PLEASE APPRECIATE THAT I GET SENT MORE INFORMATION AND LEADS THAN I CAN USE. I TRY TO RESPOND TO EVERYONE WHO CONTACTS ME BUT I CANNOT POSSIBLY USE EVERY BIT OF INFORMATION I’M SENT. DIOLCH YN FAWR

♦

![]() The title tells you what this week’s article is about. I’m going to look at how the picture has changed in the past few years.

The title tells you what this week’s article is about. I’m going to look at how the picture has changed in the past few years.

♦

THE BIG PICTURE

Obviously, there are different types of housing, from mansions like Jac o’ the North Towers to more modest owner-occupied properties; then we have social rent properties, and properties rented from private landlords.

So let’s start by looking at how types of tenure have changed over the past two decades. (The year up to March 31, 2001 is the earliest I can find on the StatsWales website.)

The table I’ve drawn up is fairly self-explanatory. ‘Registered Social Landlord’ (RSL) is of course the official term for housing associations.

The headline figure is that there are 163,067 more dwellings or housing units in 2020 than there were in 2001. Though in the same period the population rose from 2,910,232 to 3,152,879, while the average household size fell from 2.36 to 2.26.

In fact, if we multiply the total number of housing units by the average household size we arrive at a figure of 3,248,901.42. Almost a hundred thousand more than the population estimate. But of course calculations are complicated by people living in care homes, prisons and other institutions. And then there are holiday homes. And properties that have just been abandoned, where it’s often difficult to track the owner.

So, all things considered – and without taking my socks off to do some really serious figuring! – we have roughly the same availability of housing in relation to demand as we had twenty years ago. Maybe things are worse.

Something else we can extract from the table is that in 2001 19% of Welsh properties were social rents, whereas the figure today is just 16%.

But perhaps the biggest change has been the doubling in the percentage of properties now rented from private landlords.

If current trends continue then very soon more people, more families, will rent from private landlords than from councils and housing associations combined. This of course is what the Conservatives want, but why is it happening in ‘progressive’ Wales?

◊

SOCIAL HOUSING

In 2001 we had 242,853 units of social housing. By 2020 this had fallen to 229,902, a decrease of 12,951. Found in this table.

Partly explained by 34,829 units being sold in this period under the Right to Buy legislation introduced in 1980 by the first Thatcher government, with this later supplemented by Right to Acquire.

Though offset by the building of 21,878 social rented housing units in the same period. Just over 1,000 a year.

Right to Acquire is Englandandwales legislation introduced by the Blair government and in operation from 18 January, 2005. Explained more fully here.

At this point I should tell you that not all sales of social housing are accounted for by Right to Buy and Right to Acquire because this table tells us there have also been sales of “non-social housing”. Though I don’t understand why the figure for this category is only shown from 2013 – 2014. Though there’s certainly been a steady increase since then.

Building just over one thousand social housing units a year must be considered a failure after two decades of socialist administrations in Cardiff Bay. Especially when we remember that in 1979 – 1980 (immediately before Right to Buy was introduced) Welsh local authorities built 3,322 new council homes. (RSLs built a further 377.)

And a thousand a year looks even less impressive when we remember that in the period of devolution a couple of billion pounds in capital grant funding has been given to an ever-expanding galaxy of housing associations.

In the past five years alone, £574 million pounds of Social Housing Grant (SHG) has been paid to housing associations. Wales & West, Labour’s favourite, has seen £61m of it.

SHG is not the only capital grant paid. There’s also the Housing Finance Grant.

I’ve drawn up a table for SHG payments you can view by clicking here. It’s quite a big table, so please have patience.

(I should add that while the bottom line is correct I can’t vouch for every figure in every column. I may have made a mistake or two in transcribing them. So here are the figures I received.)

While the amount paid in SHG from 2015 – 2016 to 2019 – 2020 was 20% more than for the previous five years the stock of social rented housing increased in the same period by less than 2%.

We know that housing association executives like to pay themselves big salaries, and drive fancy company cars . . . shiny new offices are a must . . . and how can they miss out on all the conferences and other jollies, but these could never account for the increasing gulf between funding received and social housing built.

Something else must be going on.

If nothing else, Wales is following England in providing less social rented housing. So much for Rhodri Morgan’s, “clear red water”. So much for, “Welsh solutions for Welsh problems”.

