![]() This piece was prompted by someone asking me if I’d read an article recently published on the Nation.Cymru website. I smiled to myself, and responded in the negative.

This piece was prompted by someone asking me if I’d read an article recently published on the Nation.Cymru website. I smiled to myself, and responded in the negative.

But I went to the site anyway, and read ‘140 hectares of Welsh land purchased to restore woodland and nature habitat‘. Then one thing led to another, and here we are with yet another ‘quickie’.

Which means I must apologise again for the delay in the promised piece on the Rhug Estate. I have started, and it’s in the pipeline.

◊

CONNECTIONS

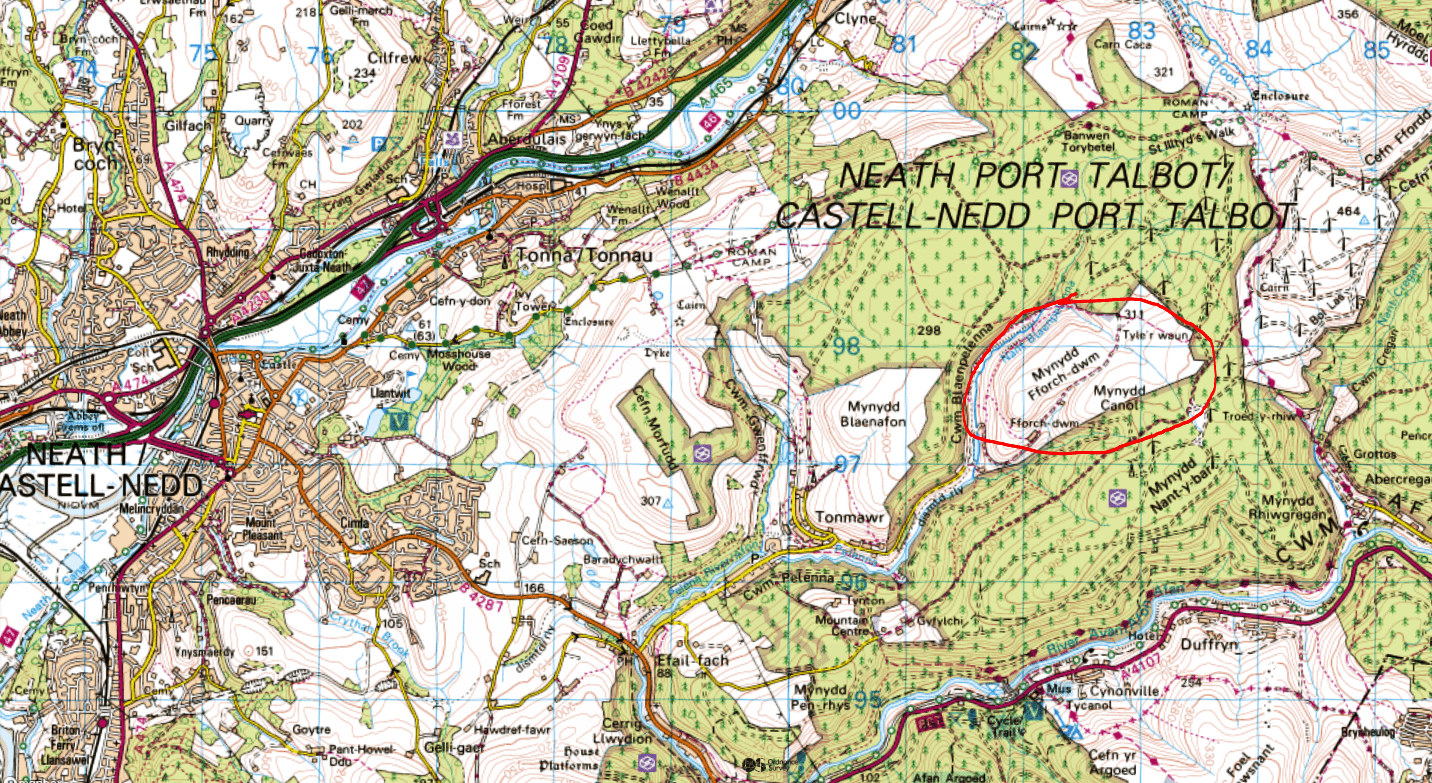

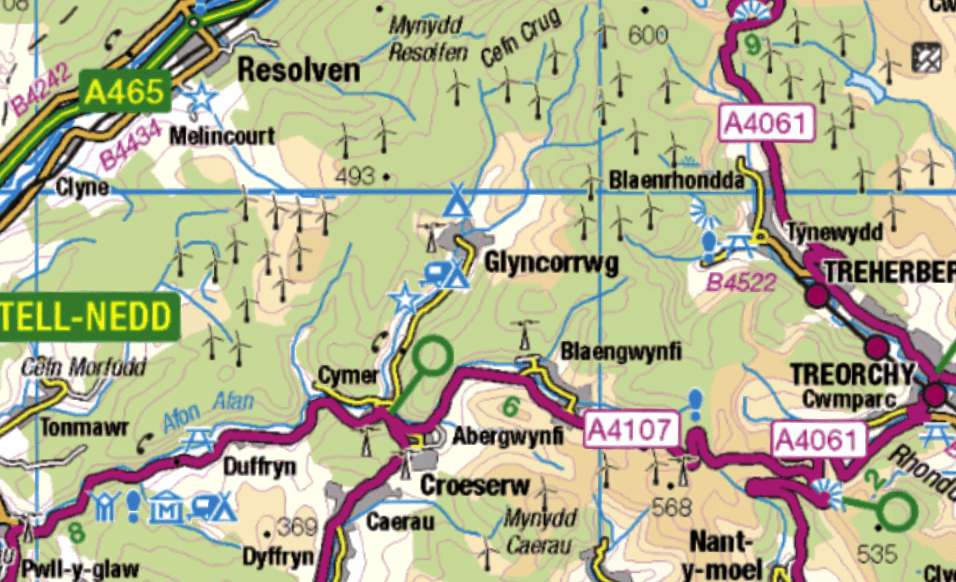

