold one share.

CJ Haus Holdings Ltd. Incorporated May 30, 2020.

Jak Property Construction Ltd. Incorporated July 30, 2021. Joining them as a director is Altaf Hussain. Hussain has had a number of companies, most of them now dissolved.

There are other companies in the cleaning business. And I’m sure there are yet other companies I didn’t unearth.

So many companies in such a short space of time is not a good look, especially with so many of them folding without apparently doing anything.

But Christopher John Birch has other irons in the fire, for he’s also in the holiday home business. In fact, when Pembrokeshire County Council recently increased the council tax surcharge for holiday homes the BBC went to him for a quote.

And a very bizarre one he gave, wearing his Holiday Homes Wales hat.

He seems to be saying, ‘Well, yeah, holiday homes are bad for Welsh people, but on the plus side – they bring in people from England’. What planet is this guy from?

Incredibly, as I was writing this, I received an e-mail from another source, telling me that Birch is also making a nuisance of himself in Newport.

My fresh source wrote:

'Do you know of a bloke called Chris Birch? Chris J Birch - Birkenhaus Investments (birchgroup.org.uk) He was in the Mirror after he said he woke up gay when he did a handstand in a rugby match playing as a flanker. His agency has taken over the Boilermakers Club presumably on Dr ---------'s instructions and he stuck a site notice on it before Newport planners turned it down yet again. It is now one of many derelict monuments to Welsh Labour's shameful neglect of this area, which they seem to have completely abandoned to drugs and destitution. Birch is almost certainly getting Welsh government money and claims to have offices in The Shard and Paris. He basically manages properties with huge numbers on AirBnB.'

Here’s an image of the Boilermakers Club in Crindau from Google Street View.

In this report from WalesOnline in May we read that Birch claims to have conducted an opinion poll among local residents which conveniently found they favour his plans to convert the building into a House of Multiple Occupation (HMO).

My source describes this claim as ‘baloney’. No survey was undertaken.

UPDATE 04.11.2021: Vale of Glamorgan council has replied to the complaint:

"I am emailing to update you following your concerns about Fredwell café, Cowbridge. A visit has been made to the premises and I can confirm that the café / restaurant is not yet open and is not trading. Therefore there is no requirement for them to register with our department until at least 28 days before they open. I have noted that on their website they are showing a food hygiene rating of 5 and have requested that this is removed, to which they have agreed."

♦

HOUSES OF MULTIPLE OCCUPATION

A house of (or in) multiple occupation is, as the name suggests, a commercial or domestic property adapted to house a number of tenants in separate units, though perhaps sharing a kitchen and other facilities.

A HMO could also be a house accommodating students, and there could be too many of them in some neighbourhoods, which creates problems for other residents.

But a HMO can also be a property used by a private landlord, a housing association, or a third sector body, to house those recently released from prison, or perhaps drug and / or alcohol abusers.

A pattern we are familiar with in Wales. The worst example would be Rhyl, where criminals and undesirables from north west England are dumped. A problem now spreading to Colwyn Bay and other towns.

But it’s not confined to the north coast. I have reported on the problems of Tyisha in Llanelli. Again, the problems are largely imported. Then there’s the area from Dyfatty flats down to High Street station in Swansea.

It’s a national problem that could be far less of a problem if the ‘Welsh Government’ and local authorities were in possession of cojones.

Anyway, my source was kind enough to supply photos of notices Birch has recently put up on the old Boilermakers Club.

But this project throws up yet more questions about our ‘serial entrepreneur’.

To begin with, and according to the Land Registry, Birch doesn’t own the property. The owner is listed as Signature Realtors Ltd, of St Mellons. Check the title document and plan.

There is no obvious connection between Birch and the family running Signature Realtors. Has he bought the property but not registered the change of ownership with the Land Registry? Is he acting for the owners? Or what?

Whatever the answer, I suspect that Birch’s plan for the building is to have a HMO housing people the neighbours would rather not have there. Why do I think this?

As you’ve read, Chris Birch recently formed a company with Altaf Hussain. Hussain has worked with a man who has the background and the connections to supply Birch and Bjornstrom with tenants.

That said, my source insists there’s not a hope in hell of Birch getting planning permission from Newport council for the increasingly dilapidated Boilermakers Club. So is he hoping for intervention from another quarter?

Locals are more concerned that the the building will left insecure and get broken into by delinquents who’ll turn it into a crack house.

Even away from the Boilermakers Club there is still plenty to give cause for concern. For I turned up a few other things that make me worry about Birch and Bjornstrom.

For a start, and until quite recently, Jak Rhys Bjornstrom was Jack Rhys Powell. Why the change? Oh, yes, and the name is normally spelt Björnström, Jack.