The Tories came to power in 2010, and that’s when the decline started. Clearly, the Labour management team in Corruption Bay is following Conservative directives when it comes to social rented housing.

◊

MONEY, MONEY, MONEY

If we take the period 2014 – 2015 to 2019 – 2020 we see that it covers important changes in the way RSLs are regulated, and also how they operate.

I’m sure most people didn’t notice, but in the past five years Welsh housing associations were originally private bodies, were then made public, before being privatised again.

It was the Office for National Statistics that decided they should be public bodies due to the amount of public funding they were receiving. Plus the political involvement. But making them public bodies transferred their debts to the public ledger and so the parliaments in London, Edinburgh, Belfast and Cardiff quickly privatised them again.

It’s explained clearly and succinctly in the article below from Inside Housing, just click on it to make it readable. (Here’s a link to the original article.)

I bet you’re thinking . . . ‘If housing associations are now private companies, why are they still getting lashings of public funding?’ Funding that, as we’ve seen, has greatly increased since they were ‘re-privatised’!

The answer is that they’ve branched out into building private housing.

To such an extent that, in addition to the public funding, our housing associations are also taking out private loans with various financial institutions.

Here’s a report from May of United Welsh of Caerphilly, which has just 6,000 properties, borrowing £50m from Scottish Widows.

In July we learnt Coastal Housing Group of Swansea had entered into a £250m ‘refinancing’ deal with Aviva Investors.

In August, Cadwyn Housing Association of Cardiff did a deal with Westbourne Capital Partners of Chicago.

And other housing associations have done similar deals with organisations much sharper than them in the ways of the financial world. I do hope they’ve read the small print.

Though I suppose the only real collateral housing associations have is their housing stock. If they default, does this mean that Welsh social housing stock gets taken over by lenders? Or will the ‘Welsh Government’ step in with yet more money?

Talking of the ‘Welsh Government’, if RSLs need money for investment, why can’t they go to the Development Bank of Wales (DBW), which is already lending to other builders, many from over the border?

So let’s recap. Housing associations, now private bodies, still receive increasing amounts of public funding. Yet they also enter into arrangements with financial institutions around the world. And let’s not forget that the other major source of income – perhaps the major source – is rents from the housing stock they own. Most of which came free as stock transfers from local authorities.

Another noteworthy feature in this period is that most if not all of our housing associations have set up subsidiary companies, or companies that are not subsidiaries but still part of the group.

◊

SUBSIDIARIES, PARTNERS, PRIVATE HOUSING

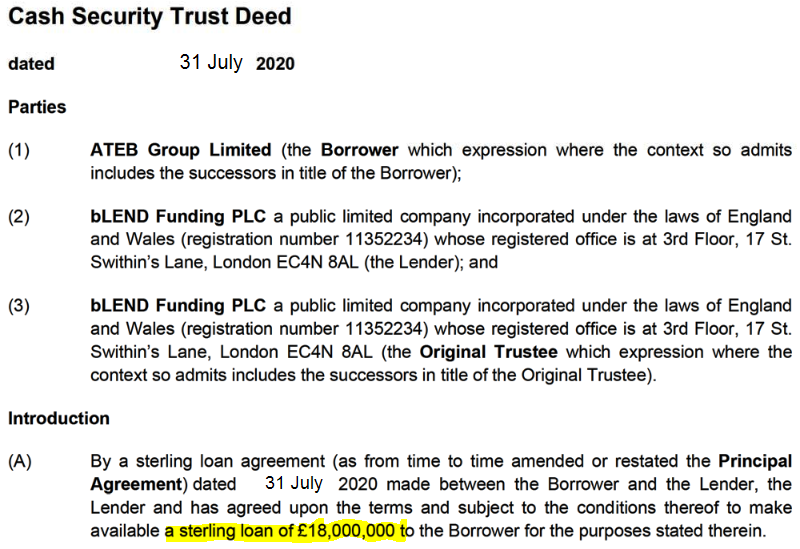

An example would be the relationship between Ateb (formerly Pembrokeshire Housing Association) and Mill Bay Homes Ltd (MBH). The latter, despite being a separate company, is a “wholly controlled subsidiary company of Ateb Group Ltd”.