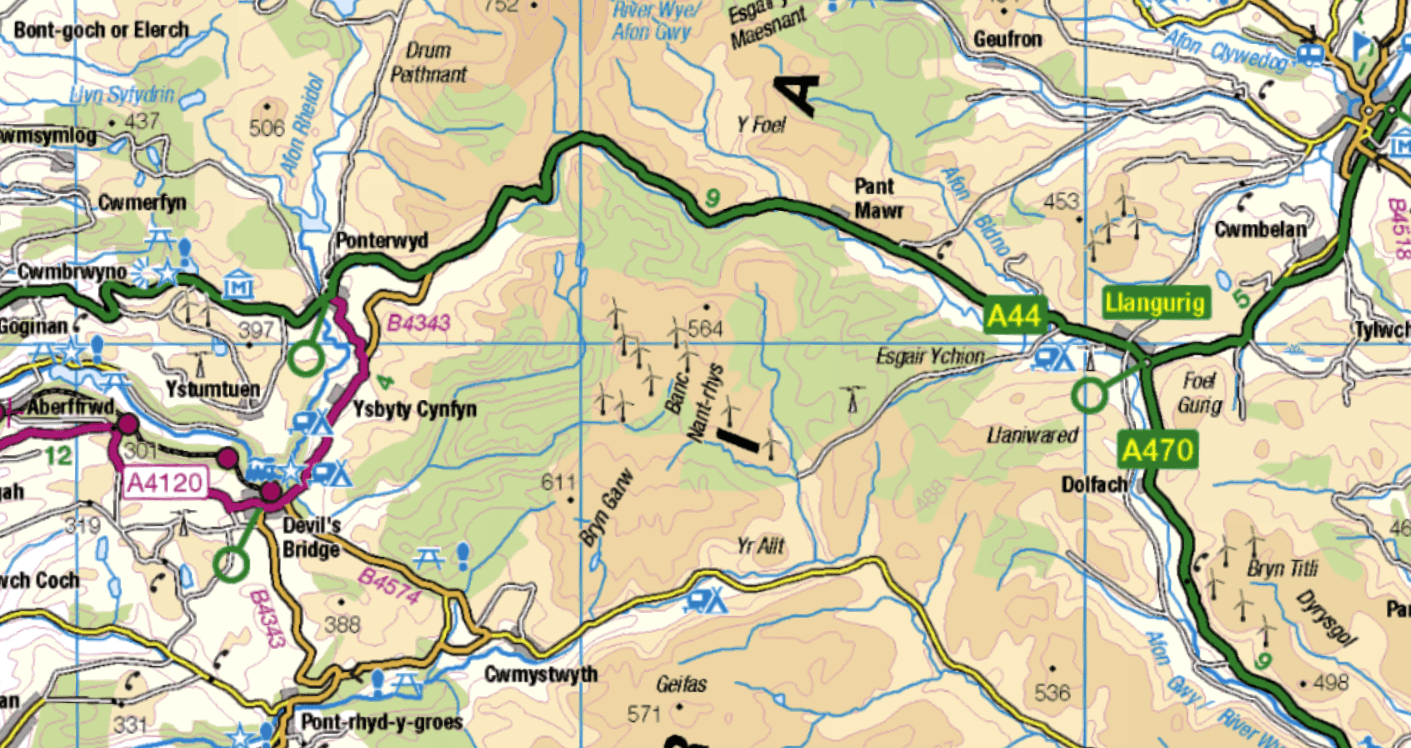

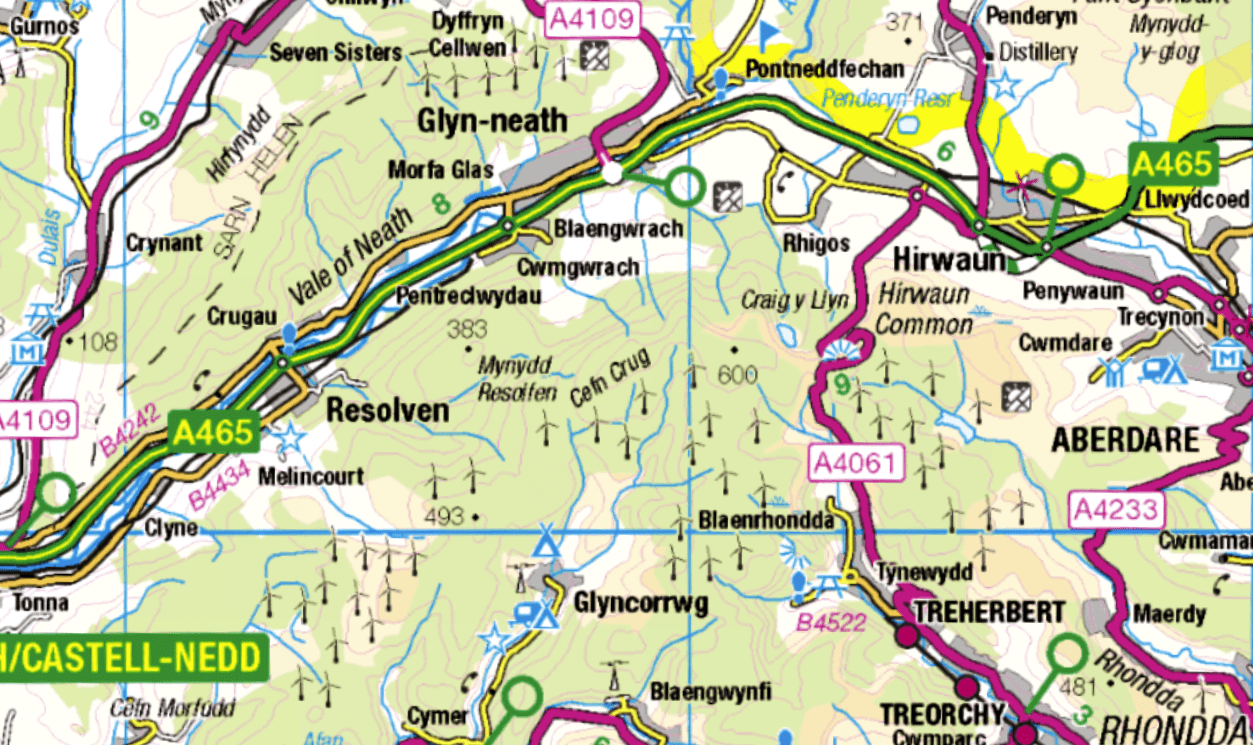

You may recall that earlier this month I wrote about 200m tall wind turbines being threatened for a hill to the east of Neath, in the Afan valley. That opus was called, Do They Know Where The Money’s Coming From? Do They Care?

(The answer to both questions is almost certainly No.)