Then there’s the Birch Group website, which gives as the address, 1 Boulevard Victor, Paris 75015. Impressive. But don’t run away with the idea that this is some plush suite of offices. It’s a building run by the company FlexibleHub.

They probably forward any mail.

And then there’s the unfortunate business of the food hygiene rating . . .

There’s also the mystery of the money, or lack of it. Because I didn’t find any company with which Birch and Bjornstrom / Powell are involved that had any money. So, if they do have money, where is it?

Setting up new companies every week is one thing, being a genuine entrepreneur is something entirely different.

The kindest thing might be to say that in Birch and Bjornstrom / Powell we are dealing with a couple of fantasists. Whether they’re harmless or not is yet to be established.

♦

GWYNEDD’S HOLIDAY HOMES PREMIUM RIP-OFF

Councillor Gruff Williams has been in touch with concerns about the ways in which the Council Tax Premium Fund (CTPF) on holiday homes is being used by Cyngor Gwynedd. The information he sent raises other issues.

Gruff represents the Nefyn ward on the Llŷn peninsula. Llŷn approximates with Dwyfor.

To help you understand the issue it might be best to think of Gwynedd and its total population of 121,874 people as being split into three parts.

Arfon, in the north, is focused on the largest Gwynedd settlements of Bangor and Caernarfon. The 2011 population was 60,573.

Dwyfor contains the settlements of Porthmadog, Pwllheli, and of course Abersoch. Population (2011) 27,725. Arfon and Dwyfor made up the old county of Caernarfonshire. (Which also included areas now in the County Borough of Conwy, such as the towns of Llanrwst, Conwy and Llandudno.)

And then there’s Meirionnydd, the former county of Merioneth(shire), containing Blaenau Ffestiniog, Barmouth, Tywyn, Harlech, and the old county town of Dolgellau. Population (2011) 33,576.

You’ll see that the population of Arfon is almost that of Dwyfor and Meirionnydd combined. And with that comes political clout.

The issue Gruff raises is that most of Gwynedd’s holiday homes are in Dwyfor. Naturally, locals in the area expected that the CTPF money raised would be used to help young people being forced out of their home areas by holiday home buyers, retirees, and others.

But no. For Gwynedd’s Plaid Cymru councillors have other ideas.

This article from the North Wales Chronicle gives a good report of the debate a few weeks back, when Plaid’s councillors thwarted Gruff’s attempt to benefit the areas suffering worst. (Though for some reason Gruff is referred to only as ‘Councillor Williams’, while his famous father, Owain, is named.)

There were some amazing contributions to the debate.

Councillor ‘Cai Larsen stated he had a “fundamental problem” with the issue of spending money only where it was raised’.

Where the money was raised is only part of the issue, Larsen; we also have to ask why it was raised.

‘Cllr Nia Jeffreys said that affordable housing was “an issue which knows no boundaries,”‘

Why is she talking about affordable housing when the issue is holiday homes?

‘Bangor councillor Richard Medwyn Jones added: “There are big issues here with over 2,000 on the city’s waiting list. If we stuck to this same principle I could put a motion forward that Bangor’s money stays in Bangor, but that’s what this is all about.”’

In 2019 Bangor had a population of 18,322, roughly half of them students. I’d like to know how many of the 2,000 on the waiting list have local connections.

When it comes to ‘Bangor’s money’ – by which Cllr Jones presumably means council tax raised – this is largely spent in Bangor. I’m sure the city council, and mayor Owen – Don’t Ask Me About My Genitals – Hurcum see to that.

All unconvincing excuses for Plaid Cymru-controlled Gwynedd council to put the holiday home surcharge money into the central pot and use it in other ways . . . mainly in Arfon.

The figures for how Council Tax Premium Fund will be spent can be found here, in Gwynedd’s Housing Action Plan 2020/2021 – 2026/7.

Let’s look at 4c (page 25), which deals with ‘innovative housing’. All the funding for this, £1.2m, comes from the CTPF. I suppose ‘Innovative housing’ could mean OPDs.

On page 27 we see that £2.5m is coming from the CTPF for ‘Extra care housing for the elderly’. Now I’m not a heartless bugger who wants to see Nain living in a cardboard box, but this should have come from core funding, not from money raised to mitigate the problem of holiday homes.

And there are other examples where Cyngor Gwynedd makes a mockery of the whole reasoning behind the Council Tax Premium Fund.

Another worry is that much of the CTPF money is to be distributed to housing associations. Private companies now that refuse to give priority to locals in social housing allocations. And then build ‘affordable’ homes that locals can’t afford.

But Gruff’s concerns made me think of another problem. Which is that the number of holiday homes in Wales is almost certainly underestimated.