The arrangement is that MBH builds and sells market properties and the profits go to parent company Ateb to build social housing or ‘affordable homes’. Which might be fine if Mill Bay Homes had its own money . . . but it hasn’t, it relies on loans from Ateb.

Which means that the ‘Welsh Government’ funds a RSL to build social housing but the money in fact goes to a subsidiary to build open market homes (that most locals may not be able to afford) with a fraction of the original money returning to the parent company.

What is the point of such a system?

While Mill Bay Homes is a company registered with Companies House the Ateb Group is registered with the Financial Conduct Authority.

As we’ve seen with other housing associations, the Ateb Group has also borrowed money recently. Last month from the Principality Building Society. Back in July it was a loan of £18m from bLEND Funding PLC.

Officially, a cash security trust deed.

Eighteen bloody million! How much does a relatively small, rural housing association need? It’s already getting money from the ‘Welsh Government’, and seems to have stopped providing social rented housing.

A visit to the Ateb Group website turns up what you see below. Quite clearly, Ateb is now a private house builder with social rented accommodation an afterthought.

Click on ‘homes for sale’ and you of course get taken to the Mill Bay Homes website.

And there seem to be some rum doings between the two.

I am indebted to Wynne Jones in Cardigan for these documents from the Land Registry website (from which I have redacted a few names in the second).

A property on this development in Cilgerran (Ceredigion) was built by MBH, with money borrowed from Ateb, then sold to Ateb for £164,950 in October 2019; the following month Ateb sold a 125-year lease on the property for £57,733.

What business model is this?

Mill Bay Homes makes no secret of the fact that it’s punting for retirees and ‘investors’. The latter category will include Buy-to-Rent landlords, and whaddya know – one of the new Cilgerran properties is already being advertised for rent.

Plot 3 at Maes Rheithordy, Cilgerran, is being rented for £670 per calendar month through Jac y Do Letting of Blaenporth.

A similar arrangement to that between Ateb and Mill Bay Homes exists in Gwynedd between Adra (formerly Cartrefi Cymunedol Gwynedd), which took over Gwynedd council’s housing stock some ten years ago, and its subsidiary, Medra Cyf.

A few days ago Adra put out this puff about building 1,200 new homes across ‘North Wales’. The “housing crisis” referred to is perhaps the lack of housing for commuters in the A55 corridor.

The subsidiary that will be doing much of the building is Medra . . . with a loan from Adra.

This loan between a Welsh RSL and its subsidiary was arranged by London law firm Trowers & Hamlins. I’ve seen that name in other loans I’ve looked at. Are there no lawyers in Wales?

Of course there are, so who’s directing them to that company?

∼

Also worth highlighting from recent years, in addition to the proliferation of subsidiaries, is the strange partnerships we see being forged.

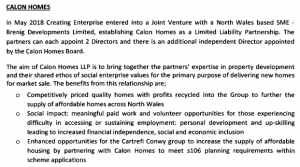

For an example of this we stay in the north, with Cartrefi Conwy, based in Abergele.

I’ve written about this lot a few times. Below you’ll read what I had to say earlier this year, in Housing Associations, a broken model. The Byzantine network of ‘partners’ also throws up a mystery investor.

“Cartrefi Conwy set up a subsidiary in 2015 called Creating Enterprise CIC (Community Interest Company). Then, in May 2018, Creating Enterprise went into partnership with Brenig Developments Ltd to form Calon Homes. (Assets at 31 May 2019 £37,853.)

As I wrote back in November: “There is a charge against Calon Homes LLP held by Creating Enterprise CIC, which in turn has a charge held by Cartrefi Conwy. Which means that, ultimately, housing association Cartrefi Conwy is in partnership with private company Brenig Developments.”

When we look at the directors for Brenig Developments Ltd we find Mark Timothy Parry and Howard Rhys Vaughan. Both are also directors of Brenig Homes Ltd.”

Another horse out of the Brenig stable is Brenig Construction Ltd. Just another local building firm, run by local people . . . so impeccably local in fact that it could have come from League of Gentlemen.

But then, in December last year, a new director joined, a man who might have been taking his life in his hands if he’d turned up in the Royston Vasey shop.

I’m referring now to Yin Han, a Chinese businessman, presumably bringing a lot of yuan. For when I say Chinese businessman I do not mean that he hails from Hong Kong or Taiwan. Yin Han is a resident and citizen of the People’s Republic of China.