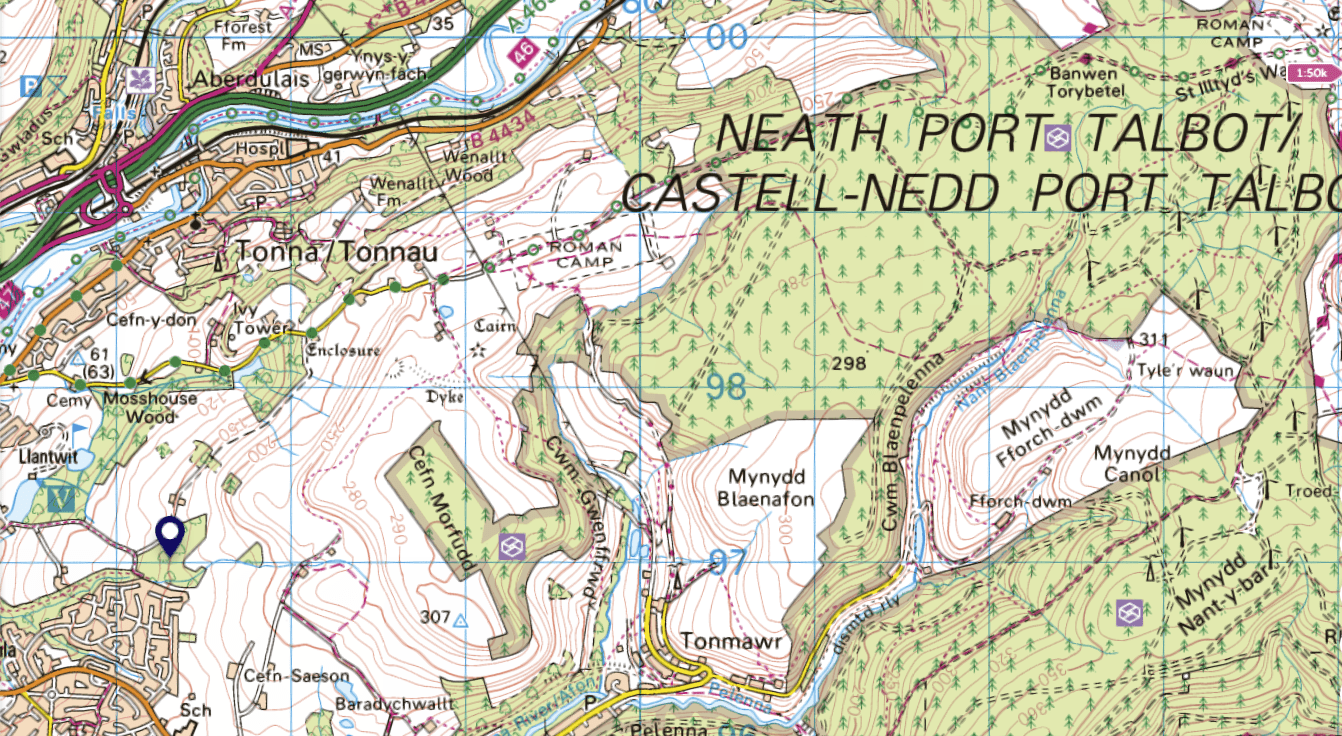

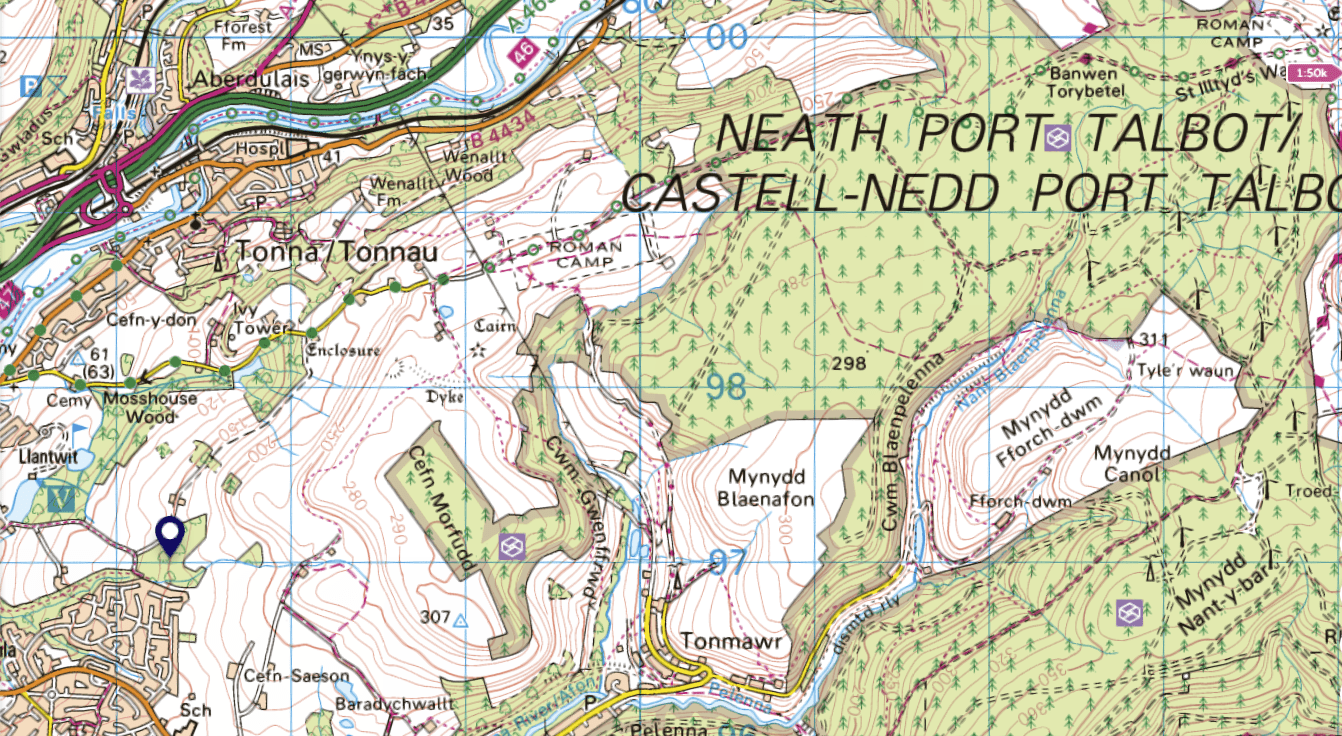

The area under threat is Mynydd Fforch-dwm. The piece in Nation.Cymru a few days back concerned Brynau (pinned) and Cefn Morfudd. Fforch-dwm is to the east.

Back to the article, which was unattributed, suggesting it was a press release, and that N.T, funded by the so-called ‘Welsh Government’, has truly joined the Welsh media.

The article told us that Coed Cadw, the Welsh branch of the Woodland Trust, had “secured” 140 hectares at Cefn Morfudd to add to the 95 hectares previously acquired at Brynau farm.

Let’s look into it a little more. And as ever, the real question is, where’s the money coming from?

The purchase . . . supported by grants from Lloyds Bank and the National Lottery Heritage Fund, funding from People’s Postcode Lottery . . . donations . . . Moondance Foundation and the Banister Charitable Trust . . . grant from The Woodland Investment Grant (TWIG) scheme, a partnership between The National Lottery Heritage Fund and the Welsh Government

Most look to be straightforward grants, but two piqued my interest.

The Moondance Foundation, is the charitable arm of the Admiral Insurance group. The company formed by American Henry Engelhardt, and Wales’ only FTSE 100 company.

But who now owns the group? Wikipedia says:

Admiral Group plc is owned by . . . shareholders, including the Moondance Foundation, Rothschild & Co, Fidelity Management & Research, and FIL Investment Advisors

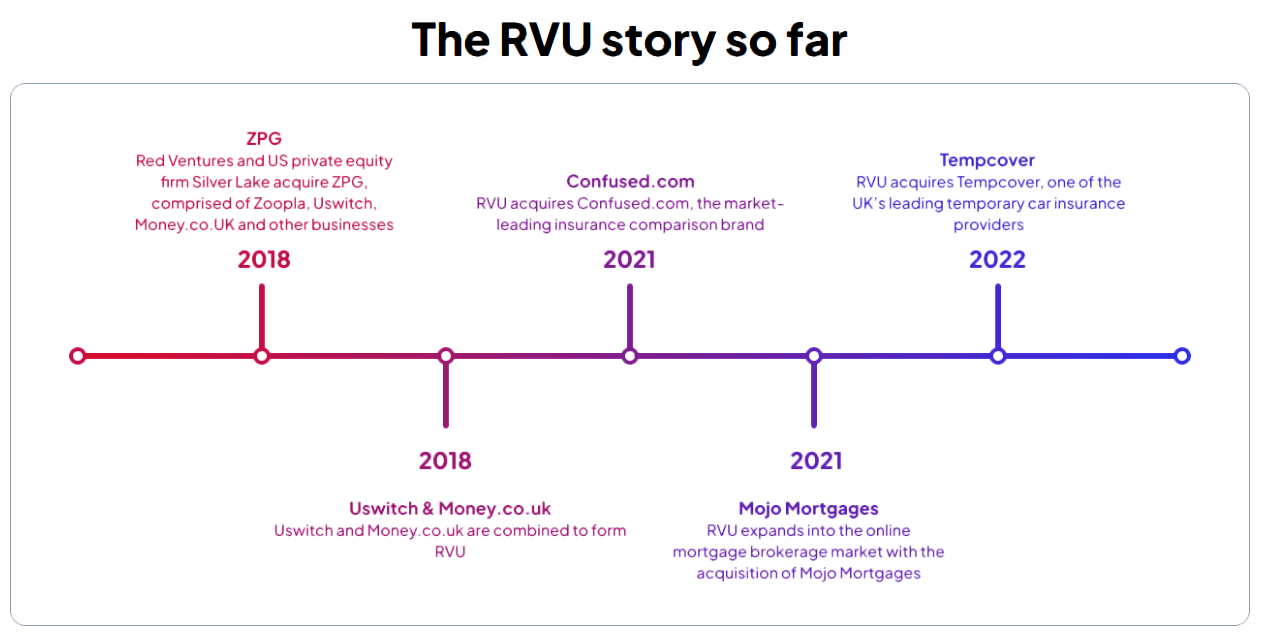

In April 2021, Admiral finalised the sale of interests, that included its Cardiff-based price comparison firm Confused.com, to RVU for proceeds of £508m.