♦

BEATING THE SYSTEM

I recall a source in Pembrokeshire contacting me just before the December 2019 UK general election to say that ‘hordes’ of second home owners had turned up to ensure that the constituency remained Conservative. (The ‘Corbyn factor’.) Clearly, they were registered to vote at their second home.

Then, during the Covid lockdown, when police were stopping cars travelling into Wales, using vehicle registrations to establish home addresses, it became clear that some people had their cars registered at their holiday homes.

Something else that came to light during the Covid lockdown was that others stopped by police were travelling to holiday homes they claimed as their main residence.

This scam normally operates by one of a couple registering at the home address, the other at the holiday home, and pretending that it’s a full-time residence. Not only does this avoid the second home surcharge it even gets a 25% council tax reduction for a single (adult) resident.

I contacted someone who is well-versed in such matters, and he tells me that the facts can be established by cross-referencing. He wrote:

'Databases that should contain the real permanent address: 1/ Council Tax – Local authority. 2/ Electoral register – Local authority 3/ NI, income tax, benefits, married persons allowance – HMRC, central government 4/ Driving licence – DVLA, central government 5/ GP – NHS, Welsh Government. It’s not possible to access the NHS record, 5, even for a police officer, without a court warrant, however, if 1 and 2 differs from 3 or 4 then the property is evading second home premium. You will only get cheaper car insurance if 4 matches 1, and students are the only residents where 2 and 3 can differ. Of course, not only are those that ------ ---------- has identified get a polling card, they would also be eligible for free prescriptions, and a bus pass at 60, even though they don’t really live permanently in Wales. 3 and 4 is subject to a general data comparison sweep to identify car crime.'

My well-informed source then went on to suggest a simple measure for establishing the facts.

'The first method of detection is to place a FoI request to the council asking for the number of single person discount properties on the books, over the last five years, per ward. It will show up as a surge of such properties when the council tax premium is introduced or raised. This gives an indication of the scale of the problem and which wards are particularly affected. We all have local knowledge that this is the case, but it needs to be quantified. Prosecuting fraud works on evidence, not on anecdote.'

Therefore, I suggest that we all submit FoI requests to our local council asking a) for the number of single-person discounts on their books over recent years, and, b) whether the council checks that those claiming single-person discount are genuine.

I’m sure my countless socialist followers will appreciate the unfairness of prosecuting locals – usually women – when their boyfriend moves in, while some bugger with a new Range Rover parked outside Cartref Mon Repos gets away with the surcharge and pockets a 25% discount!

♦

BRYN LLYS

Regular readers will be familiar with this incredible story of a family of crooks named Duggan that bought a little farmhouse, Bryn Llys, not far from Caernarfon, knocked it down, built a monstrosity they called Snowdon Mountain View, broke all the planning rules, tore up hedges, chopped down trees, tried to intimidate neighbours, etc., etc.

If you’re up to it, you could start with Lucky Gwynedd – more ‘investors’, scroll down to the section ‘Castle’ Gwynfryn, and then the section Bryn Llys aka ‘Snowdon Summit View’. You can then work back from there.

The Duggans are fraudsters and con men from West Yorkshire. When the father got sent down the son took over the business and moved to Wales, bought Bryn Llys, and spent a lot of their money on the new property.

The problem was that they weren’t supposed to have any money, so all manner of subterfuges had to be employed. Including getting a sap named Andrew Battye to put his name on the title document and pretend he owned Bryn Llys.

The Duggan gang at Bryn Llys soon got pally with another unwelcome arrival in the form of Aaron Hill, who lived in Caernarfon. Where he was bullied by them nasty Cofis!

It’s a harrowing tale. I urge you to read it with a tissue to hand.

Though urinating through the letter box sounds a trifle risky. Especially if there’s a dog in the house.

Jon Duggan bought land off Hill, with money Hill loaned him! Because of course if Duggan is seen to have money the Proceeds of Crime Act 2002 comes into play.

Another case I was looking into at the request of concerned neighbours was the ambitious plans for Gwynfryn Plas, an old gentry mansion near Llanystumdwy. The bloke making trouble here was Phillip Andrew Bush, who seems to have made his money from taking derelict ships to be broken up on Asian beaches.

I’m not saying that Bush is a crook, but a man is judged by the company he keeps.

And Bush was soon keeping company with Aaron Hill, even selling him some Gwynfryn land. It was also reported that the Duggan gang had been sighted there

Amazing how these people find each other! Is it some form of echolocation, like bats?

To cut a long story short . . . it was reported that Hill and Bush had boasted of new ventures in Scotland. And now I hear that the Duggan family – but not the whole gang – has also removed itself to Yr Hen Ogledd.

Word is that the Duggans are in Dumfries. Home to Queen of the South FC. (Not a lot of people know that.) I’ve been to Dumfries a few times. Nice town. Looking forward to going back.

