Opponents of the Labour Party, no matter what they think of the party generally, are always impressed by its discipline; by how a council group made up of individualists, the intellectually challenged, revolutionaries, Blairites and disgruntled back-benchers, can still be made to vote as instructed and hang together in order to face down any challenge. But how is it achieved? Well, a clue may be coming out of Swansea, and if this theory suggested to me is correct then my guess is that the method employed is unlikely to be restricted to that city.

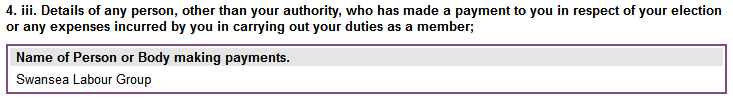

Now I don’t want Uplands Labour councillor John ‘Boy’ Bayliss to think I’m picking on him, but I must start with him for he might, unwittingly, provide the key to unlocking this great mystery of Labour Party solidarity. The place to start is the extract here taken from Bayliss’s Declaration of Interests on the council website.

This tells us that John Boy received an undisclosed amount of money from the Swansea Labour Group for a reason or purpose that is also undisclosed. And note that it came from the ‘Swansea Labour Group’, not the council, so it must be supplementary to any official payment for his work as a councillor. What are we to make of this? Was it a birthday present? If so, why did other Labour councillors not receive their ‘presents’? I’m told there is another explanation.

It has long been rumoured that Labour councillors in Swansea are required to pay ten per cent of their allowances to the party. Some of this, it is suggested, is used for elections and to otherwise promote the party in the city; a portion is sent to ‘Welsh’ Labour HQ; while the remainder is distributed among those Labour councillors lower down the food chain who do not receive hefty allowances for chairing committees and being in the cabinet. With a percentage also going to pay the dues of students from local universities who’ve been given free party membership.

Now quite obviously, a disgruntled Labour backbencher can have his or her disaffection ameliorated with a sweetener of a few grand every year. And a red-hot ‘revolutionary’ could also be persuaded to toe the party line. Which could help explain Labour Party ‘solidarity’. As I say, it’s only a rumour, but if true, it would give Swansea Labour group a secret pot of maybe £70,000 to play with every year. A great deal of ‘solidarity’ can be bought with that kind of money when it’s used to top up flat-rate councillor pay, especially if the recipient has no other obvious source of income.

So if the suggestion being made is correct, then the first issue is that the Labour Party is virtually extorting money from leading councillors (because you mustn’t believe that all Labour councillors give up their 10% willingly). Then we have the issue of recipients of this secret levy – recipients other than  ‘Honest John’ Bayliss – not declaring this income in their Declaration of Interests. And finally, we have the consideration of income tax. For if the loyalty of Labour back-benchers is being bought with what are effectively back-handers, then we can be fairly certain that these secret payments are not being declared to the tax authorities.

‘Honest John’ Bayliss – not declaring this income in their Declaration of Interests. And finally, we have the consideration of income tax. For if the loyalty of Labour back-benchers is being bought with what are effectively back-handers, then we can be fairly certain that these secret payments are not being declared to the tax authorities.

A final consideration is that if what I’m hearing about Swansea Labour Party is true, and if this is how the Labour Party operates elsewhere in Wales – a reasonable assumption – then Labour in Wales must have well over a million pounds to play with every year. A million pounds that perhaps no one outside the party knows about, and that no one inside the party is willing to talk about. Essentially undeclared income and tax-dodging of the kind that so agitates the bruvvers when done by others.

I feel we need clarification on this matter. First, we need a statement from the Swansea Labour Party on whether or not it demands that its leading councillors ‘donate’ ten per cent of their allowances to help sustain (and retain the loyalty of) less fortunate brethren, and to also top up the party coffers. Then, we need a statement from ‘Welsh’ Labour, telling us if this is common practice within the party. Finally, it would be interesting to hear the views of the tax authorities; so maybe HMRC can give an opinion on whether income derived in the manner described is a) legal and b) if so, whether it should be declared for tax purposes.