This is a reference to RVU, which in recent years seems to have bought up a number of well-known insurance companies. The RVU website gives us the timeline, and we see Confused.com under 2021.

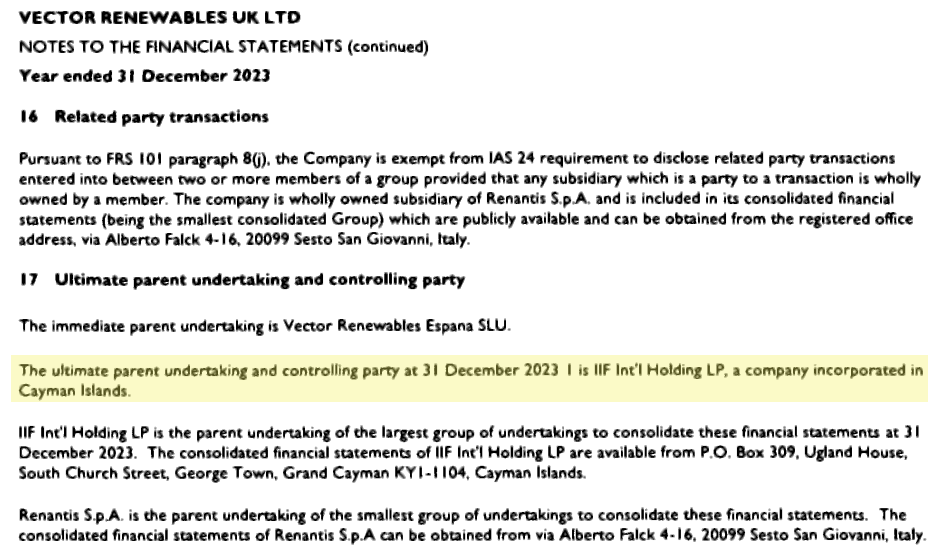

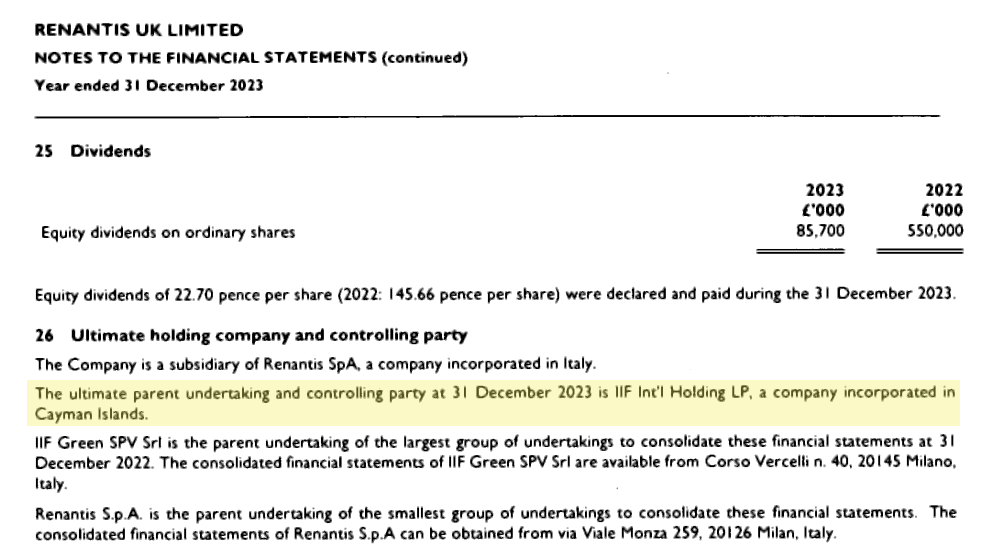

The first entry mentions Silver Lake as a ‘US equity firm’. Silver Lake (Offshore) AIV GP V Ltd is the ultimate owner of RVU, and it’s registered in the Cayman Islands.

How often do we end up in the Caymans – or other sun-blest locales – when looking into planet savers?