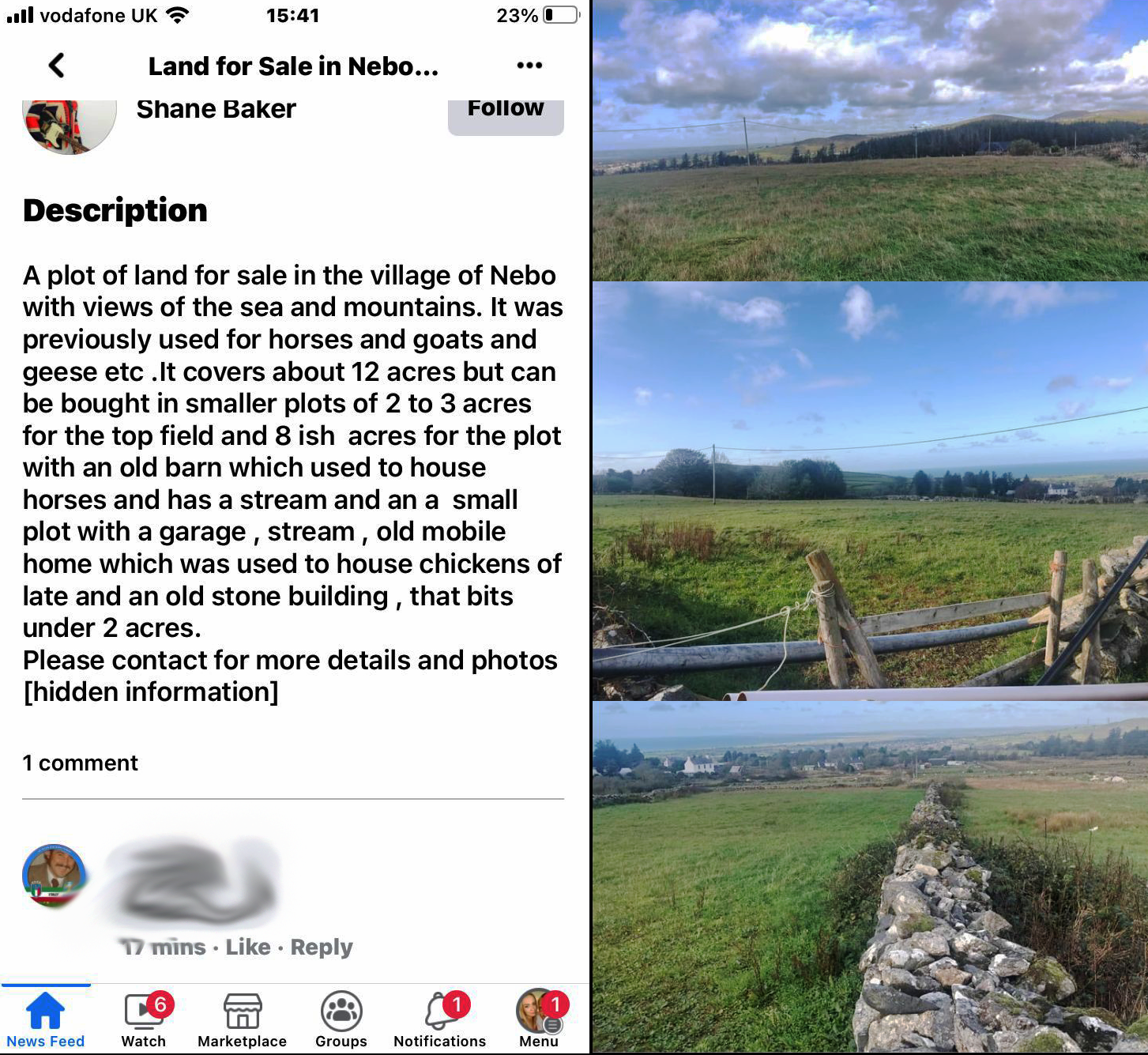

While they have decamped, faithful family retainer and failed rocker, Shane Baker, has been trying to sell off the family assets. Which of course they don’t really own!

Of course, what Baker will not tell any prospective buyer, but what my local source reminds me is:

'This is the land which was formerly attached to 4 Glanrafon Terrace, Nebo and, through which, Jonathan Duggan built a new access track to Bryn Llys and which he later purchased from Aaron Hill. There is no mention of the Enforcement Order for the removal of the access track and restoration of the land to its original state.'

Which means that anyone silly enough to buy this land could be buying into a whole lot of trouble. So steer well clear.

You have been warned!

♦

As this has been a biggie, and it’s taken up quite a bit of my time, don’t expect anything next week. I’m supposed to be bloody retiring!

♦ end ♦