How did Yin Han and Brenig Construction find each other? What do we know about him? I guarantee he did not get involved with Brenig Construction without permission from back home. And that means the Communist Party.

These subsidiaries and partners, together with the loans and investment, are needed to build private housing for sale on the open market.

But housing associations are now private entities, so why do they need subsidiaries and partners to build open market housing? Surely they could do it in their own names?

Of course they could, but that would make it too obvious and probably jeopardise the public funding. So we have this charade of public money for social housing being given to RSLs and then filtered through intermediaries to build private housing.

And the ‘Welsh Government’ is a willing party to this deception.

◊

‘AFFORDABLE HOUSING’

As a student of history, I’ve always loved Palmerston’s quote: “Only three people have ever really understood the Schleswig-Holstein business – the Prince Consort, who is dead – a German professor, who has gone mad – and I, who have forgotten all about it.”

It comes to mind when I see the term ‘affordable housing’. Because there’s a great deal of confusion as to what it means.

It’s important to get a definition because it’s what RSLs now claim to be building, and what the so-called ‘Welsh Government’ is funding.

When I contacted the ‘Welsh Government’ I was referred to a publication wherein was found . . .

“The concept of affordability is generally defined as the ability of households or potential households to purchase or rent property that satisfies the needs of the household without subsidy (further guidance is provided in the Local Housing Market Assessment Guide) 7 This could be based on an assessment of the ratio of household income or earnings to the price of property to buy or rent available in the open market in the required local housing market area.”

Which is interesting, and for two reasons.

If the concept of affordability is based on what local people on local wages can afford, then why is ‘affordable housing’ not reserved for those same local people? I ask because all the term means in practice is that a few properties in a development are labelled ‘affordable’ – but still put on the open market.

And if a small number of properties in a development are classed as ‘affordable’ then it must follow that the majority of the properties are regarded as unaffordable to most locals. So why are we building so many properties – with public funding! – beyond the reach of most local buyers?

The woolly term ‘affordable housing’ is just a fig leaf for the ‘Welsh Government’ and RSLs to disguise the fact that very little social housing is being delivered.

We are encouraged to believe that ‘affordable housing’ is for local people, or that it means social rented properties. Wrong.

◊

CONCLUSION

This system, as I’ve argued before, is broken. It is broken because it consumes vast amounts of Welsh public funding for little or no Welsh public benefit.

Another cause for concern is that just as many third sector bodies are agencies of the Labour Party a similar picture emerges with housing associations.

In fact, housing associations and third sector bodies operate hand in glove, with the former housing the disruptive ‘clients’ of the latter, many of whom have been shipped into Wales. It’s collaboration like this that contributes to the problems we’ve looked at in Tyisha, Llanelli.

‘Welsh’ Labour’s little empire; stuffed with cronies and others dependent on political patronage and public handouts.

Take Wales & West, which I’ve referred to as Labour’s favourite. The CEO is Anne Hinchey, whose hubby Graham is a Labour Councillor in Cardiff. This explains why Wales & West has pulled down £100m in Social Housing Grant alone in the past decade.

And yet, let us remember that the reason the Office for National Statistics decided to put housing associations into the public sector was because there was so much governmental control!

As the June 2018 article from Inside Housing I reproduced above put it,

“In a letter to the Welsh Government sent yesterday, the ONS left open the possibility to reclassify individual associations as public should the level of state control increase.”

A strong case could be made for reclassifying a number of Welsh housing associations. Certainly Wales & West.

Where do we go from here?

I suggest that it starts with making it clear we do not want housing associations to build properties for sale to Home Counties retirees in Pembrokeshire, or to Manchester commuters in Denbighshire.

The sole duty of Welsh housing associations must be to deliver homes to Welsh people at sales prices or rents WE can afford.

If they are unable or unwilling to fulfil that role then I believe we should let our local councils provide social rented housing. Ensure they are well enough funded to provide decent accommodation to any and all local people wanting it. And make strong local connections the over-riding consideration in allocating those properties.

Then cut all funding to housing associations, which are, after all, private companies. Let them borrow from private lenders – as they are already doing – and cease being a burden on the public purse.

Whatever is decided, the present system is broken. Changes must be made. Even if you think this doesn’t affect you, just think what we could do with the money saved!

♦ end ♦