The money for Coed Cadw at Bryn Morfudd may be coming from the Moondance Foundation, or the Moondance Foundation might simply be acting as a conduit. For having just mentioned so many hard-nosed investors, and tax haven companies, I wouldn’t be at all surprised if we were looking at another bit of greenwashing.

The other name that caught my attention was the Banister Charitable Trust. But I couldn’t find a website, only references like this. It’s based in Bristol, the source of so much ‘green-ism’.

There is of course an entry on the Charity Commission website, which set me off down a few more rabbit-holes. Especially when I checked out the trustees.

Where we see two surnamed Banister, but above them, Ludlow Trust Company, which seems to manage other trusts. So what is the Ludlow Trust?

Let’s start with the website. Where we read:

Established in 2020 to acquire and manage the UK trust business of Coutts and the NatWest Group . . .

In 2024, Ludlow Trust also acquired the UK trust business of C. Hoare & Co.

So it’s a very recent creation, and it would appear to be in the business of saving people money, by way of avoiding taxes wherever possible, or investing in those areas offering reductions in tax, and other benefits.

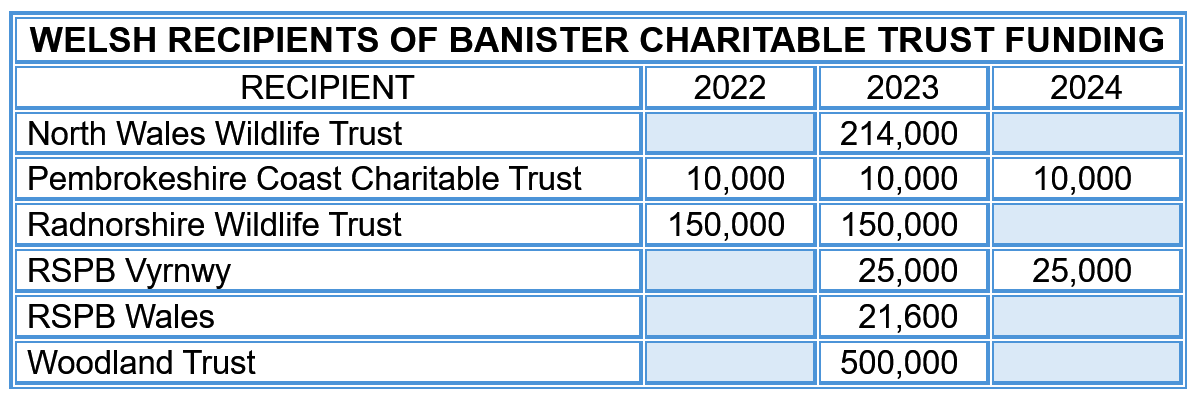

The Companies House entry is also interesting. Looking through the recent grants I found a number of recipients based in Wales. (I include the Woodland Trust because there’s unlikely to be a separate payment to Coed Cadw.)

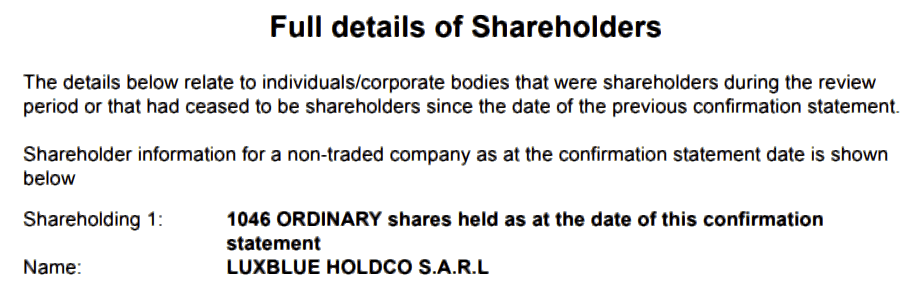

Tracking the ultimate ownership and control of the Banister Charitable Trust led me to Luxembourg, the EU’s internal tax haven. To be exact, 2 Rue des Gaulois and the Charter Trust Group.

It then comes back to London, and there’s an Isle of Man connection. But the point, I think, with both Moondance and Banister, is that the money offered may be rather more than no-strings-attached grants.

◊

THE BIT IN THE MIDDLE

To recap: In a recent post we looked at the 200m turbines planned for Mynydd Fforch-dwm, and now we’ve looked at Woodland Trust expanding its little empire at Brynau and Cefn Morfudd.

But if we look again at the map, we see there’s a bit in between, Mynydd Blaenafon, so who owns this?

To find out I obviously went to the Land Registry website. Here’s the title document I downloaded. You’ll see the land was bought in September 2020, for £525,000, by Peter Jeffrey Solly, of Exeter in Devon, who has a chequered record.

Solly’s also in the business of saving the planet . . . or of making money from pretending to do so. For the ‘Natural capital’ he mentions is the scam of scams. Described by the European Investment Bank thus:

Natural capital is the value of everything that comes from nature — soil, air, water and all living creatures

This is the Greensters dream – get politicians to introduce subsidies, grants and tax breaks for just about anything. Buy a field and claim it’s capturing carbon, breeding worms, or providing a habitat for moles – then wait for the lucre to roll in.

And when things start growing in your field . . . well, you’ll be able to order your private jet to get to the January knees-ups in Davos.

And you can even demand payment for the air above your field.

This explains why assorted corporations, asset managers, hedge funds, tax avoidance specialists, investors, etc., are buying up just about every parcel of land they can.

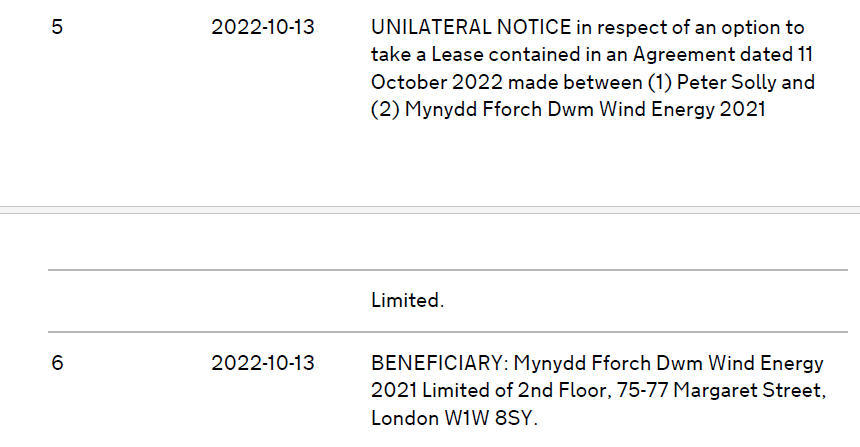

Though in the case of Solly his ambitions tread an already well-worn path. Because if we look more closely at the title document we see, at the very end:

He has a lease agreement with a company called Mynydd Fforch Dwm Wind Energy 2021 Ltd. This is a front for Naturalis, which we read about in the earlier piece. So I won’t go over the links again.

What I find intriguing though is the timing. Solly bought the land at Mynydd Blaenafon in September 2020. The Naturalis website for Mynydd Fforch Dwm Wind Farm is also dated 2020.

Is Solly working with, or for, the company behind the plan for Mynydd Fforch-dwm? Was he tipped off? Then again, is Mynydd Fforch-dwm a red herring, and are the turbines really planned for Mynydd Blaenafon?

Or are turbines planned on both mountains? God knows there are enough in the area already. Maybe somebody’s hoping a couple of dozen more won’t be noticed.

I’m not sure what exactly’s happening, but it begins to look a little complicated, maybe even devious. So here’s a thought . . .

According to the Land Registry, Mynydd Fforch-dwm is still in Welsh ownership. The owner has entered into an agreement with Mynydd Fforch Dwm Wind Energy 2021 Ltd.

While next door, the land at Mynydd Blaenafon was sold outright to Peter Jeffrey Solly. So was the previous owner, the Welsh owner, unaware of the turbine plans?

Worth asking, because everywhere we look in modern Wales we see Welsh people losing out, being displaced. We own less of Wales now than at any time in our history. Certainly less than we did before devolution.

That’s what 26 years of socialist rule under Labour and Plaid Cymru has achieved.

◊

CONCLUDING THOUGHTS

In our former mining valleys today it seems as if all land outside towns and villages is to be given over to wind farms. All of them foreign owned, with vast profits flooding out of Wales every day.

But why be surprised – this is Globalism. The land is bought up, cleared, exploited, and people are confined to 15-minute settlements, with travelling discouraged.

Superficially, and from a Welsh perspective, it may look bleak. But with President Trump declaring the ‘climate emergency’ to be a scam, and J D Vance humiliating the Globalist puppets running Europe, our enemy’s agenda is under real threat.

Starmer has a massive majority in MPs, but little popular support (less credibility). The EU is tottering. Germany goes to the polls on the 23rd. The war in Ukraine will soon end, and there’ll be huge revelations that not even the BBC will be able to ignore.

Thinking more locally – Labour will lose the 2026 Senedd elections. And many or most of the council by-elections between now and then.

So hang on in there. Better times are a-coming!

♦ end ♦

© Royston Jones 2025